Could Dogecoin Be the Next Bitcoin?

September 30, 2025

Bitcoin’s rise to prominence has sparked a frenzy to find the next big opportunity in the cryptocurrency market.

Like traditional markets, the cryptocurrency space has its own hierarchy of assets. At the top of the pyramid sits Bitcoin (BTC -0.49%) — often referred to as digital gold. Over the past decade, Bitcoin has not only gained mainstream recognition but also institutional adoption, cementing its role as the most dominant cryptocurrency in existence.

Naturally, Bitcoin’s rise has fueled curiosity among investors eager to discover the next breakout token. One digital asset that consistently sparks debate is Dogecoin (DOGE -1.17%).

Much like Bitcoin in its early days, Dogecoin trades at a fraction of just one dollar. For many retail investors, this “low” entry price creates the perception of untapped upside — the idea that Dogecoin could someday follow a similar trajectory to Bitcoin and deliver exponential returns.

This raises a critical question: Could Dogecoin realistically become the next Bitcoin?

Image source: Getty Images.

To answer that, let’s explore the fundamentals of each coin and examine what makes Bitcoin unique — and learn whether Dogecoin can measure up.

Bitcoin’s advantage: Scarcity, adoption, and high-profile status

At its core, Bitcoin was designed to create a system of commerce that operates outside the standard protocols of central banks and governments.

What truly sets Bitcoin apart is its hard-capped supply of just 21 million coins. Unlike fiat currencies — which can be printed in unlimited quantities — Bitcoin’s built-in scarcity parallels that of other rare alternative assets like commodities or art. Because of this, many investors see Bitcoin not only as a revolutionary payment network but also as a store of value and a hedge against inflation.

Beyond its scarcity, Bitcoin has also achieved remarkable levels of institutional trust. High-profile investors like Ark Invest CEO Cathie Wood have become vocal supporters, while corporations such as GameStop and Strategy (formerly MicroStrategy) have added Bitcoin to their balance sheets — highlighting its growing role in corporate treasury management.

On Wall Street, financial giants like BlackRock now offer spot Bitcoin ETFs — giving investors across all demographics unprecedented access to the world’s largest cryptocurrency through a familiar and convenient investment vehicle.

What is Dogecoin?

Unlike Bitcoin’s ambitious origins, Dogecoin was born out of humor. Its creators sought to ride the wave of early altcoins and chose a relatable Shiba Inu dog mascot as a lighthearted logo. But what started as satire swiftly snowballed into a viral internet sensation.

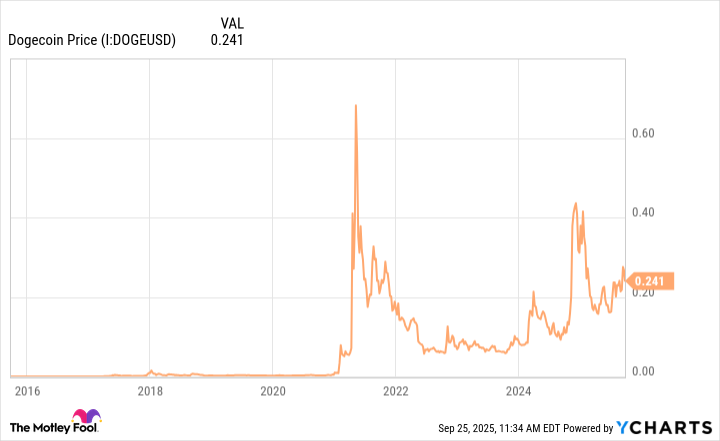

Over the years, Dogecoin’s price has experienced numerous fleeting surges — often fueled by speculative trading, hype-driven narratives, or even humorous celebrity endorsements.

Dogecoin Price data by YCharts.

While developers have made efforts to expand its utility through decentralized applications and potential Dogecoin ETFs, its valuation still rests largely on community-driven momentum rather than concrete underlying fundamentals.

Dogecoin vs. Bitcoin

Where Dogecoin falls short is as a store of value. Unlike Bitcoin, Dogecoin has an unlimited supply. This structure makes it inherently inflationary, and therefore difficult to sustain meaningful long-term price appreciation. This fundamental difference explains why Dogecoin is unlikely to ever rival Bitcoin. Instead, Dogecoin’s future seems rooted in its role as a meme-driven asset — prone to unpredictable and fleeting bursts of enthusiasm fueled by internet culture.

While Dogecoin may never be the next Bitcoin, it has still carved out a unique cultural niche within the broader cryptocurrency market. Its developers have built a vibrant, loyal community with strong brand recognition, and its transaction fees are relatively low compared to other blockchain networks. For traders, Dogecoin offers entertainment value and liquidity — though with an overly pronounced risk profile.

Although I do not see Dogecoin as a prudent buy-and-hold investment opportunity, its developers deserve some credit for creating a token that has captured global attention and added a distinctive — albeit unconventional — layer to the crypto ecosystem.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool recommends BlackRock. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post