Crypto stocks surge as bitcoin refuses to go down in 2026

January 5, 2026

We’re on our fifth day of 2026 and bitcoin has gone up in every single one of them, rising about 6% in the process.

The crypto asset is working on its longest streak of gains since October, propelling bitcoin-adjacent stocks higher in premarket trading on Monday, including:

-

Strategy, even as it announces a $17.44 billion unrealized loss on its crypto holdings in Q4.

-

Other digital asset treasury companies like Strive Inc. and Trump Media & Technology Group.

-

Miners MARA Holdings, Riot Platforms, and Hut 8.

-

Bitcoin miners turned data center stocks IREN and Cipher Mining.

-

Trading platforms Coinbase and Robinhood Markets.

(Robinhood Markets Inc. is the parent company of Sherwood Media, an independently operated media company subject to certain legal and regulatory restrictions.)

More Markets

Intel rises in early trading after upgrade

Melius Research gave Intel a lift in early trading with an upgrade to “buy” from “hold,” based partly on optimism that the partially nationalized American chipmaker will find a corporate partner to use its next-generation chip-making process, which is known as 14A.

According to the Fly on the Wall, Melius analysts see a “good chance” that Nvidia and Apple kick the tires on the new technology by 2028-29.

Melius’ new $50 price target for the stock implies a gain of roughly 20% from current levels.

Melius’ new $50 price target for the stock implies a gain of roughly 20% from current levels.

Comcast sinks as it completes the spin-off of most of its cable channels

Shares of cable juggernaut and Peacock parent Comcast sank more than 6% in premarket trading on Monday.

Driving the move was the completion of a separation of most of its cable channels into a separate entity trading as Versant Media.

The spin-off, which you can blame for the MSNBC to MS NOW rebrand (and any resulting logos), was first announced in late 2024. Comcast’s cable channels, including USA Network, Golf Channel, Oxygen, and E!, have all moved under the Versant umbrella, along with digital brands like Rotten Tomatoes and Fandango. Comcast will retain NBC, Peacock, and Universal under the new structure.

Comcast isn’t the only cable giant trying to separate itself from cable. The media bidding war target of the moment, Warner Bros. Discovery, announced last year that it would perform a similar split.

Micron surges as Foxconn’s sales beat and rivals plan production boosts, underscoring demand for memory chips

The start of the year is bringing more reassuring signs about the longevity and intensity of the AI build-out, letting the good times roll for Micron, with the stock up nearly 4% in premarket trading.

Hon Hai, more commonly known as Foxconn, announced sales about 8% above estimates for Q4, while Korean media reports that Samsung and SK Hynix (which along with Micron make up the power trio in memory chips) are planning to boost production materially this year, in order to take advantage of hot demand and high prices.

Shares of the memory chip specialist are up 40% (and counting) since it announced blowout results for its fiscal Q1 and a stellar outlook on December 17.

Micron’s upward momentum this morning builds on Friday’s more than 10% gain, which contributed to a record-setting outperformance of hardware stocks relative to software stocks — a theme that looks to be carrying into this week, albeit with both groups higher in early trading.

Tesla trades higher after Musk has “lovely dinner” with President Trump

Tesla is up about 1.5% in premarket trading on Monday, as Elon Musk and President Trump start 2026 as they began 2025 — hanging out and being buddies, with Tesla’s CEO writing about his “lovely dinner” with Donald and Melania Trump over the weekend.

Considering Musk posted on X that “2026 is going to be amazing,” alongside a photo of him dining at Mar-a-Lago, the dinner appeared to be an indication that the Tesla CEO and Trump are back in one another’s good graces after a very public falling-out last year.

Better ties with the head of the US government is outweighing any negative sentiment about Tesla’s China business, after an update from China’s Passenger Car Association on Monday confirmed that Tesla’s shipments in the region dropped in 2025, down 7% from a year earlier to 851,732 vehicles.

Though Tesla’s December 2025 sales figure in China was actually solid, up 3.6% compared to December 2024, the year as a whole was a tough one for Tesla’s core business, as it ceded its crown as the world’s biggest EV maker to China’s BYD. Indeed, on Friday Tesla announced that its annual deliveries had dropped for a second straight year, in contrast to BYD’s 28% jump in EV annual sales last year.

Oil and defense stocks gain after President Trump says the US plans to “run” Venezuela after Saturday’s military operation

Oil and defense stocks rose in premarket trading Monday as markets reacted to the US military’s Saturday operation in Venezuela, which resulted in the capture of President Nicolás Maduro.

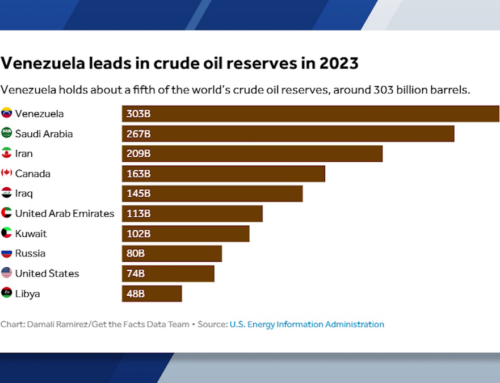

The rally in energy shares followed weekend statements from President Trump, who said the US will temporarily “run” Venezuela throughout the transition and that US oil companies are prepared to “spend billions of dollars” rebuilding the country’s oil infrastructure. Indeed, Venezuela’s oil sector has been crippled by years of underinvestment, US sanctions, and mismanagement, despite the country holding the world’s largest proven oil reserves — estimated at ~19% of global reserves or 303 billion barrels as of 2024, according to OPEC’s annual statistical bulletin.

Those seen as potential beneficiaries — and among the key movers as of Monday morning — include major names such as Chevron, the only US oil producer still operating in Venezuela, as well as Exxon and ConocoPhillips. Oil field service firms like Halliburton and Schlumberger are also up more than 4.5%, as investors wager their services could potentially be central to repairing the country’s production facilities. Refineries like Valero, Phillips 66, and Marathon Petroleum gained as well, as their US Gulf Coast facilities are designed to process heavy, high-sulfur Venezuelan crude.

Latest Stories

Sherwood Media, LLC produces fresh and unique perspectives on topical financial news and is a fully owned subsidiary of Robinhood Markets, Inc., and any views expressed here do not necessarily reflect the views of any other Robinhood affiliate, including Robinhood Markets, Inc., Robinhood Financial LLC, Robinhood Securities, LLC, Robinhood Crypto, LLC, or Robinhood Money, LLC.

- Privacy Notice

- Disclosures

- Terms and Conditions

- Editorial Standards

- Masthead

- Your Privacy Choices

- Advertising Disclaimers

©2026 Sherwood Media, LLC

Search

RECENT PRESS RELEASES

Related Post