Could This Company’s AI Investments Finally Pay Off for Shareholders?

November 25, 2025

This stock has underperformed the S&P 500 year-to-date.

In recent years, the world’s biggest tech companies have turned their attention to artificial intelligence (AI), an area they expect to be the next big thing. This is because AI offers the possibility of revolutionizing everything from factory operations to the development of new lifesaving drugs. All of this should result in enormous cost savings for companies, game-changing innovation, and significant gains in earnings over time.

So, it’s not surprising that technology leaders are eager to make progress in AI — and are spending billions of dollars along the way. In fact, one company in particular has made headlines quarter after quarter as it’s announced increased AI spending. Could this company’s AI investments finally pay off for shareholders? Let’s find out.

Image source: Getty Images.

A social media giant

You might be surprised to learn that this company isn’t an AI equipment maker or a cloud service provider, but instead, it’s known for its leadership in social media. I’m talking about Meta Platforms (META +3.45%), owner of Facebook, Messenger, WhatsApp, and Instagram. These apps drive Meta’s billion-dollar sales thanks to advertising — advertisers are eager to reach us across these platforms, where they know we spend a lot of our time.

This business has proven to be successful for Meta, generating earnings gains over the years. And the financial picture is so strong that Meta even launched its first-ever dividend last year.

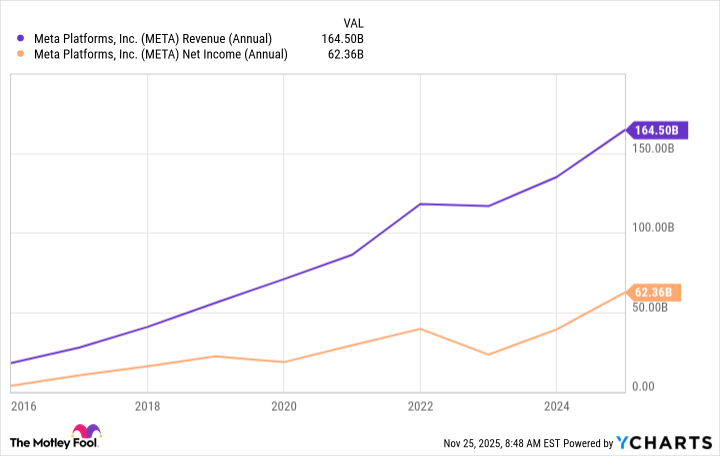

META Revenue (Annual) data by YCharts

In recent years, though, Meta has expanded its business to include a major focus on AI, and that includes billions of dollars in investment annually. For the current year, Meta predicts capital expenditures, which include investment in AI, to reach the range of $70 billion to $72 billion — that’s up from earlier expectations of $66 billion to $72 billion. Next year, the company predicts capex dollar growth will be “notably larger” than it was in 2025, and total expenses will grow faster. All of this will support costs such as infrastructure buildout and compensation for recently hired AI talent.

Meta aims to offer all of its users AI assistants and features that will prompt them to spend more time on the company’s apps. And at the same time, the company is using AI to improve the advertising process and advertising results. All of this should please advertisers and, therefore, increase the ad revenue opportunity for Meta.

The road to leadership

The company also supports open source AI and currently offers more than 600 such projects. Open source involves allowing anyone to participate and develop a particular platform, and by launching these projects, Meta may advance more quickly in AI and establish itself as a clear leader.

All of this sounds fantastic, but investors have worried about one risk, and that’s the idea that Meta may build out too much capacity and overspend in this AI boom. This has weighed on the stock, which is heading for a gain of less than 5% this year, underperforming the S&P 500.

Meta Platforms

Today’s Change

(3.45%) $21.18

Current Price

$634.23

And as a result, Meta has become the cheapest of the Magnificent Seven tech stocks. Today, the stock trades for only 23x forward earnings estimates.

It’s important to note that Meta chief Mark Zuckerberg, in the latest earnings call, made comments that should ease concerns about AI buildout. He said that demand for compute from Meta’s core business is high, suggesting the need for aggressive investment — and in the worst-case scenario, if demand slipped, Zuckerberg said Meta would slow the buildout and grow into what’s currently available.

What Mark Zuckerberg says

Now, let’s return to our question: Could Meta’s AI investment finally pay off for shareholders? Zuckerberg has said in the past that scaling new products always has taken time, but Meta and its shareholders eventually have benefited from the efforts — and he expects the same to be true in the case of AI.

“Building the leading AI will also be a larger undertaking than the other experiences we’ve added to our apps, and this is likely going to take several years,” he said during the first quarter 2024 earnings call.

But Meta is seeing progress along the way, for example, the company’s ads business is benefiting from the AI efforts. Zuckerberg said in the latest earnings call that the annual run rate for complete AI-powered ad tools has surpassed $60 billion.

So, Meta’s investment in AI is likely to pay off in stages, not all at once at a particular time, and this means shareholders may see some of these gains now and progressively from quarter to quarter. This, along with Meta’s solid social media business and bargain price today, makes it a great AI stock to buy and hold.

Search

RECENT PRESS RELEASES

Related Post