Companies Using Debt to Buy BTC Could ‘Hurt Bitcoin’: Anthony Scaramucci

June 18, 2025

In brief

- SkyBridge Capital’s Anthony Scaramucci criticized companies that issue debt to buy Bitcoin for their corporate treasuries, calling it a risky trend that could hurt Bitcoin when it goes out of fashion.

- Scaramucci’s stance puts him at odds with MicroStrategy’s Michael Saylor, whose company has used convertible debt to build a $61.9 billion Bitcoin treasury and inspired other firms to follow suit.

- While both men are bullish on Bitcoin, Scaramucci sees it as “digital gold” worth $24-25 trillion versus Saylor’s view of it as “digital property” potentially worth $500 trillion.

SkyBridge Capital may be investing in Bitcoin, but the firm’s founder Anthony Scaramucci is “not a fan” of companies following Strategy’s playbook of issuing debt to buy BTC for their corporate reserves.

Responding to a question about Bitcoin treasury companies issuing debt to buy BTC, Scaramucci declared that he was “not in love with that,” during a keynote interview at the DigiAssets 2025 conference. “That feels like SPACs, that feels like stuff that happens in our industry that you get excess of,” he said.

“I’m worried that there’ll be a crack in that, that will actually come back and hurt Bitcoin,” he added.

He likened the enthusiasm for becoming Bitcoin treasury companies to shifting sartorial tastes in the fashion industry.

“The skirts go up, the skirts go down; the lapels widen, they narrow,” he said. While issuing debt to buy Bitcoin is “a hot thing to do right now,” Scaramucci added, “It will become out of fashion and it’ll hurt Bitcoin.”

That stance places him at odds with Strategy chairman Michael Saylor, whose firm has aggressively pursued a playbook of using convertible debt to acquire BTC, while capitalizing on the momentum of its own stock price during bull markets. At the moment, Strategy is sitting on a BTC treasury worth approximately $61.9 billion, according to Bitcoin Treasuries.

While firms including Metaplanet, Mara and Riot Holdings have adopted Strategy’s playbook, it hasn’t been without criticism.

In a recent research note, Swiss digital asset bank Sygnum flagged the risk of a “very damaging signal to the market” if Bitcoin experienced a prolonged downturn and Strategy was forced to liquidate part of its BTC holdings to cover debt obligations.

And while analysts at The Kobeissi Letter noted earlier this year that structural safeguards render a forced liquidation scenario for Strategy “highly unlikely,” they flagged the risk that “prolonged weakness could pressure its ability to meet obligations.”

While he shares Saylor’s bullish outlook on Bitcoin, Scaramucci takes a more cautious view on its likely price appreciation. “For me, it’s digital gold—so I think it will trade to the market cap of gold” he said.

“If Michael Saylor was up here, he’d say, ‘No, it’s digital property, it will be tied to the rest of the world’s property,’” Scaramucci added. “He thinks it’s a $500 trillion asset. I think it’s a $24 or $25 trillion asset.”

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

NASCAR Prime Video ratings revealed after Mexico City weekend

SWI Editorial Staff2025-06-18T09:48:31-07:00June 18, 2025|

Amazon CEO Jassy says AI will reduce its corporate workforce in the next few years

SWI Editorial Staff2025-06-18T09:48:28-07:00June 18, 2025|

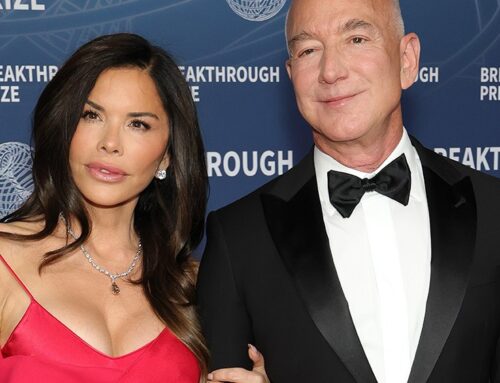

Jeff Bezos and Lauren Sánchez’s Upcoming Venice Wedding Prompts Local Protests: ‘No Space

SWI Editorial Staff2025-06-18T09:48:24-07:00June 18, 2025|

Amazon Prime Day prep: 15 early tech deals you can’t afford to miss

SWI Editorial Staff2025-06-18T09:48:12-07:00June 18, 2025|

Amazon plans to slash workforce as AI becomes more prominent, CEO says

SWI Editorial Staff2025-06-18T09:48:05-07:00June 18, 2025|

Companies Using Debt to Buy BTC Could ‘Hurt Bitcoin’: Anthony Scaramucci

SWI Editorial Staff2025-06-18T09:47:08-07:00June 18, 2025|

Related Post