Crypto Today: BTC price hits $100K as Trump announces UK trade deal, boosting Ethereum, PE

May 8, 2025

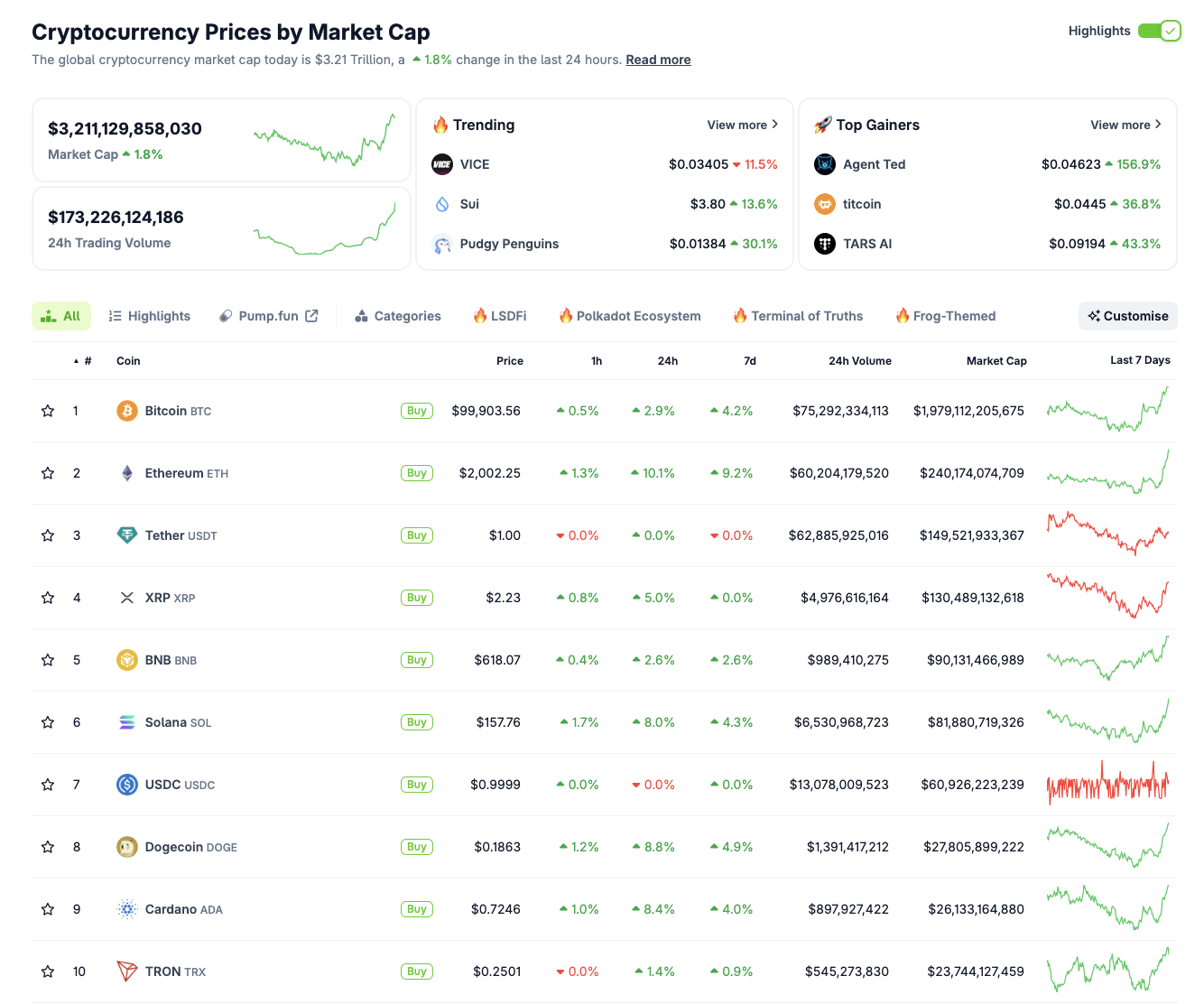

- Cryptocurrency sector valuation holds above $3.1 trillion on Thursday as global financial markets react to bullish macro pointers.

- US President Donald Trump announced a trade deal with the UK, hinting at more deals in the works.

- Ethereum-hosted assets are attracting unusually high-demand with ETH, PEPE and Chainlink price gains accompanied by rising trading volumes.

- SUI, Virtuals Protocol and the official TRUMP token are also among the standout performers, driven by distinct catalysts.

The cryptocurrency sector valuation crossed the $3.1 trillion market on Thursday, as markets reacted to bullish macro pointers.

