Cannabis Market Update Year End 2024 A Mixed Bag of Progress and Challenges

January 8, 2025

Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

Key Trends in 2024 and Outlook for 2025

The cannabis market 2024 has been a mixed bag of challenges and progress. Despite delays in federal regulatory changes, the US cannabis industry has continued to mature. The year saw significant developments, such as Nebraska becoming the 39th state to legalize medical marijuana.

However, the legalization momentum has slowed in some regions, with states like Florida and the Dakotas rejecting adult-use measures. Nevertheless, recreational cannabis is now legal in 24 states, and medical cannabis is legal in 40 states.

The industry has also faced a divide between hemp and marijuana. Hemp products have embraced a more unrestricted regulatory framework, leading to open-air transactions and consumption lounges. Meanwhile, the traditional cannabis market has seen consolidation, with companies merging to gain scale and bargaining power.

This growth is driven by increasing public support for medical and recreational cannabis, with 70% of Americans supporting legalization. According to Headset’s analysis and forecast, the US cannabis industry is poised for significant growth in 2025, with projected total annual sales reaching $45.8 billion.

Let’s face it: the cannabis market is here to stay and will continue to grow;

it may just look and smell a little different.

-

Cannabis Legalization Status: As of November 2024, recreational cannabis is legal in 24, and medical cannabis is legal in 40 states. 74% percent of Americans live in a state where cannabis is legal for medical or recreational use.

-

DEA’s Announcement: The DEA announced its intention to reschedule cannabis from Schedule I to Schedule III of the Controlled Substances Act, a significant step towards federal legalization.

-

Potential Impact: Rescheduling could address significant issues for the state-legal cannabis industry, such as federal illegality and access to banking services. However, it could also raise new challenges, such as FDA involvement and potential regulatory discrepancies.

-

Competition: The market is becoming increasingly competitive, creating pricing pressure in states with oversupply.

-

Industry Consolidation: Larger operators are expanding their market share by pursuing strategic M&A and organic market share growth to offset pricing pressures.

Progress Despite the Challenges?

The Mixed Bag Presents Opportunity

-

Innovation: There are opportunities for companies to develop new and innovative products, such as cannabis-infused beverages and edibles. Companies prioritizing innovation, product development, and consumer experience will thrive.

-

Consumer Trends: Consumers look for high-quality and easy-to-consume cannabis products. There is a growing demand for cannabis-infused products, such as edibles, beverages, and topicals. Companies with innovative product development and experienced marketing teams will thrive.

-

Partnerships and Collaborations: Companies can form partnerships and collaborations with other companies, both within and outside the cannabis industry.

-

Interstate Sales: Federal legalization will allow for instate sales, allowing companies prepared for this to expand their sales territory and, accordingly, revenue substantially.

-

Market Growth and Investment: The US cannabis market is experiencing significant growth, with sales projected to reach $40 billion by the end of 2024 and total annual sales reaching $45.8 billion in 2025.

-

Industry Attractiveness: The cannabis industry is becoming more appealing to private equity and venture capital firms due to improved federal legalization prospects and a more favorable capital market outlook.

