Crypto news: Bitcoin sell-off extends 📉Ethereum falls below important support zone

November 4, 2025

Crypto news: Bitcoin sell-off extends 📉Ethereum falls below important support zone | XTB

9:51 AM · 4 November 2025

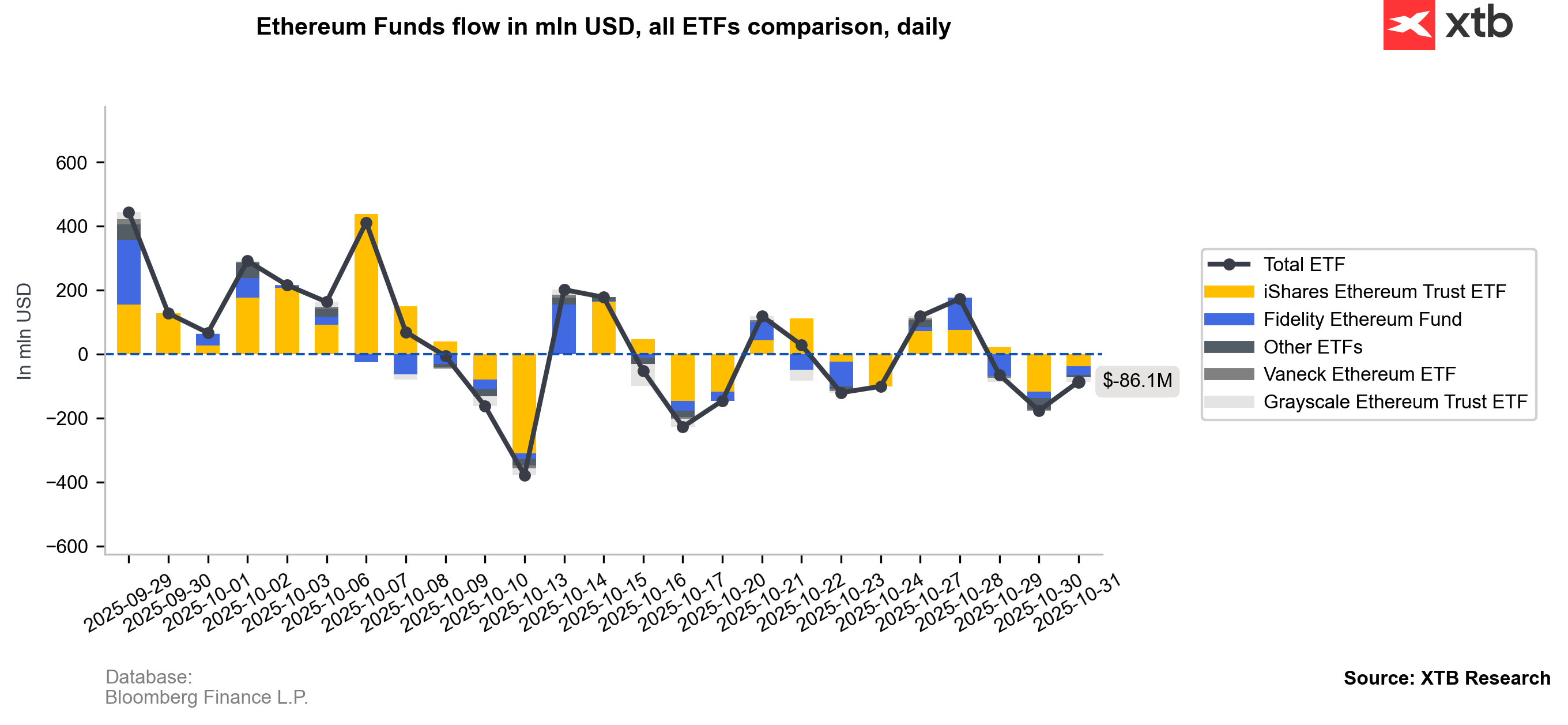

Cryptocurrencies remain largely dependent on stock market sentiment. According to Goldman Sachs data, the put-call skew in the Mag7 group (the seven largest tech companies) inverted for the first time since December 2024, meaning that the implied volatility of call options (betting on price increases) has exceeded that of puts (betting on declines). This phenomenon is rare and may signal that investors are potentially over-positioned for further equity market gains.However, weak technical conditions (also visible in Ethereum) and declining interest in U.S. spot ETF inflows are, to some extent, undermining the narrative of a strong autumn rally in the crypto market. As a result, the market may increasingly mirror the 2021 scenario, when the first half of November brought sharp declines in cryptocurrencies, triggering a bear market that lasted until around December 2022.

