China Renewable Energy Certificate Market to Reach $4.2 Billion by 2032 | I-REC dominates

November 27, 2025

11-27-2025 11:03 AM CET | Energy & Environment

Leander, Texas and Tokyo, Japan – Nov.27.2025

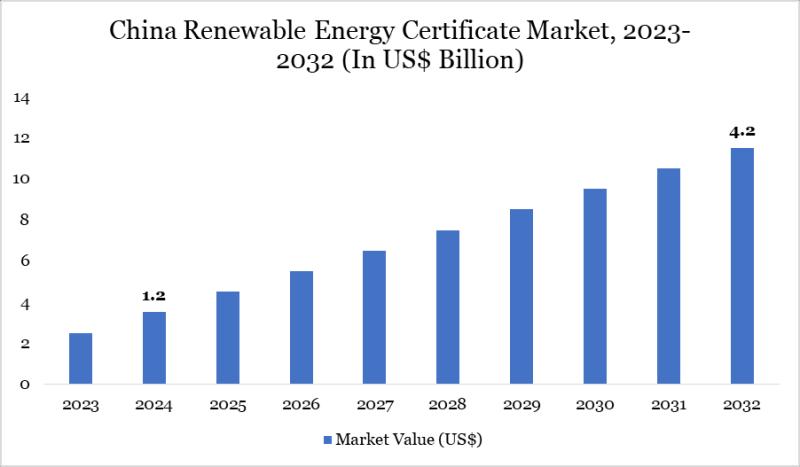

As per DataM intelligence research report” China renewable energy certificate market reached US$ 1.2 billion in 2024 and is expected to reach US$ 4.2 billion by 2032, growing with a CAGR of 14.2% during the forecast period 2025-2032.” China’s decarbonization push and corporate sustainability commitments are accelerating the adoption of renewable energy certificates.

Download your exclusive sample report today: (corporate email gets priority access):

https://www.datamintelligence.com/download-sample/china-renewable-energy-certificate-market?Prasad

China: Renewable Energy Certificate – Recent Industry Developments

✅ In November 2025, State Grid Energy Services advanced its Renewable Energy Certificate (REC) digital trading platform to improve traceability and verification transparency. The upgrade accelerates corporate sustainability adoption. This reinforces State Grid’s role in China’s clean-energy compliance.

✅ In October 2025, China Three Gorges Renewables enabled large-scale hydro and solar REC bundling for industrial buyers. The offering increases corporate clean-power sourcing flexibility. This strengthens CTG’s influence in renewable certification.

✅ In September 2025, Goldwind partnered with regional grid operators to integrate wind-power RECs into enterprise decarbonization programs. The initiative supports net-zero commitments and regulatory alignment. This elevates Goldwind’s position in green-energy monetization.

✅ In August 2025, SPIC piloted blockchain-based REC issuance for traceable renewable consumption. The innovation improves accountability and market transparency. This reinforces SPIC’s leadership in clean-energy solutions.

✅ In July 2025, Huaneng Group expanded REC trading services with real-time verification and settlement tools for corporate clients. The enhancement improves operational efficiency. This strengthens Huaneng’s renewable certification capabilities.

✅ In June 2025, Envision Energy integrated smart metering data with REC platforms to optimize issuance and auditing. The approach increases reliability and compliance. This reinforces Envision’s technology leadership in energy certification.

China Renewable Energy Certificate Market: Drivers

The China renewable energy certificate (REC) market is gaining momentum as the country accelerates its clean energy transition and encourages corporate sustainability commitments. RECs allow companies to demonstrate renewable energy consumption and support grid decarbonization, making them valuable tools for ESG reporting and carbon neutrality goals. Growing regulatory backing, corporate procurement programs, and rising participation from manufacturing, technology, and service sectors are driving demand. Digital tracking systems, blockchain verification, and transparent issuance processes are improving certificate credibility and traceability. Additionally, China’s expanding renewable energy capacity including solar, wind, hydropower, and biomass is strengthening REC supply availability.

Collaboration among energy authorities, power exchanges, and sustainability platforms is improving REC accessibility and trading efficiency. Increasing corporate demand for green electricity, driven by global supply chain expectations, is accelerating adoption across major industries. Integration of RECs into carbon neutrality roadmaps and international compliance frameworks is expanding their strategic value. Investments in grid modernization, clean energy infrastructure, and green finance initiatives are further supporting market growth. With rising corporate sustainability obligations, expanding renewable capacity, and improving certification mechanisms, China’s REC market is positioned for significant long-term development.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/china-renewable-energy-certificate-market?Prasad

China Renewable Energy Certificate Market: Major Players

China Green Certificate Trading Platform, I-REC Standard, APX Inc., Beijing Power Exchange Center, Shanghai Environment and Energy Exchange (SEEE) and Climate Bridge (Shanghai) Ltd.

Segment Covered in the China Renewable Energy Certificate Market:

By Type

I-REC dominates with 63% share, driven by rising corporate sustainability commitments and cross-border traceability needs. GEC accounts for 37%, supported by government-led renewable consumption targets. Both segments benefit from expanding renewable capacity and compliance-driven procurement.

By Energy Source

Solar RECs hold 41% share as China expands large-scale solar farms and rooftop PV installations. Wind RECs represent 33%, supported by strong onshore and offshore wind development. Hydro, biomass, and geothermal together contribute 26%, driven by legacy hydropower assets and emerging bioenergy initiatives.

Regional Analysis

East China (Market Share: 38%)

East China leads with 38% share, supported by high industrial energy consumption and strong corporate REC purchases. Large-scale solar and wind integration strengthens certificate supply. Demand is concentrated across major commercial hubs.

North China (Market Share: 27%)

North China holds 27% share, driven by extensive wind capacity and grid-connected renewable expansion. Corporates in manufacturing and data centers boost REC demand. Policy support for decarbonizing heavy industry accelerates market activity.

South China (Market Share: 17%)

South China accounts for 17% share due to strong commercial and retail energy consumption. Solar REC procurement grows rapidly with rooftop PV adoption. Multinational enterprises increase voluntary REC purchases for sustainability compliance.

Central China (Market Share: 11%)

Central China captures 11% share, supported by hydropower availability and growing biomass projects. Industrial clusters adopt RECs to meet ESG reporting requirements. Moderate renewable generation keeps REC supply steady.

Northeast China (Market Share: 7%)

Northeast China holds 7% share with contributions from wind and legacy hydro projects. Local utilities participate actively in REC trading. Gradual renewable modernization efforts support slow but consistent market expansion.

Purchase this report before year-end and unlock an exclusive 30% discount:

https://www.datamintelligence.com/buy-now-page?report=china-renewable-energy-certificate-market

(Purchase 2 or more Repots and get 50% Discount)

Request for 2 Days FREE Trial Access:

https://www.datamintelligence.com/reports-subscription?Prasad

✅ Competitive Landscape

✅ Technology Roadmap Analysis

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Consumer Behavior & Demand Analysis

✅ Import-Export Data Monitoring

✅ Live Market & Pricing Trends

Have a look at our Subscription Dashboard:

https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us –

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us –

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Search

RECENT PRESS RELEASES

Related Post