Coinbase Sentiment Hits Rock Bottom as Bitcoin Correlation Crushes Options Traders

December 12, 2025

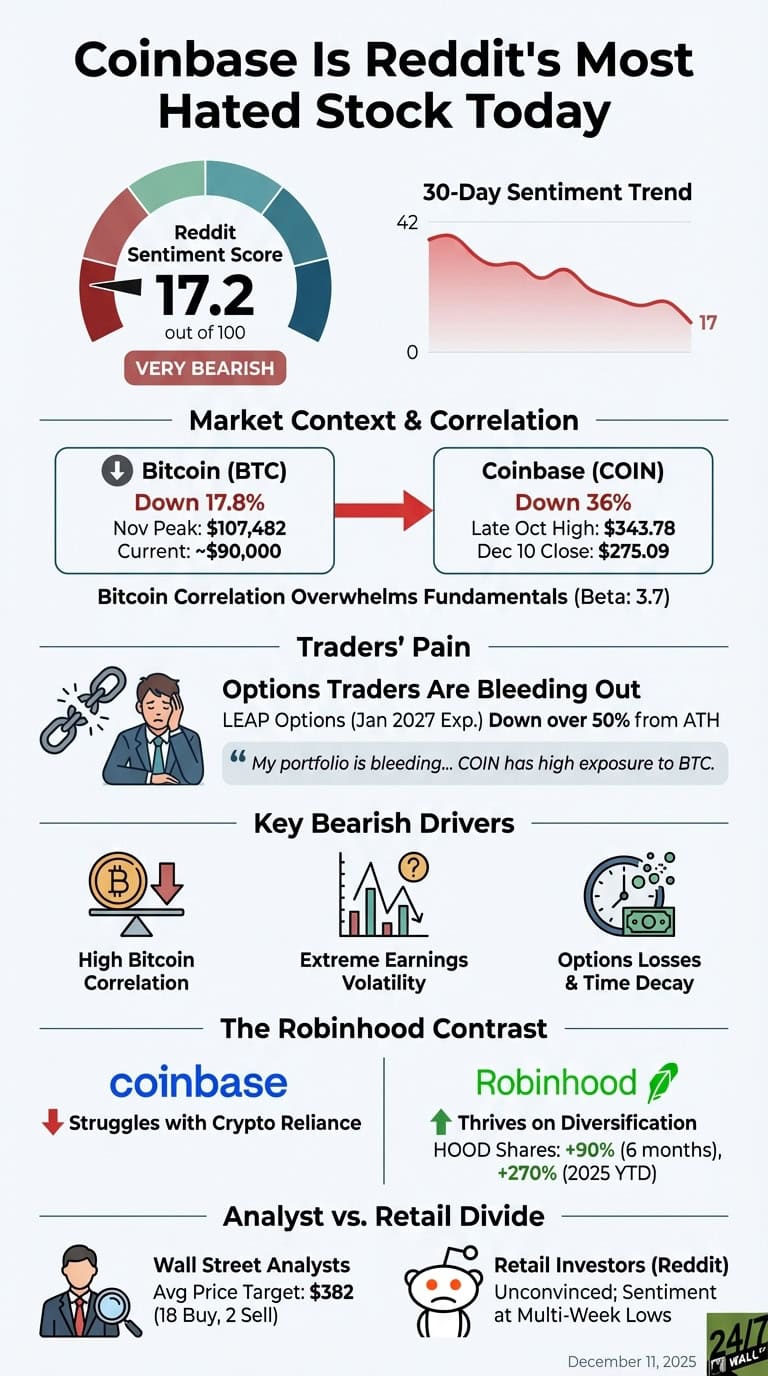

Shares of Coinbase (NASDAQ:COIN) closed at $275.09 on December 10 as retail investor sentiment on Reddit remains deeply negative. The stock carries a sentiment score of just 17.2 out of 100, placing it in the “very bearish” category. Bitcoin’s 17.8% decline from its November peak of $107,482 to around $90,000 has dragged Coinbase down 36% from its late October high of $343.78.

Options Traders Are Bleeding Out

The pain is palpable in retail trading communities. One trader on r/options posted about their LEAP options (long-term calls expiring January 2027) purchased during the March-April dip. The trader wrote: “I almost reached $250k like 2 months ago and now I’m down over -50% from ATH. My portfolio is bleeding.” They explained their positions, noting “COIN has high exposure to BTC so that’s really not helpful.”

LEAP Options Jan 2027 Exp. Down over -50% from ATH (Need Advice)

Despite Coinbase beating Q3 earnings estimates by 27% (delivering $1.50 per share versus $1.18 expected) and posting a 43.7% profit margin, the stock has failed to hold gains. Three factors drive the bearish sentiment:

- Bitcoin correlation overwhelms fundamentals, with COIN’s beta of 3.7 amplifying crypto market swings

- Earnings volatility makes timing impossible, alternating between 240% beats and 87% misses in recent quarters

- Options holders face magnified losses as extreme volatility crushes time value

Robinhood Thrives While Coinbase Struggles

The contrast with Robinhood (NASDAQ:HOOD) is striking. Robinhood shares have surged 90% over the past six months and 270% in 2025, benefiting from diversification into event contracts, options trading, and financial services that reduce reliance on crypto volatility. While both platforms saw strong Q3 results, Robinhood’s broader revenue base has insulated it from Bitcoin’s weakness.

Wall Street analysts maintain an average price target of $382 for Coinbase with 18 buy ratings versus just 2 sells, suggesting professional investors see value. But with Bitcoin trading below $91,000 after Wednesday’s Fed-driven selloff and Reddit sentiment at multi-week lows, retail traders remain unconvinced that Coinbase can break free from crypto’s gravitational pull.

Search

RECENT PRESS RELEASES

Related Post