China Coal-Fired Generation Additions Tied to Economics, Energy Security

March 31, 2025

China’s construction of coal-fired power plants reached nearly a 10-year high in the past year, even as the country also continues a massive expansion of renewable energy installations. A February report from Europe’s Centre for Research on Energy and Clean Air (CREA), and the U.S.-based Global Energy Monitor (GEM), said China began building 94.5 GW of new coal-fired generation capacity in 2024, the most in any year since 2015. The report said work resumed on another 3.3 GW of generation capacity projects that had been suspended. The groups’ research noted that “Instead of replacing coal, clean energy is being layered on top of an entrenched reliance on fossil fuels,” adding that “A substantial number of new plants will come online in the next 2–3 years, further solidifying coal’s role in the power system.”

|

|

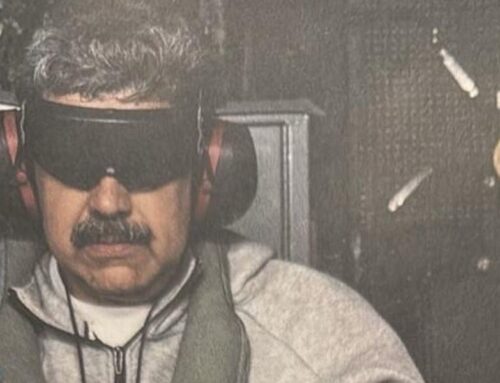

1. Huaneng Dezhou power station is a six-unit coal-fired facility totaling 2,700 MW in Shandong, China. It was commissioned from 1991 to 2002. In September 2023, plans were announced for Phase IV, which involves adding two 660-MW units to the station by the end of this year. Source: Envato Elements |

The continued buildout of coal-fired generation is seemingly at odds with declarations from Chinese President Xi Jinping, who a few years ago said his country—which receives more than half its power generation from coal—would look to peak its carbon emissions in 2030, and achieve carbon neutrality by 2060. The report from the two research groups said China accounted for 93% of all construction starts for coal-fired power plants (Figure 1) worldwide last year.

“Coal-fired power generation could decline, yet the coal industry continues to expect growth, setting the stage for an increasingly unsustainable conflict between coal investments and the need to decarbonize the power system,” the CREA-GEM report said. The groups also noted that China added 356 GW of wind and solar power capacity in 2024, about the equivalent of the current total of solar and wind installed capacity in the U.S.—and about 4.5 times the new renewable energy capacity installed in the European Union.

“China’s rapid expansion of renewable energy has the potential to reshape its power system, but this opportunity is being undermined by the simultaneous large-scale expansion of coal power,” said Qi Qin, lead author of the report and China analyst at CREA. “The continued approval and construction of new coal plants—one driven by industry interests and outdated contracts rather than actual grid needs—risks locking China into fossil fuel dependence at a time when flexibility is crucial for integrating clean energy. Without decisive policy shifts, China’s energy transition will remain an ‘energy addition’ rather than a true transformation away from coal.”

Increasing Industrialization

Energy industry analysts who spoke with POWER agreed on the reasons for China’s continued building of new coal-fired power plants, often citing economics and increasing industrialization, which is increasing energy demand. “China continues to build coal-fired plants for three reasons: politics, employment goals, and energy consumption,” said Justin Evans, founder and CEO of EvansWerks, an international technology research and development company with primary offices in the U.S., South Africa, and Taiwan. Evans told POWER, “The coal-producing regions cannot afford high unemployment rates so the best way to keep people happy is to keep them employed. And China’s electricity consumption outstrips its ability to produce sufficient solar panels. It’s also worth noting that solar is usually purchased by a single building for its specific needs while a coal-fired power plant is built for a region and financed with government debt. Both can happen at the same time without either party consulting each other.”

China’s coal mines last year boosted production to record highs, and the country also continues as the world’s leading importer and consumer of coal. The country last year extended its lead in imports over India, the second-largest buyer of coal, to the widest margin since at least 2013, according to industry data. Chinese coal imports reached a record 542.7 million metric tons in 2024, according to customs data, or more than twice as much as the 250.2 million tons imported by India. Data showed that India’s imports of thermal coal, primarily used for power generation, dropped about 3% in 2024. China’s imports of thermal coal, meanwhile, rose about 13%.

Brad Kuntz, senior managing director at Stax Consulting, said, “China’s energy output has doubled since 2011, driven primarily by ongoing industrialization. This growth contrasts with major economies like Japan, Germany, and the U.S., where energy output has remained flat or declined over the same period. To meet its baseline energy needs, China has continued expanding coal-powered plants, making it difficult to envision such a significant increase in output without coal as a key source. However, China is gradually shifting away from coal, reducing its share from 79% to 63% of total output since 2011, while simultaneously increasing its reliance on renewables, which have grown from 17% to 29% over the same period.”

