Clean Energy Beats Fossil Fuel in Historic $3.3T Global Energy Investment in 2025, IEA Rep

June 6, 2025

This article explores the main trends, drivers, and challenges shaping energy investment this year, with the main findings from the IEA’s World Energy Investment 2025 report. It provides a clear picture of where global energy capital is flowing and what challenges lie ahead.

Clean Energy Surges Past Fossil Fuels in Investment Race

In 2025, an expected $3.3 trillion will be invested in global energy generation. Of this, around $2.2 trillion will support renewables, nuclear power, electricity grids, storage, low-emission fuels, energy efficiency, and electrification. This is double the amount set for oil, natural gas, and coal, which will receive around $1.1 trillion.

Clean energy investment surged after the COVID-19 pandemic. This growth continues thanks to technology, economic factors, and policy support, not only climate policies.

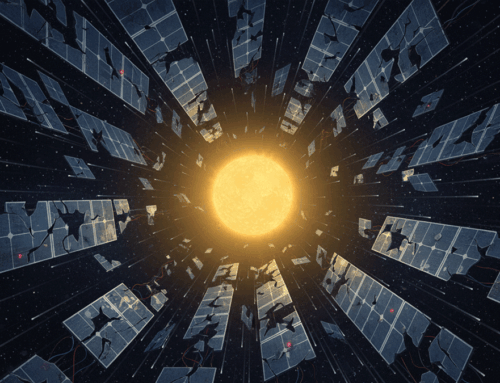

Solar Power Leads the Way

Investment in low-emission power has nearly doubled in five years. Solar photovoltaic (PV) technology is driving this growth. By 2025, global spending on solar energy, including utility-scale and rooftop systems, is set to hit $450 billion. This will make it the largest energy investment category.

Solar panels, especially those imported from China, are becoming more affordable and are driving energy investment in many developing countries. For example, Pakistan imported 19 gigawatts (GW) of solar capacity in 2024, about half its total grid-connected capacity.

Growth in Batteries and Nuclear Energy

Spending on batteries for power sector storage will hit $66 billion by 2025. This will help integrate renewable energy sources into electricity grids. Nuclear investment is also rising, with spending on new plants and refurbishments expected to exceed $70 billion this year. Interest in new nuclear technologies, such as small modular reactors (SMRs), is growing, especially in the United States and the Middle East.

Global Giants Drive the Clean Energy Boom

About 70% of the recent increase in clean energy investment comes from countries that import fossil fuels, led by China, Europe, and India. China is investing heavily in reducing its reliance on imported oil and gas and becoming a leader in clean energy technologies.

A separate report by energy think tank Ember also shows the same trend – China takes the lead in clean energy investment in early 2025.

Meanwhile, Europe sped up its investment in renewables and energy efficiency. This change came after Russian gas supplies were disrupted due to the Ukraine invasion. The United States has boosted investment. This is partly to compete with China in the supply chains for new clean technologies.

Emissions reduction is a big reason to invest, but it’s not always the main one for mature and cost-competitive clean technologies. Investors are also influenced by concerns about energy security and the desire to lead in new industries.

Uncertainty in the global economy and trade is making some investors hold off on new project approvals. However, spending on current projects is still strong, especially in the field of rising artificial intelligence (AI) dominance.

AI + Energy: The Data Center Effect

The fast rise of AI and data centers is driving up electricity demand. This trend is also boosting investment in power generation. Annual investment in data centers has risen by 67% over the past two years, and from 2025 to 2030, an additional $4.2 trillion is expected globally.

By 2030, data centers might use 950 terawatt-hours of electricity, doubling their current amount. This could lead to over $170 billion in investments for new generation capacity. Renewables will meet most of this demand, as shown below.

However, interest is rising in next-generation solutions like small modular nuclear reactors. SMRs provide stable power and fit the constant energy needs of data centers.

Technology companies are also exploring geothermal energy partnerships, supported by rising venture capital. Tech giants and energy developers are teaming up for new nuclear and geothermal projects. However, challenges like cost uncertainties and regulatory hurdles for SMRs still exist.

Gridlock Ahead: Infrastructure Struggles to Keep Pace

Investment in the electricity sector is set to reach $1.5 trillion in 2025, about 50% higher than the total spent on bringing oil, natural gas, and coal to market. Spending on electricity grids is around $400 billion each year. But this isn’t enough to match the fast rise in power demand and the growth of renewables.

Delays in permitting, supply chain bottlenecks for components like transformers and cables, and the weak financial health of utilities, especially in developing countries, are slowing progress.

Coal and Gas Remain Significant

Despite the focus on clean energy, coal and gas continue to play a major role in some regions. In 2024, China greenlit nearly 100 GW of new coal-fired power plants. India added another 15 GW. This raised global approvals to their highest since 2015.

In contrast, advanced economies did not order any new coal-fired power plants last year.

Notably, investment in new gas-fired power is rising. The United States and the Middle East make up nearly half of the new project approvals.

Fossil Fuel Investment Trends: Oil and Gas Investment Declines

Oil prices and demand are set to drop, leading to a 6% decrease in investment in upstream oil projects in 2025. This will be the first annual decline since the COVID-19 pandemic in 2020 and the largest since 2016.

Upstream oil and gas investment is expected to drop by around 4%. This brings the total to just under $570 billion. Of this amount, 40% will go toward maintaining production at current fields. Investment in oil refineries is also set to reach its lowest level in a decade.

Spending on new LNG facilities is rising despite some delays and cost overruns. Projects in the United States, Qatar, and Canada are getting ready to start. From 2026 to 2028, the world may experience huge yearly jumps in LNG capacity, with the United States set to nearly double its export capacity.

Meanwhile, investment in coal supply is expected to increase by 4% in 2025, continuing a trend of steady growth over the past five years. This reflects ongoing demand in parts of Asia, even as advanced economies move away from coal.

The Outlook for 2025 and Beyond

The global energy investment scene is changing fast, as reported by the IEA. Clean energy technologies are drawing more money and interest. Fossil fuels are still important in some areas. However, the trend is shifting.

More investment is going into renewables, electrification, and energy efficiency. This transition is being shaped by technology advances, economic factors, and the need for energy security, as well as by climate policies.

To meet rising electricity demand and ensure energy security, investment in grids and storage should accelerate. As such, continued support for innovation and infrastructure will be crucial for a successful energy transition in the years ahead.

Search

RECENT PRESS RELEASES

Related Post