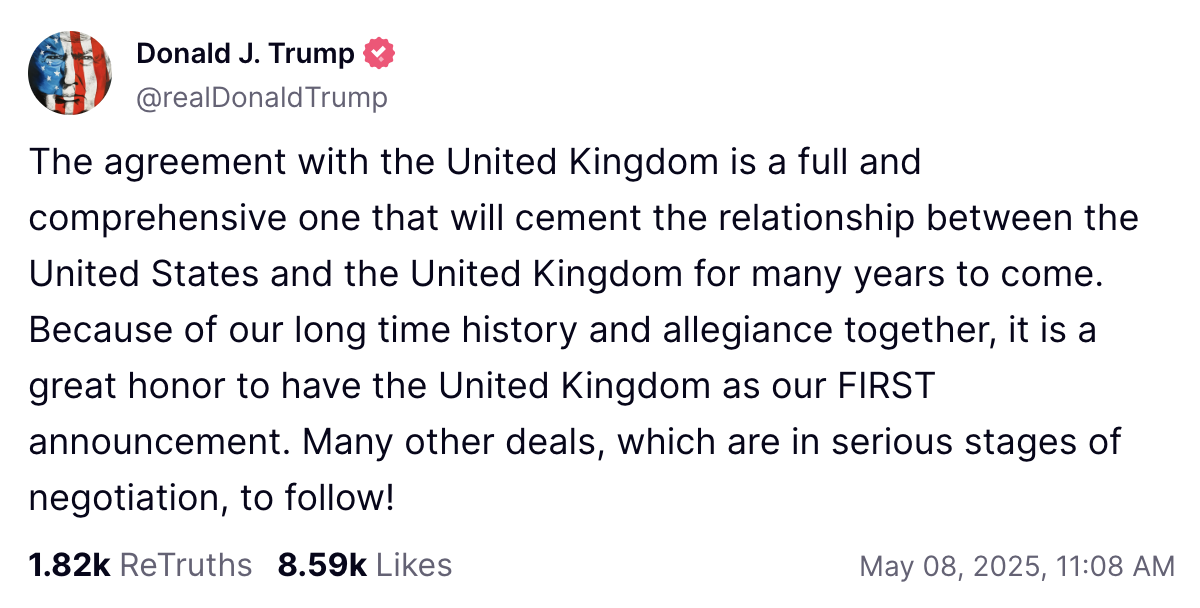

United States (US) President Donald Trump announced a trade deal with the United Kingdom (UK) on Thursday morning. Markets had priced in the move before its announcement, with top-ranked assets, including BTC and ETH, breaking multi-month resistance levels at $2,000 and $100,000, respectively.

Trump announces trade deal with UK, May 8, 2025 | TruthSocial

With Trump’s post hinting at more trade deals in the works and Chinese authorities confirming talks to discuss existing tariffs, the crypto market is expected to witness more capital inflows as the US day-trading session unfolds.

For the first time since February, Bitcoin price tested the $100,000 resistance on Thursday, trading as high as $101,525 according to TradingView data.

Bitcoin price action | Coingecko

More so, BTC’s 24-hour trading volume has more than doubled, rising from $35 billion at the close of Wednesday to hit $76 billion at press time. Rising trading volumes during a rally often signal more bullish action ahead, as the asset continues to find buyers at its current high prices.

