Challenges in India’s tender-driven renewable energy market

March 5, 2025

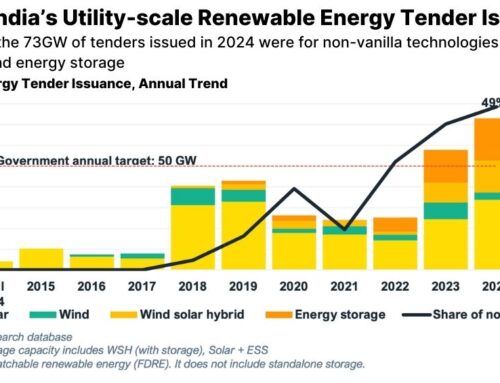

India’s utility-scale renewable energy tendering market is reaching new heights, with record-breaking issuances in 2023 and 2024. In 2024, the Ministry of New and Renewable Energy’s (MNRE) annual bidding plan, which mandates a minimum of 50GW of tendered capacity each year, primarily drove cumulative tender issuance to a record-high 73 gigawatts (GW).

Both the issuance and allotment of tenders are increasingly focusing on non-traditional renewable energy technologies, indicating demand from energy offtakers for improved power quality. Based on tender allotments, wind-solar hybrid (WSH) surpassed solar power in 2024 to become the leading segment in utility-scale renewable energy tendering.

Recognising the market shift toward non-traditional renewable energy technologies, some developers are prioritising these segments to establish a niche. For example, new entrants like IndiGrid and Gensol focus primarily on standalone storage tenders. Meanwhile, Hexa Climate has secured all its capacity so far in firm and dispatchable renewable energy (FDRE) tenders.

Following the significant increase in renewable energy tendering and allotments after 2022, there has also been a notable rise in challenges related to the execution of utility-scale renewable energy projects, resulting in three interconnected outcomes:

- Tender undersubscription: In 2024, approximately 8.5GW of capacity in utility-scale renewable energy tenders was undersubscribed, five times higher than the undersubscription in 2023. This trend can be attributed to several factors, including complex tender designs (such as demand following FDRE), aggressive bidding during reverse auctions, and delays in the readiness of interstate transmission system (ISTS) infrastructure.

- Delays in power agreements with energy offtakers: Industry stakeholders report that India’s cumulative unsigned power sale agreement (PSA) capacity has exceeded 40GW,[1] with Solar Energy Corporation of India (SECI) tenders alone accounting for about 12GW. The primary reason for the delays in signing these PSAs appears to be the expectation from energy offtakers of continuously falling renewable energy tariffs. The delay may also stem from the additional time required for state distribution companies (DISCOMs) to obtain internal approvals from state governments and electricity regulators to adopt the tariffs discovered. Power developers argue that the strict mandate to meet an annual bidding target of 50GW puts pressure on renewable energy implementing agencies (REIAs) to issue bids and finalise auctions without securing and planning for offtake agreements.

- Tender cancellations: From 2020 to 2024, 38.3GW of utility-scale renewable energy capacity was cancelled, accounting for about 19% of the total issued capacity during that period. Tender cancellations can occur at any stage of the bidding process, either before or after auctions. Cancellations before auctions typically happen when authorities identify substantial challenges related to tender design, location or technical complexity, based on feedback from industry stakeholders following the issuance of the request for selection (RfS). Significant causes of cancellations after auctions include undersubscription and PSA delays.

Delays in project implementation pose a significant challenge to India’s renewable energy target for 2030. Ongoing issues with project realisation could deter investor interest in future renewable energy projects in India, potentially affecting the availability of low-cost financing from overseas large-scale investors. Until there is clarity on clearing the unsold power inventory, independent power producers (IPPs) may hesitate to bid for new large-scale projects. According to JMK Research, these challenges in project realisation could cumulatively affect 75GW of utility-scale renewable energy capacity tendered by 2030.

The significant backlog of PSAs from SECI suggests a gradual shift in market share from SECI-led tenders to those directly invited by energy offtakers. Developers highlight that tenders facilitated by offtakers often lead to quicker PSA signings, as there is no intermediary agency involved.

For viable growth of the renewable energy tendering market, the government must focus equally on all aspects of the tendering process, from the issuance of RfSs to allotment and signing of PSAs. In addition to issuing tenders, the government should establish annual targets for both allotments and the execution of PSAs. This will ensure that REIAs issue bids only after securing the necessary offtake agreements. Furthermore, stricter enforcement of renewable purchase obligations and associated penalties is essential to sustain renewable energy demand.

[1]Business Standard. Renewable energy projects of 40 GW fail to find buyers for green power. 26 February 2025.

Search

RECENT PRESS RELEASES

Related Post