Crypto Today: Traders discuss Solana futures and Ethereum Hoodi update as Bitcoin price stalls at $83,000

March 17, 2025

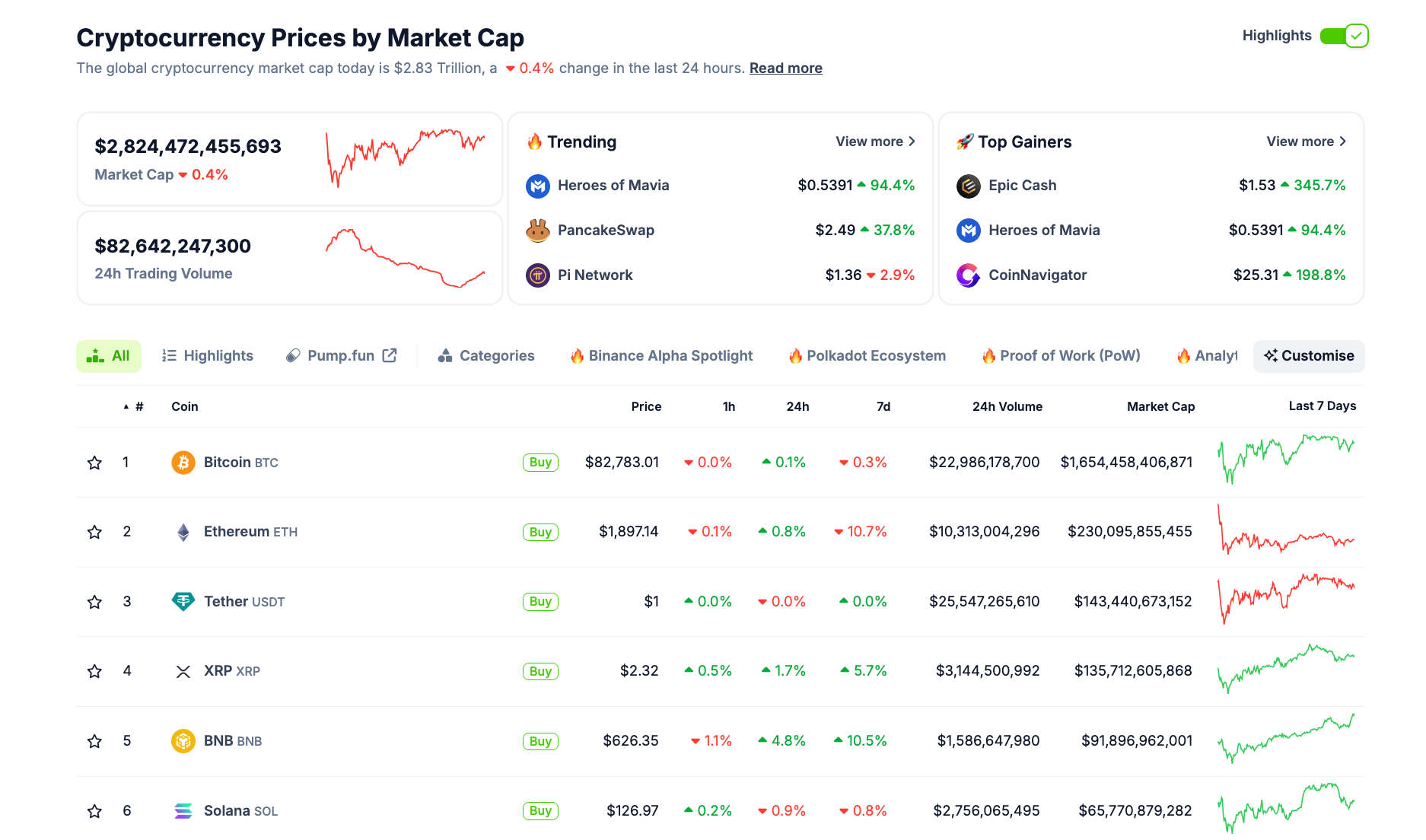

- Amid a 2% decrease in market capitalization, crypto trading volume surges 42% to $87.2 billion in the last 24 hours, signalling active capital rotation.

