Cannabis Market Update October 2025 – STILL Struggling to get There – We are not Selling

October 7, 2025

CANNABIS MARKET UPDATE OCTOBER 2025

U.S. Market STILL expected to grow to $76 billion by 2030

STILL Struggling to get There – We are not Selling

Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

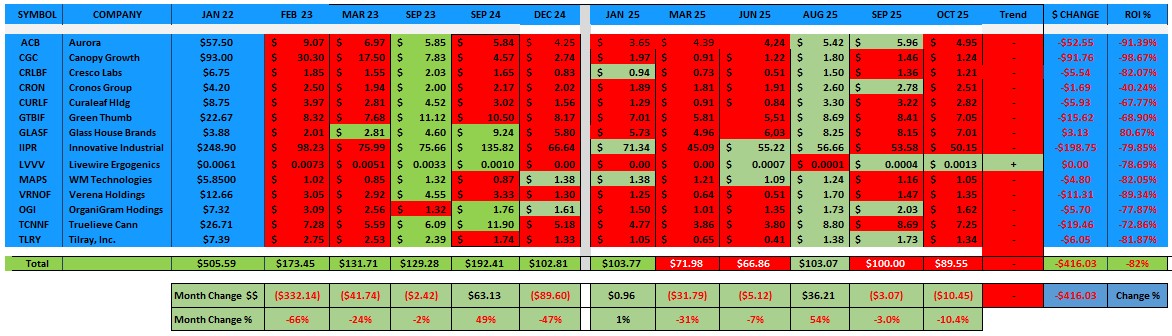

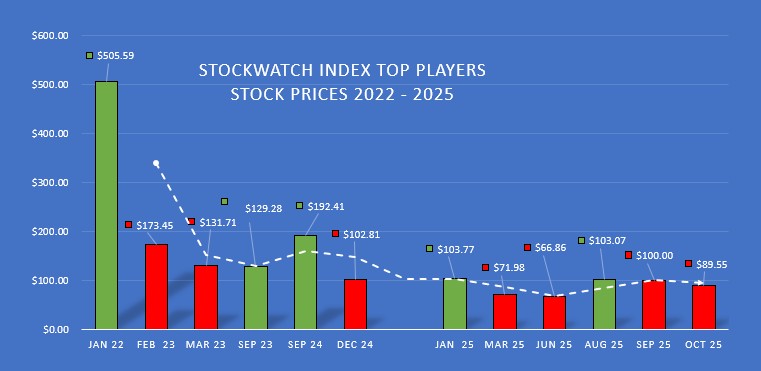

In September and October, we noticed a continued decline in cannabis stock prices both in our SWI portfolio and in the broader market. Despite this downturn, the market is still projected to experience significant growth in the coming year. The U.S. cannabis market is expected to reach a value of $44.30 billion by 2025 and $76.39 billion by 2030, reflecting a compound annual growth rate (CAGR) of 11.51%. While there is broad consensus among analysts regarding these projections, it seems that the major companies in our portfolio are having difficulty gaining traction to meet these expectations. Still, we are not selling,

The SWI Cannabis Portfolio Performance

In August and the last few days of September, we observed some improvement; however, the overall performance in September was still 3% lower than in August and declined further by another 10.3% in October. Despite these challenges, the consensus is that the market is undergoing continuing consolidation and health-shrinking, with expectations for a strong market recovery in 2026.

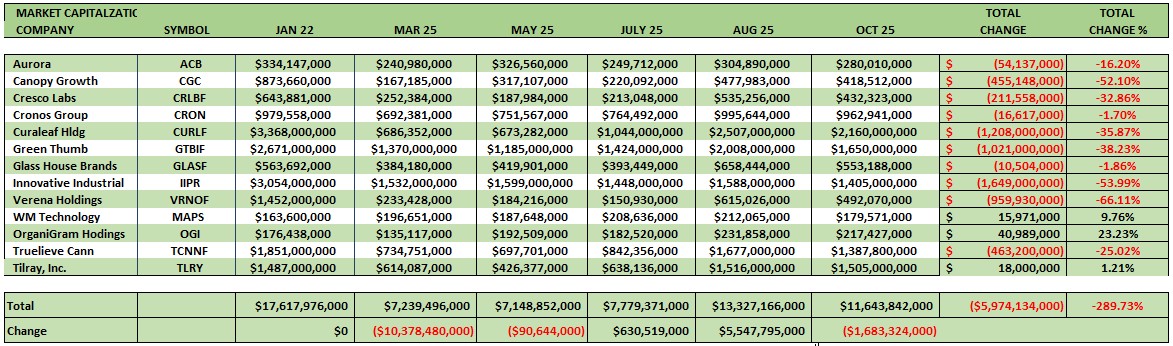

The SWI Portfolio Outliers’ Market Capitalization

There are three companies in the portfolio that we consider Outliers. While the share prices still declined somewhat in October, they are the three companies in the portfolio with an increasing Market Capitalization since we monitored from their highs in January of 2022, improving between 1.2 to 23.2 %.

WM Technologies (MAPS) + 9.76%

Organigram Holdings (OGI) + 23.23%

Tilray (TLRY) + 1.21%

Our Favorite Cannabis ETFs

For investors who have a strong risk tolerance, a marijuana-themed exchange-traded fund could be a better option than individual stocks. Keep in mind that investing in cannabis ETFs comes with risks, including regulatory uncertainty, financing hurdles, and market volatility. Top-performing names this October include the following:

-

AdvisorShares Pure US Cannabis ETF (YOLO): This ETF invests in companies across the entire marijuana industry, including Green Thumb Industries, Trulieve Cannabis Corp, and Curaleaf. With a one-year performance of 16.46%, it’s one of the best-performing cannabis ETFs.

-

Cambria Cannabis ETF (TOKE): This ETF has a one-year performance of 4.91% and provides diversified exposure to the cannabis industry.

-

ETFMG Alternative Harvest ETF (MJ): With assets under management of $200.69 million, this ETF has a strong presence in the market and a one-year performance of -9.49%.

-

Amplify Seymour Cannabis ETF (CNBS): This ETF has a one-year performance of -45.24% but is still considered a notable player in the cannabis ETF market

When choosing a cannabis ETF, consider the following factors:

-

Diversification: Look for ETFs that spread risk across multiple companies and segments of the industry.

-

Expense Ratio: Consider the fees associated with the ETF, as they can eat into your returns.

-

Assets Under Management: A larger AUM can indicate a more stable and liquid ETF.

-

Performance: Check the ETF’s historical performance, but keep in mind that past performance is not a guarantee of future results.

If you want to follow other companies that we cover with in-depth articles and research reports,

go to www.stockwatchindex.com or our research site at www.swiresearch.com.

If this has been passed on to you, and you want to receive the SWI Newsletter,

go to stockwatchindex.com/sign-up

Dynamic Market Concepts (DMC) or its affiliate Stockwatchindex (SWI) are marketing publications with a team of writers and analysts that publish articles and research reports about subjects of interest for the editorial teams and reflect the writers’ opinions. Some of the published information has been provided by the companies covered, generated by publicly available sources, or by what the team deems reliable third-party entities. This is not meant as investment advice or stock solicitation, and the author is not responsible for any errors, mistakes, or shortcomings that may be occasioned when publishing the information in this publication and accepts no liability for any mistakes.

Search

RECENT PRESS RELEASES

Related Post