Could Buying Berkshire Hathaway Stock Today Set You Up for Life? @themotleyfool #stocks $BRK.B $BRK.A

March 9, 2025

Warren Buffett’s trillion-dollar conglomerate could still be a great long-term investment.

On average, Berkshire Hathaway (BRK.A -0.56%) (BRK.B -0.45%) has outperformed the S&P 500 ever since Warren Buffett took over the company in 1965. Under Buffett, Berkshire shut down its struggling textile business, acquired cash-rich insurance and energy companies, and expanded into other industries. It also built a massive portfolio of stocks that is worth $285 billion today.

Over the past 30 years, a $10,000 investment in Berkshire Hathaway would have grown to about $341,000. So could a $10,000 investment in Buffett’s conglomerate today possibly set you up for life over the next three decades?

Image source: Berkshire Hathaway.

What happened to Berkshire Hathaway over the past 30 years?

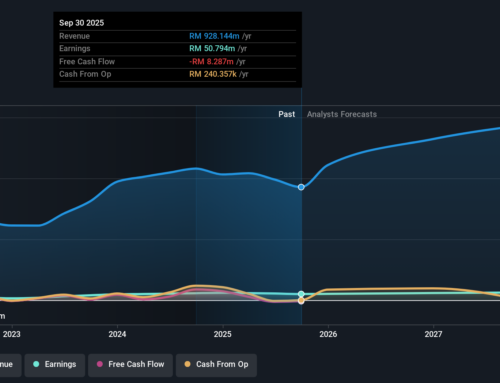

Berkshire Hathaway uses its “operating earnings,” which exclude the capital gains or losses from its investment portfolio, to measure its bottom-line growth instead of its net income on a generally accepted accounting principles (GAAP) basis. Buffett says that proprietary metric tunes out the near-term noise from the stocks in its portfolio.

From 1994 to 2024, its operating earnings grew at a compound annual growth rate (CAGR) of 16% from $606 million to $47.4 billion. During those three decades, its insurance underwriting operating earnings grew at a CAGR of 17% as its insurance investment income rose at a CAGR of 13%. Those two core businesses accounted for 48% of its operating earnings in 2024.

Berkshire significantly expanded those two businesses by acquiring insurance companies like GEICO, Gen Re, Alleghany, Wesco, and National Indemnity over the past few decades. It also invested in big insurers like Chubb.

Buffett turned insurance companies into Berkshire’s core growth engines for two reasons. First, insurance companies collect a lot of cash upfront through their premiums, and they can invest that money to grow their profits until they need to pay out their claims. Second, insurance companies are resistant to economic downturns because most of their customers won’t cancel their policies just to save a few dollars.

Those evergreen businesses, along with Berkshire’s other subsidiaries, generate a steady flow of cash for its closely watched investment portfolio — which holds big stakes in blue chip giants like Apple, American Express, and Coca-Cola. That stable growth cycle enabled Berkshire to keep expanding its core business through acquisitions while investing in more stocks.

But what will happen to Berkshire Hathaway over the next 30 years?

Berkshire Hathaway’s biggest problem is that its success was mainly driven by Warren Buffett and his longtime partner Charlie Munger. However, the 94-year-old Buffett plans to retire soon and hand the reins over to Greg Abel, the chairman and CEO of Berkshire Energy. Munger, whom Buffett called the company’s “architect,” passed away in 2023. Ajit Jain, who served as its insurance chief for nearly four decades, also sold more than half of his shares last year and might retire in the near future.

That changing of the guard could shake up Berkshire’s stable business model that has generated such strong returns over the past six decades. Over the past year, Berkshire’s decision to pause its buybacks, sell some of its top stock holdings, and raise its cash holdings and T-bills to record levels also strongly indicated its own stock — and the broader market — was getting overheated at these historically high levels.

Looking further ahead, the main concern is that Abel won’t stick with Buffett’s balanced strategy of milking its conservative, cash-rich businesses and investing in undervalued stocks. If Abel and his successors get too aggressive and “di-worsify” Berkshire’s sprawling business over the next three decades, its growth could stagnate and it could underperform the market.

But if Buffett’s successors stick with his time-tested strategy of growing its core businesses and conservatively expanding its investment portfolio, it could continue to outpace the S&P 500’s average annual return of about 10% over the next 30 years.

Could Berkshire Hathaway’s stock set you up for life?

If you invest $10,000 in Berkshire Hathaway, and its stock keeps pace with the market and appreciates at a CAGR of 10% over the next 30 years, your investment will grow to nearly $174,500 by the end of the final year.

At a faster CAGR of 15%, your $10,000 investment would grow to more than $662,100. That would certainly be a life-changing gain, but it might not be enough to “set you up for life” on its own as inflation erodes the value of the dollar. That said, Berkshire Hathaway could still be a great long-term investment as long as Buffett’s successors stick with his market-beating playbook.

Search

RECENT PRESS RELEASES

Related Post