- Bitcoin price stagnates below $85,000 as Gold enters a record rally to $3,000 ahead of the US Fed rate decision.

- Solana futures ETF launch and Ethereum Hoodi updates dominate crypto media on Monday.

- Bitcoin (BTC) price is posting a 1% uptick, briefly grazing $84,000 on Monday, spurred by a rebound in US stocks after the government avoided a shutdown.

- The broader market capitalization has dipped by about 1.07% to $2.82 trillion, though trading volume has surged 42% to $66.68 billion, suggesting active positioning by traders.

- Bitcoin has remained pinned down below $85,000, as media coverage around Gold (XAU) rallying to new all-time highs above $3,000 encroached on investor mindshare on Monday.

The global altcoin market is agog with activity as investors rotate assets across the markets to navigate the market lull.

Among mega-cap altcoins, Solana (SOL) and Ethereum (ETH) have taken center stage, driven by significant ecosystem developments.

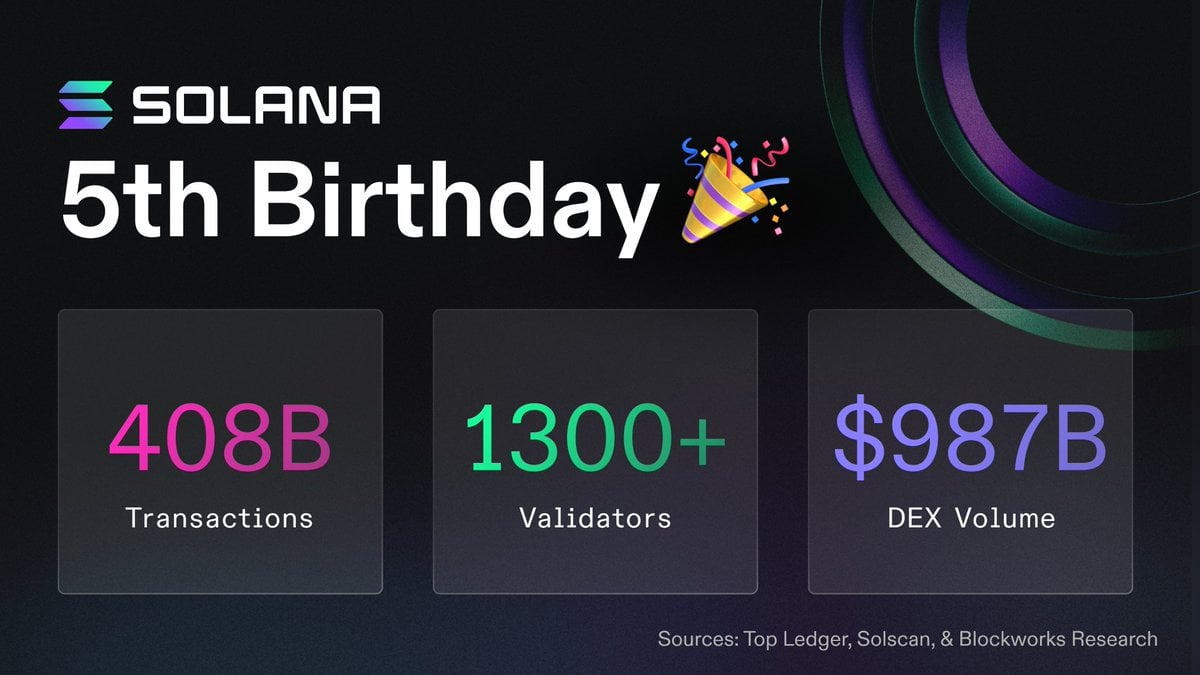

For Solana, the CME Group, one of the world’s largest institutional trading platforms, has confirmed the launch of Solana ETF futures on Monday.

This news aligns with the blockchain marking its fifth anniversary — forming a dual bullish catalyst.

