Cautious Analyst Estimates Might Change The Case For Investing In Okta (OKTA)

November 1, 2025

- In the days leading up to its recent earnings announcement, Okta drew heightened investor attention as analysts projected earnings per share of $0.75 and revenue of $729.17 million, both reflecting increases from the prior year.

- This focus comes amid analyst concerns over slower growth in sales and free cash flow, raising questions about Okta’s near-term growth trajectory despite continued expansion in the identity security market.

- We’ll look at how investor caution around Okta’s recent sales and billing trends could influence its overall investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Advertisement

Okta Investment Narrative Recap

To feel confident as an Okta shareholder right now, you need to believe that enterprise demand for identity security remains resilient, even as competitors expand and analysts voice concerns about Okta’s slowing sales and free cash flow. The latest earnings forecast, calling for a double-digit gain in EPS, is the most important near-term catalyst, while underwhelming billing growth and slower sales momentum stand out as the biggest immediate risk. The news event does not materially change these short-term drivers or risks.

Among several product updates and industry partnerships, Okta’s recent introduction of AI agent integration directly speaks to its efforts to stay ahead of new security threats and could support future growth, but it has not altered the main questions around billings trends and top-line acceleration. The greater focus on AI-related security, while promising, does not directly address the latest concerns over sales growth and cash flow headwinds highlighted in analyst commentary.

Yet while the long-term outlook is often shaped by product innovation, investors should also be aware of the risk that, if billing weakness persists…

Read the full narrative on Okta (it’s free!)

Okta’s narrative projects $3.6 billion in revenue and $414.2 million in earnings by 2028. This requires 9.5% yearly revenue growth and a $246.2 million earnings increase from the current $168.0 million.

Uncover how Okta’s forecasts yield a $120.37 fair value, a 32% upside to its current price.

Exploring Other Perspectives

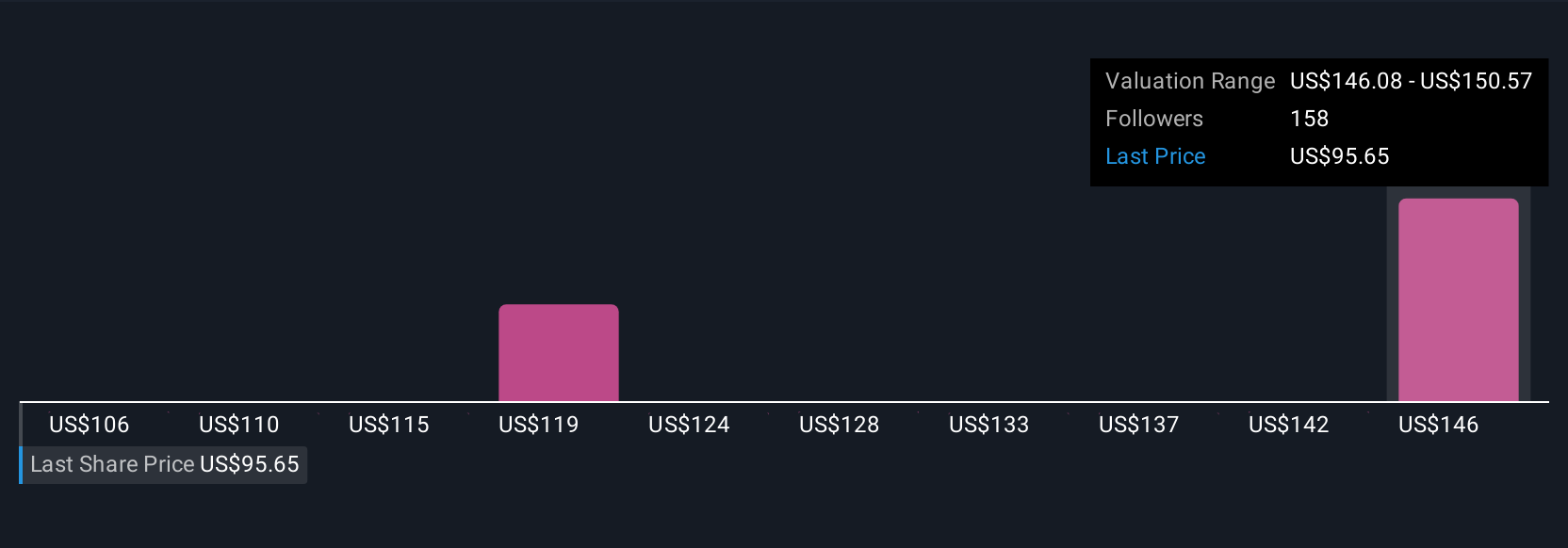

Six different fair value estimates from the Simply Wall St Community place Okta between US$116.73 and US$147.87 per share, illustrating a broad spectrum of investor expectations. When analysts caution about slowing sales and billing trends, it reminds you that opinions can vary widely and alternative viewpoints are worth exploring.

Explore 6 other fair value estimates on Okta – why the stock might be worth just $116.73!

Build Your Own Okta Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Okta research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Okta research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Okta’s overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post