Bitcoin and Ethereum

Bitcoin (BTC)

Key support levels for BTC remain the psychological $100,000 area and $94,000 (the retracement of this year’s entire advance). Should both levels be broken, we may cautiously assume that Bitcoin’s uptrend has ended. The current price is about 6% below the average cost basis for short-term holders, which indicates stress and potential loss realization within this group. Based on realized price metrics across all investor cohorts, a potential bear-market bottom would likely form in the $50,000–$55,000 range. Conversely, if Bitcoin finds solid support and resumes its rally, a breakout above $110,000 could open the way toward new all-time highs above $126,000.

Source: xStation5

Ethereum (ETH)

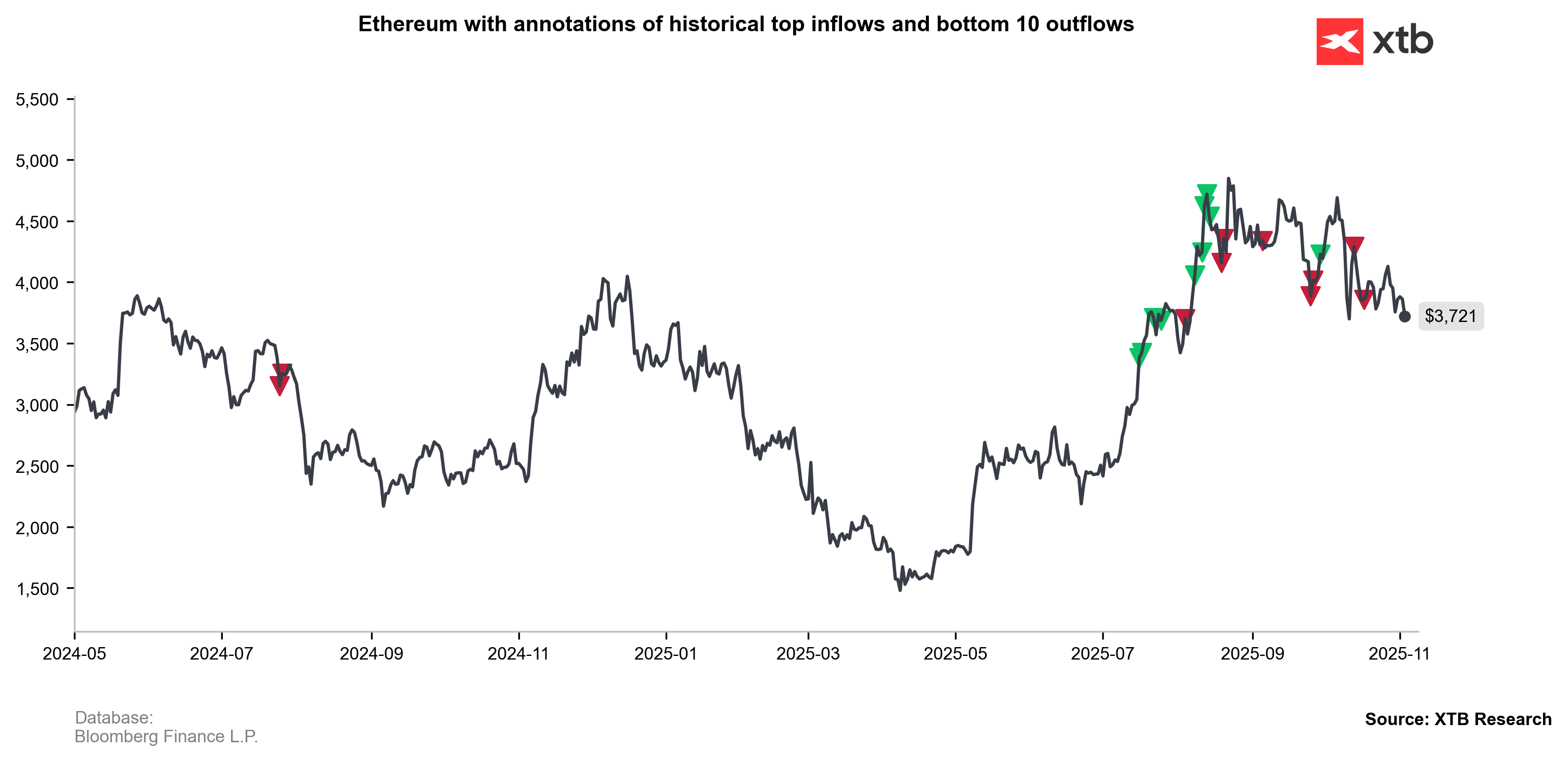

Ethereum is currently under pressure, but based on historical price impulses, we can cautiously assume that market geometry supports at least a consolidation phase after the recent decline. Historically, however, drops below the 200-day EMA have almost always led to deeper sell-offs for ETH than the current one. To maintain a bullish trend, a quick rebound above $3,700 would be necessary. Otherwise, renewed pressure could push the price back toward $2,500, erasing this summer’s upward move.

Sources: xStation5

Source: xStation5

Bloomberg Finance L.P. , XTB Research

Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finane L.P. , XTB Research

Search

RECENT PRESS RELEASES

Related Post