Solana 5th Annivesary Stats, March 17 | Source: X.com/Solana

Ethereum’s “Hoodi” testnet goes live on Monday, marking a key step toward boosting DeFi capabilities and scalability.

ETH price has increased by 1.7% to reclaim the $1,900 level at press time, signalling widespread optimism around the network update.

Taking a broader look at the market, here’s a breakdown of the day’s standout performers and laggards:

- BinaryX (BNX) price scored an over 30% advance, crossing $1.68 on Monday, rising on positive momentum surrounding a token swap event to emerge as the top gainer among the top-100 ranked crypto assets.

- PancakeSwap (CAKE) rose 30% to hit $2.50 – riding a wave of increased DeFi staking interest amid an uncertain macro landscape ahead of the US Fed interest rate decision on Wednesday. PancakeSwap exchange also overtook Uniswap in terms of trading volume on the day.

- Berachain (BERA) price surges 7.83% — gaining traction from investors switching focus to commodity-backed Real-World Assets and fixed income yield-bearing tokenized securities.

- Binance Coin (BNB) is up by 5% on Monday, consolidating above the $625 mark, buoyed by rising exchange token demand.

- PI Network (PI) price is down 5%, facing bearish headwinds from investors who lost funds to the mainnet upgrade deadline slated for Monday.

Celestia Price Action (TIA), March 17 | CoinmarketCap

- Celestia (TIA) price is down 3% to hit $3.30, pulling back after a stretch of gains that saw TIA peak at $3.70 last week.

- Despite the pullback on Monday, TIA is still holding 19% on the seven-day timeframe.

The price action among major altcoins reflects a mixed market sentiment :

- Solana (SOL) has slipped 1%, trading under the $130 resistance.

- Ripple (XRP) bucks the negative market trend, posting a modest 2.99% gain to reach $2.30.

- Litecoin (LTC) price also posted a 4% gain to clear the $90 resistance on Monday.

Crypto market performance, March 17 | Source: Coingecko

The current market dynamic signals that despite positive catalysts from Solana fifth birthday and SOL futures ETF launch on CME Group, fears surrounding the FXT estate’s recent token unlocks continue to weigh heavily on SOL’s short-term price momentum.

In response, investors are strategically channeling funds toward Solana’s layer-1 rivals, XRP and LTC, with ETF filings in progress.

- Pavel Durov returns to Dubai amid ongoing Telegram investigation

Pavel Durov, the founder and CEO of Telegram linked to the development of blockchain network Toncoin, has announced his return to Dubai after spending several months in France due to an ongoing investigation into criminal activities on the messaging platform.

Durov expressed gratitude to the investigative judges for permitting his return and thanked his legal team and the Telegram community for their support.

He emphasized that Telegram has consistently exceeded legal obligations concerning moderation and cooperation with law enforcement.

The investigation, which began with Durov’s arrest in August near Paris, centers on allegations that Telegram facilitated illegal activities such as the distribution of child sexual abuse material and drug trafficking.

- VanEck files for AVAX ETF to offer direct market exposure

VanEck has submitted a filing to the US Securities & Exchange Commission for an Avalanche (AVAX) ETF, aiming to provide investors with direct exposure to the smart contract platform.

The proposed fund will track AVAX’s price performance while deducting operating expenses.

According to the filing, the ETF will value its shares based on the MarketVector Avalanche Benchmark Rate.

If approved, this would mark one of the first AVAX-focused ETFs in the US, expanding institutional access to the Avalanche ecosystem.

- OKX suspends DEX aggregator after detecting misuse by Lazarus Group

OKX has temporarily halted its decentralized exchange (DEX) aggregator after identifying misuse linked to the North Korean hacking group Lazarus.

The exchange announced the suspension as a precautionary measure while conducting an internal review and implementing additional security upgrades.

Despite the suspension, OKX will continue to offer wallet services but will restrict new wallet creation in certain markets.

The platform’s security enhancements aim to strengthen defenses against hacker activity and prevent further exploitation of its DeFi services.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post