Cardano, Ethereum Outperform Bitcoin Ahead Of FOMC Meeting As Altcoins Surge

December 10, 2025

Altcoins rise ahead of FOMC announcement as Bitcoin holds $92,000 after leverage resets across key levels.

- Cardano’s retail sentiment on Stocktwits remained in ‘bullish’ territory, with ‘high’ levels of chatter.

- Ethereum was the second-best performer in the altcoin market, up 6.4% in the last 24 hours.

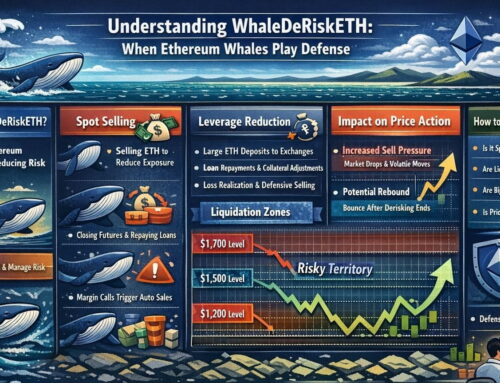

- Institutional interest in Ethereum has surged with $3.1 billion bought by whales in the past three weeks, according to Santiment data.

Cardano (ADA) was the best-performing altcoin in early morning trade on Wednesday, followed by Ethereum (ETH) among the major tokens, as traders watch for the Federal Reserve’s rate cut decision later in the day.

Cardano’s price rose 8.7% in the last 24 hours to $0.463. Leverage was cleared before the price stabilized at higher levels, according to Coinglass data, which shows concentrated long liquidations between $0.44 and $0.46.

ADA is entering the FOMC window with less overhead pressure, as there were fewer liquidation bands above $0.48. Stocktwits retail sentiment for Cardano trended in the ‘bullish’ zone over the past day. Chatter around the cryptocurrency remained at ‘high’ levels.

Ethereum (ETH) followed the bullish rally, climbing 6.4% in the last 24 hours to $3,319.41. The liquidation heatmap shows heavy long liquidations in two ranges around $3,350-$3,500 and $3,150-$3,250. These levels lost the most leverage in the last 24 hours.

An analyst on X noted that if Ethereum can move past the $3,300-$3,400 range, the next support level would be $3,700. This comes as Ethereum whales bought around $3.1 billion in ETH in the last three weeks, as per Santiment. On Stocktwits, the retail sentiment for Ethereum remained in the ‘bullish’ territory over the past day, with ‘normal’ levels of chatter.

Meanwhile, Bitcoin (BTC) traded at $92,618, up 2.5% from the previous day. Data from Coinglass shows that many leveraged long positions were wiped out near $93,500-$94,500, where the price struggled to rise. On Stocktwits, retail sentiment continued to be in the ‘neutral’ territory over the past day, with ‘low’ levels of chatter.

Solana (SOL) rose 5.2% to $139.25 in the last 24 hours. The liquidation heatmap shows heavy long wipes near the $145 range. For now, liquidation clusters around $135 remain active, indicating this is the primary support area within the current range.

Dogecoin (DOGE) was up 4.7% to $0.1467. Binance Coin (BNB) was trading at $890.97, up 0.5% over the past day. BNB retail sentiment remained ‘bullish’ with message volumes at ‘neutral’ on Stocktwits.

For Ripple (XRP), there were dense long liquidations between $2.15 and $2.20, aligning with the intraday ceiling. XRP was trading at $2.08, up only 1% since Tuesday.

Retail traders are now eyeing Fed Chair Jerome Powell’s press conference, which could provide clues on the direction of the monetary policy for 2026. Speculation is heavy on potential new liquidity measures such as balance sheet expansion or a restart of quantitative easing, which often supports a Bitcoin rebound.

Read also: Crypto Sees ‘Cooling Period’ – BTC, ETH Hold Weekly Gains While Altcoins Lose Steam

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post