Clay County residents have lost millions to a new scam. Bitcoin makes it hard to trace

December 1, 2025

In just the last two years, 156 people have lost $3 million dollars in Clay County to cryptocurrency ATM scams.

“The scams are limited only by your imagination, but they all rhyme with each other,” Clay County Prosecutor Zach Thompson told KCUR.

The con, Thompson said, is as old as the telephone.

“What we’re seeing in Clay County is folks are getting calls from people who purport to be from the sheriff’s office,” he said. “They tell them they miss jury service and there’s a warrant out for their arrest. And unless they make this payment, someone will come arrest them.”

What’s new is the sting.

Instead of telling people they must get a money order or gift cards, crooks direct victims to Bitcoin kiosks — often called BTMs — and other cryptocurrency machines. They look like regular ATMs, but users can buy and sell cryptocurrency using cash or a card. The difference is people don’t need a bank account.

“Scammers prefer to use these machines because the transactions are near instantaneous and they’re really, really difficult, to reverse and also trace,” Thompson said.

So hard to trace that Clay County hasn’t been able to arrest anyone in any of those 156 cases, he said.

And another one just added in October.

Liberty police say a 67-year-old woman got a call from someone claiming to be from the sheriff’s office saying she had a felony arrest warrant, Deputy Police Chief Matt Kellogg said.

They told her to come in immediately, but on her way, she got another call directing her to go to the bank, withdraw $9,000 and “not talk to the teller,” Kellogg said.

She fed the cash to a Bitcoin ATM and was then convinced to withdraw $5,000 more, instructed all along not to talk to the tellers or police.

“They make them nervous enough to do what they’re told,” Kellogg told KCUR.

In 2024, cryptocurrency kiosk fraud in the U.S. totaled more than $107 million dollars, a 31% increase from the previous year, according to the FBI.

The Federal Reserve Bank of Kansas City first wrote about these scams in 2023.

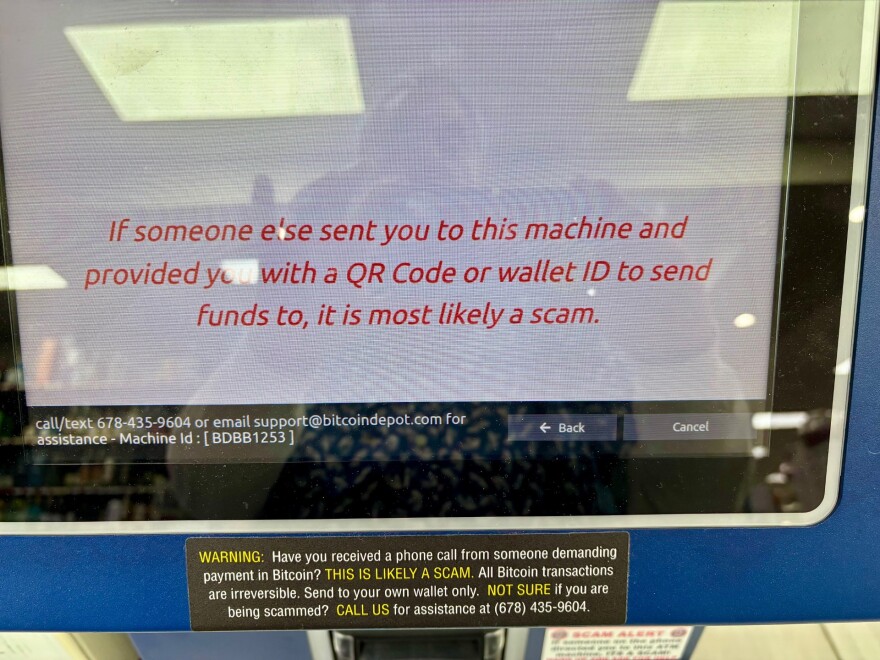

“Victims are usually sent a QR code (the scammer’s digital wallet address) and directed to go to a BTM, convert cash into cryptocurrency, and send it to the address provided. These funds are unrecoverable,” according to the report titled “The Controversial Business of Cash-to-Crypto Bitcoin ATMs.”

As money services businesses, BTMs are supposed to follow state and federal rules, including anti-money laundering regulations.

“However, many BTM operators do little or nothing to comply with existing regulations,” the Kansas City Fed report found.

The problem is so bad that the St. Paul, Minnesota city council will ban all cryptocurrency kiosks on Dec. 21.

“St. Paul city council members in support of the ban said scams involving cryptocurrency kiosks/ATMs particularly impact seniors and those with low incomes,” CBS reported.

Clay County is acting, but not nearly as harshly.

“We’ve generated a flier that we plan on posting at these machines, in hopes of interrupting the criminal process,” Thompson said.

“Are you being scammed?!” the flyer says in all caps. “Beware of cryptocurrency demands!” The flyer also features a stern photo of Thompson.

Sam Zeff

/

KCUR 89.3

Clay County has 60 cryptocurrency machines, according to the prosecutor’s office, mostly in convenience stores, gas stations and liquor stores.

Two examined by KCUR already warn of potential scams on their screens.

About 40% of all cryptocurrency kiosks are in convenience stores, according to CoinLaw.io. Bitcoin Depot dominates the market with 22% of the machines, followed by CoinFlip and Athena Bitcoin.

Coinme, which makes software for ATMs, said the company has gotten better at identifying and stopping potentially fraudulent transactions – but thieves were still able to get around its scam-prevention measures, the company told The New York Times.

By far, most cryptocurrency kiosk fraud victims are older than 60, the FBI said. They are victimized twice as often as everyone else.

However, the fastest growing group of victims are students, Thompson said.

“The younger generations are actually being targeted by scammers online at a higher rate than senior citizens,” he said.

The criminals may claim to help pay off student loans, offer scholarships or a too-good-to-believe deal on a laptop.

Younger generations grew up with online banking. “So, scammers know this and they target them,” Thompson said.

Search

RECENT PRESS RELEASES

Related Post