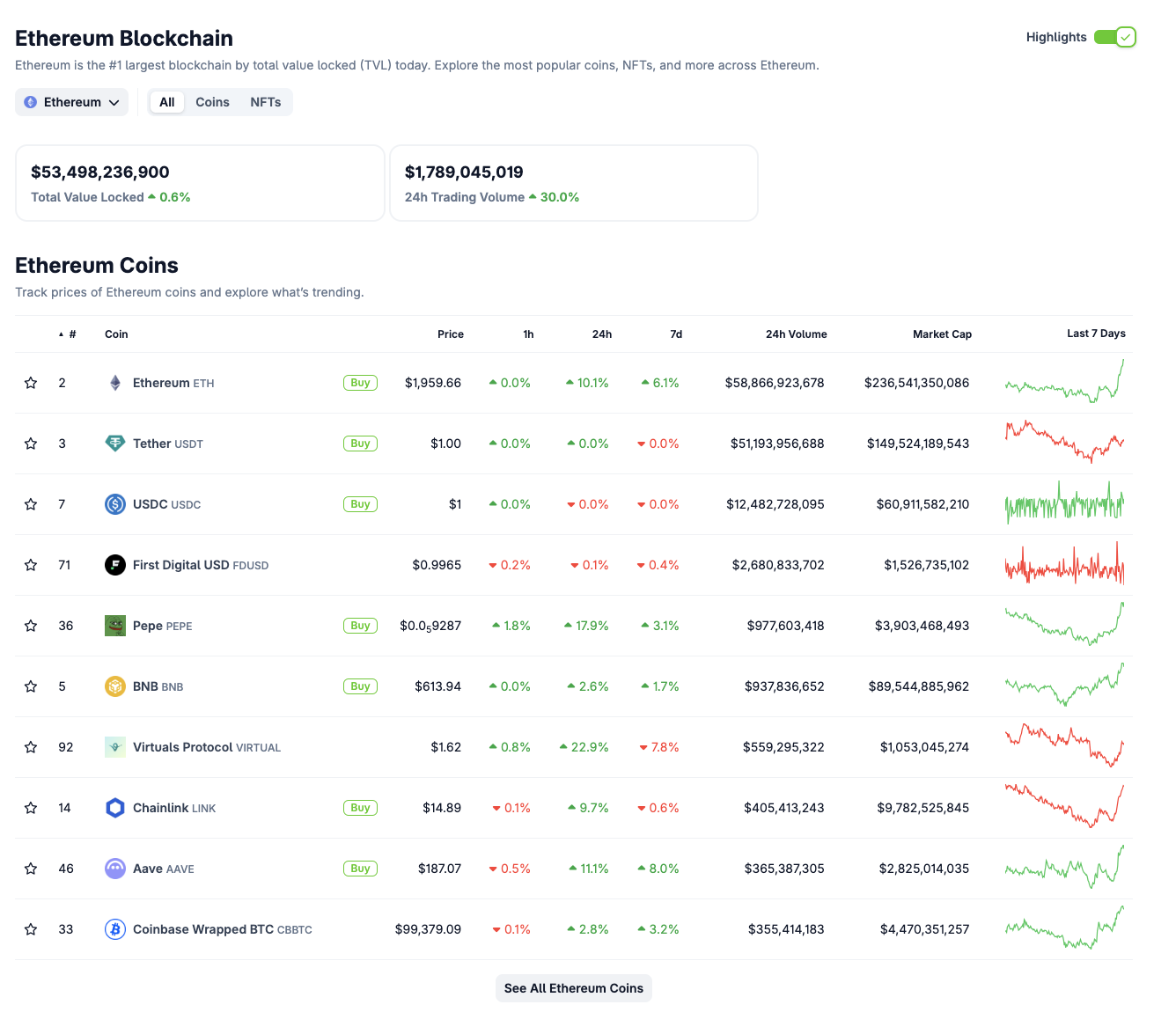

Investors are pouring into Ethereum and its ecosystem tokens as macro and internal bullish tailwinds converge.

The recent Ethereum Pectra upgrade, executed successfully on Wednesday, came amid a favorable macro backdrop, including renewed optimism from Trump-led trade deals and the Federal Reserve’s third consecutive rate pause decision.

A technical quirk further accelerated the Ethereum price rally. During the Pectra rollout, major exchanges like Coinbase temporarily paused ETH withdrawals.

This led to artificially low sell pressure just as markets turned bullish, enabling Ethereum to post a strong 13% daily performance.

ETH surged to $2,002.25 at press time, outpacing Bitcoin, which is gaining 4% after breaching the $100,000 milestone.

Ethereum ecosystem aggregate market cap surges to $53.5 billion with its trading volumes rising 30% within the last 24 hours. This aligns with the narrative that investors are increasingly leaning into Ethereum-hosted projects to capitalize on improved sentiment from the Pectra upgrade.

Ethereum Ecosystem Performance, May 8 2025 | Source: Coingecko

Among Ethereum-native tokens, the top performers in the last 24 hours include:

- PEPE price gained 17.0% to $0.00006, riding memecoin momentum and renewed whale interests.

- Virtuals Protocol (VIRTUAL) price up 21.0% to trade at $1.62, benefiting from speculative flows into new DeFi infrastructure.

- Chainlink (LINK) price posts 9.4% gains at it nears $15, driven by growing cross-chain integration narratives and close affiliation to Trump as one of the tokens held by Trump-back Word Liberty Financial (WLFI).

- AAVE price is also up by 10.6% as it crossed $187, reflecting renewed interest in Ethereum-based lending and borrowing platforms.

Top-ranked layer-1 altcoin performance:

- Ripple (XRP): XRP rose 4.7% to $2.23 as bulls push higher despite unresolved legal headwinds. Rising daily volumes suggest renewed momentum.

- Cardano (ADA): ADA surged 8.1% to $0.7246, riding Layer 1 optimism. A break above $0.75 is needed to confirm trend continuation.