Growth in New Markets – The Turnaround is Coming

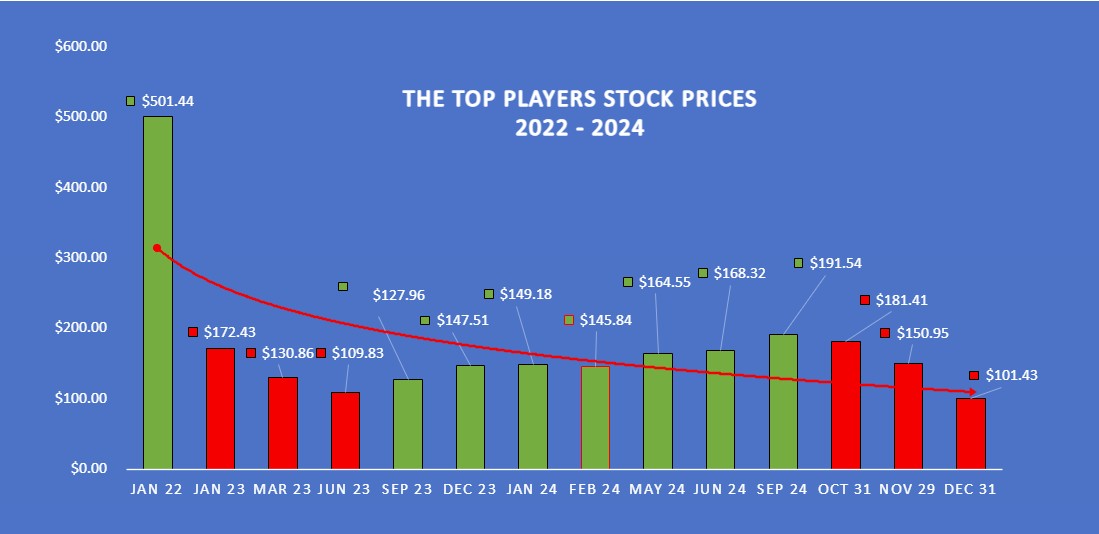

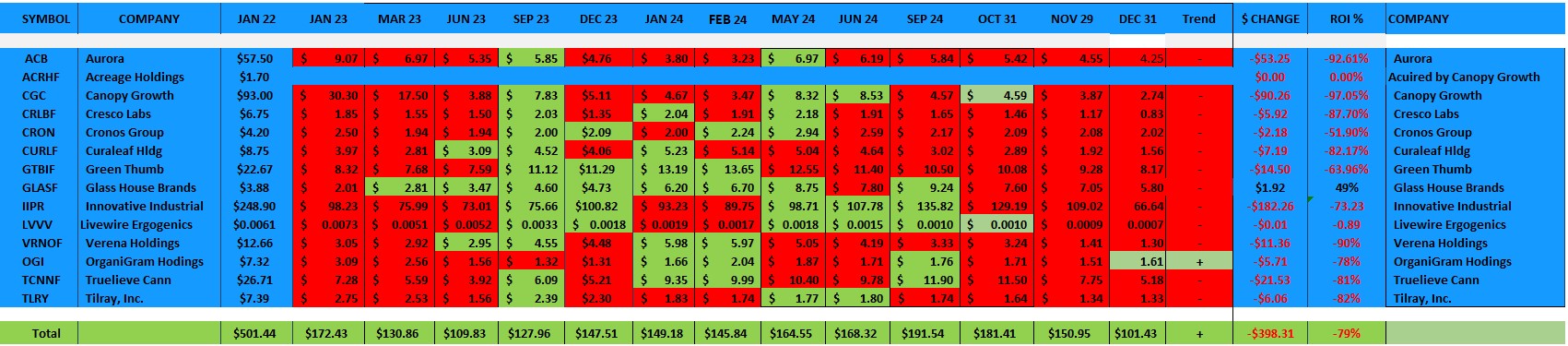

Overall, the cannabis market 2024 has been characterized by growth in new markets, strong expectations for 2025, and a shift toward consolidation and specialization. While all companies in our portfolio still have shown a decline in share prices by the end of 2024, producing a staggering 79% negative return on investment, it has slowed down somewhat during the second half of December. We believe this may be the beginning of the tuna runs, as companies are tightening their belts and paying attention to return on investment. With stock prices where they are, the future looks promising, but the industry must navigate these complexities smartly to continue its upward trajectory. We are not selling. Instead, we are looking for new investment opportunities, and we consider this a good time to buy, especially if you have somewhat of a mid-term investment horizon. Nevertheless, doing your due diligence and picking the right company is more crucial than ever.

About StockWatchIndex

This website, presented by StockWatchIndex (SWI), the newsletters it distributes, and the blogs it publishes make no recommendations about what securities to buy or sell. It is simply a watch list and a collection of different external information sources, often from the companies it represents. SWI does not provide financial, legal, or investment advice and is not soliciting the buying or selling of stocks. The user acknowledges that SWI is in no way responsible for its users’ investment and trading, and/or legal decisions. While SWI makes every effort to provide only correct information, data utilized is externally sourced and is provided “as is” and on an “as available” basis. The user acknowledges and accepts that SWI assumes no responsibility for inaccurate, erroneous or unavailable data. The user is encouraged to conduct his own due diligence. Any tips represented are simply SWI’s opinion and meant to pass on information about the markets and companies represented and do not constitute financial or investing advice. By using the information, you acknowledge that SWI is not providing financial or investment advice and agree that SWI is in no way responsible for your trading and investment decisions, regardless of whether those decisions were inspired by using this site and/or its news letters or not.

Search

RECENT PRESS RELEASES

Related Post