“China’s economy is growing rapidly, and so is its energy demand,” said Irina Tsukerman, a geopolitical analyst and president of Scarab Rising. “Coal remains a reliable and affordable source of power to meet this increasing demand, particularly in industrial sectors where renewable energy cannot yet fully replace coal. As one of the world’s largest industrial economies, China prioritizes energy security. Coal is domestically abundant, and using it reduces reliance on imports, ensuring a stable and predictable energy supply.”

Tsukerman told POWER: “China has set ambitious long-term goals for reducing carbon emissions, but it also recognizes the need for short- and medium-term flexibility in its energy mix. Coal continues to be a significant part of this mix, and while renewable energy projects are scaling up, the pace of transition is carefully managed to avoid energy shortages or disruptions to economic growth. While China has committed to peak carbon emissions before 2030 and to achieve carbon neutrality by 2060, its current energy needs and infrastructure mean that coal continues to play a central role. The government is balancing international climate goals with the practical needs of economic development.”

Supporting Coal and Renewables

Authors of the CREA-GEM report said China likely is building more coal-fired generation than it needs, particularly as the country also brings massive amounts of renewable energy online. “Chinese coal power and mining companies are sponsoring and building new coal plants beyond what is needed to back up the country’s impressive growth in solar and wind power,” said Christine Shearer, a research analyst at GEM. “The continued pursuit of coal is crowding out the country’s use of lower-cost clean energy, and is threatening to undermine President Xi’s 2021 pledge to strictly limit coal consumption and phase it down over the next five years.”

A report from the University of California, San Diego, outlined how politics and economics, along with technical challenges, impacts China’s energy industry. Researchers said transitioning away from coal must consider not only concerns about climate change, but also the need for a secure supply of energy.

“The future of coal in China will depend on striking a balance between economic growth, energy security, and environmental sustainability,” said Michael Davidson, an assistant professor with a joint appointment with UC San Diego’s Jacobs School of Engineering and School of Global Policy and Strategy, and author of the report. “The findings of this study provide a roadmap for policymakers and researchers looking to navigate this complex transition.”

The study noted that coal is still critical for China, supporting a significant number of jobs. The country also has about 140 billion tons of coal available for mining, meaning production and consumption of the fuel is key for the economy. “China’s success in reducing its reliance on coal will be key to shaping the country’s future,” said Davidson.

Tsukerman agreed that coal will continue to play a major role in China, likely for years. “While renewable energy is growing, China’s electricity grid is still dependent on coal for backup during times of high demand or when renewable energy production is low,” said Tsukerman. “Coal plants can be ramped up quickly when needed to ensure grid stability.”

Tsukerman also told POWER: “China’s energy demand and infrastructure needs vary greatly across regions. Some areas, particularly in the northern and western parts of the country, have greater access to coal resources than to renewable energy sources like wind and solar, making coal a more practical option in those regions.” Tsukerman added, “Coal mining and coal-fired power plants provide significant employment in certain regions. In these areas, continued investment in coal power helps support local economies and industries, especially in provinces with large coal reserves.”

U.S. Coal Exports to China

The U.S. is among the countries exporting coal to China, though Evans told POWER that a trade war and reciprocal tariffs between China and the U.S. likely would have little to no impact on China’s imports of U.S.-produced coal. “Personally, I don’t think [President] Trump’s tariffs will have any impact on importing coal for two reasons: China imported more U.S. coal in 2024 than ever before, and tariffs, as we all know, are paid by the importer not the exporter. But U.S. imports are still a tiny sliver of China’s needs. China consumes 50% of the entire world’s annual coal production.”

Maksim Sonin, an energy executive and Projects Fellow at Stanford University, told POWER: “Business comes first. With global competition in energy-intensive sectors such as technology and heavy industry, environmental concerns take a back seat to economic growth. Strategically, developing both renewable and fossil fuel energy ensures greater operational flexibility and more leverage when negotiating with trading rivals. Of course, these tariffs affect exports and imports. But the good thing about coal? It’s a commodity—the market adjusts pretty quickly, with more U.S. coal, for instance, likely heading to India.”

Tsukerman noted that China has plenty of other trade partners when it comes to coal. “Trump’s tariffs could potentially have an impact on U.S. coal exports to China. During the U.S.-China trade war under the [first] Trump administration, China imposed retaliatory tariffs on U.S. coal as part of its broader strategy to target U.S. exports,” she said. “While U.S. coal isn’t among China’s primary imports, the tariffs made U.S. coal less competitive compared to coal from other countries like Australia, Indonesia, and Russia, which don’t face the same tariffs. Tariffs on U.S. coal would increase the price of American coal in the Chinese market, making it less attractive to Chinese buyers, especially when other coal-exporting countries offer more competitive pricing without additional tariffs.”

That impact already is underway. Mongolian officials recently said that country plans to increase its coal exports to China by nearly 20% in 2025. A new cross-border rail link between the countries will support those exports. Australia also has increased its exports of coal to China, and Indonesia is expected to remain the top exporter, providing more than half of China’s imports of the fuel.

—Darrell Proctor is a senior editor for POWER.

Search

RECENT PRESS RELEASES

Related Post