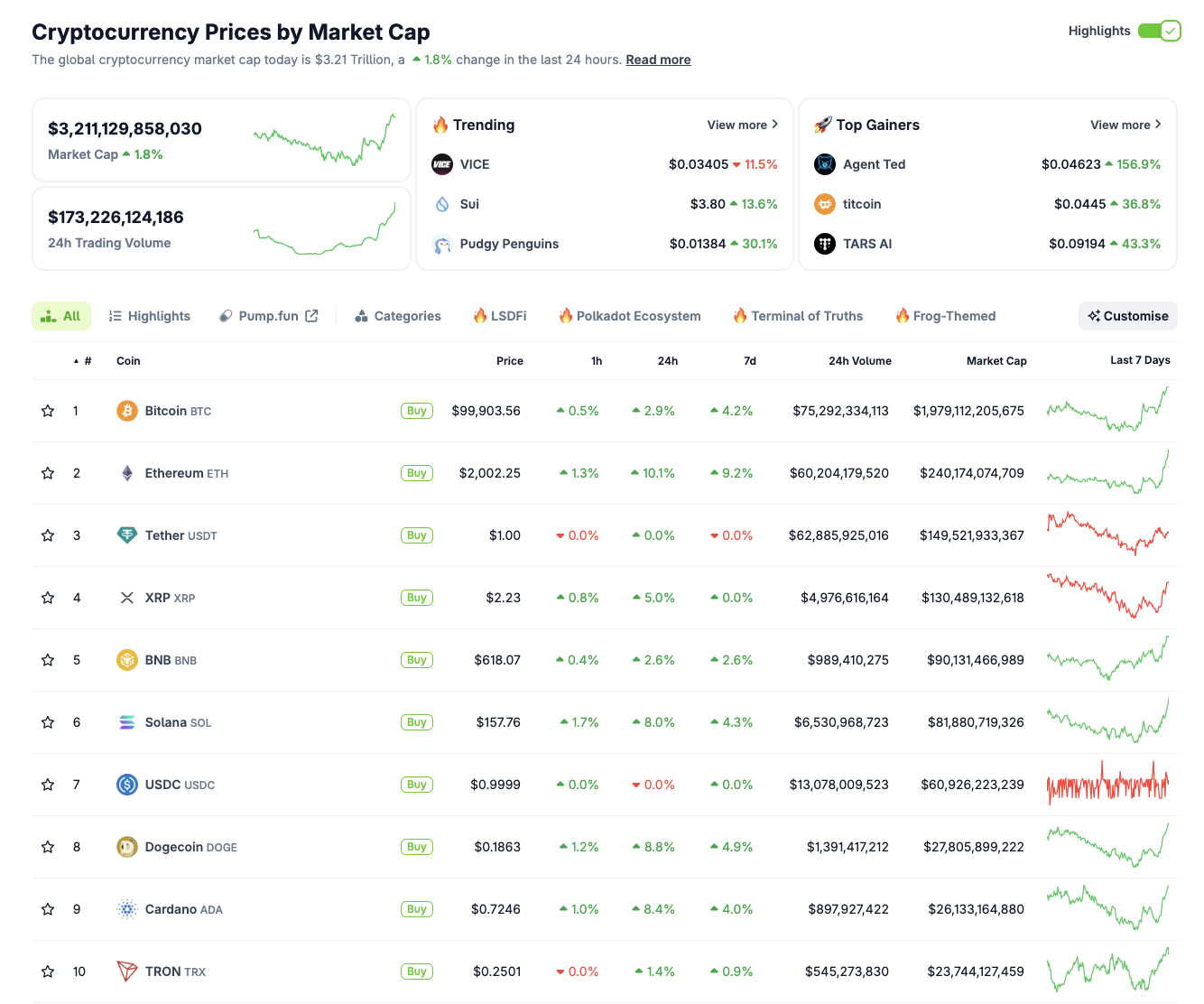

Top 10 cryptocurrencies performance May 8, 2025 | Source: Coingecko

- Dogecoin (DOGE): DOGE jumped 8.3% to $0.1863, nearing overbought RSI levels. Social buzz remains the key driver of short-term gains.

- Solana (SOL): SOL climbed 8.0% to $157.76, with increased network activity offsetting adverse volatility from memecoin speculation.

In summary, the global cryptocurrency market cap now stands at $3.21 trillion, with a 24-hour trading volume of $173.2 billion, aligning strong inflows across global risk assets markets.

Ethereum’s post-upgrade strength and the spillover into its ecosystem projects may signal the start of a major altseason rotation theme, especially if Bitcoin continues to stall below key levels, as often seen during periods of increased investor risk appetite.

The Office of the Comptroller of the Currency (OCC) has granted national banks the authority to buy and sell cryptocurrencies on behalf of their clients. Banks are also permitted to outsource custody and trade execution services to third-party providers under this directive.

The ruling emphasizes a risk-managed framework, requiring institutions to demonstrate the ability to handle operational and security challenges.

The Ethereum Foundation has announced the allocation of $32 million in grants for the first quarter of 2025.

The funding is directed toward bolstering the Ethereum ecosystem through investments in community programs, developer tooling, cryptographic research, and core infrastructure enhancements.

According to the Foundation, the grants will support a wide range of initiatives, including improvements to the developer experience, expansion of educational programs, advancements in zero-knowledge proof technologies, and continued development of the execution layer.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post