Crypto Today: Trump’s tariff updates sparks Bitcoin rally, as AVAX, SOL, Chainlink lead altcoin gains

March 24, 2025

- Cryptocurrency sector’s valuation rose 3.3% on Monday, reaching the $2.83 trillion mark for the first time in two weeks.

- The market rally is linked to reports that the US plans to exclude sector-specific tariffs ahead of the April 2 deadline.

- Bitcoin price recovers above the $88,000 level, with Solana, Chainlink, and Avalanche among the top-gainers within the altcoin market.

- Bitcoin price surges 4%, nearing $89,000 in the early hours on Monday.

- The BTC price rally has been linked to imminent tariff rollbacks by the Trump administration, adding to active positive sentiment from the Federal Reserve (Fed) rate pause last week.

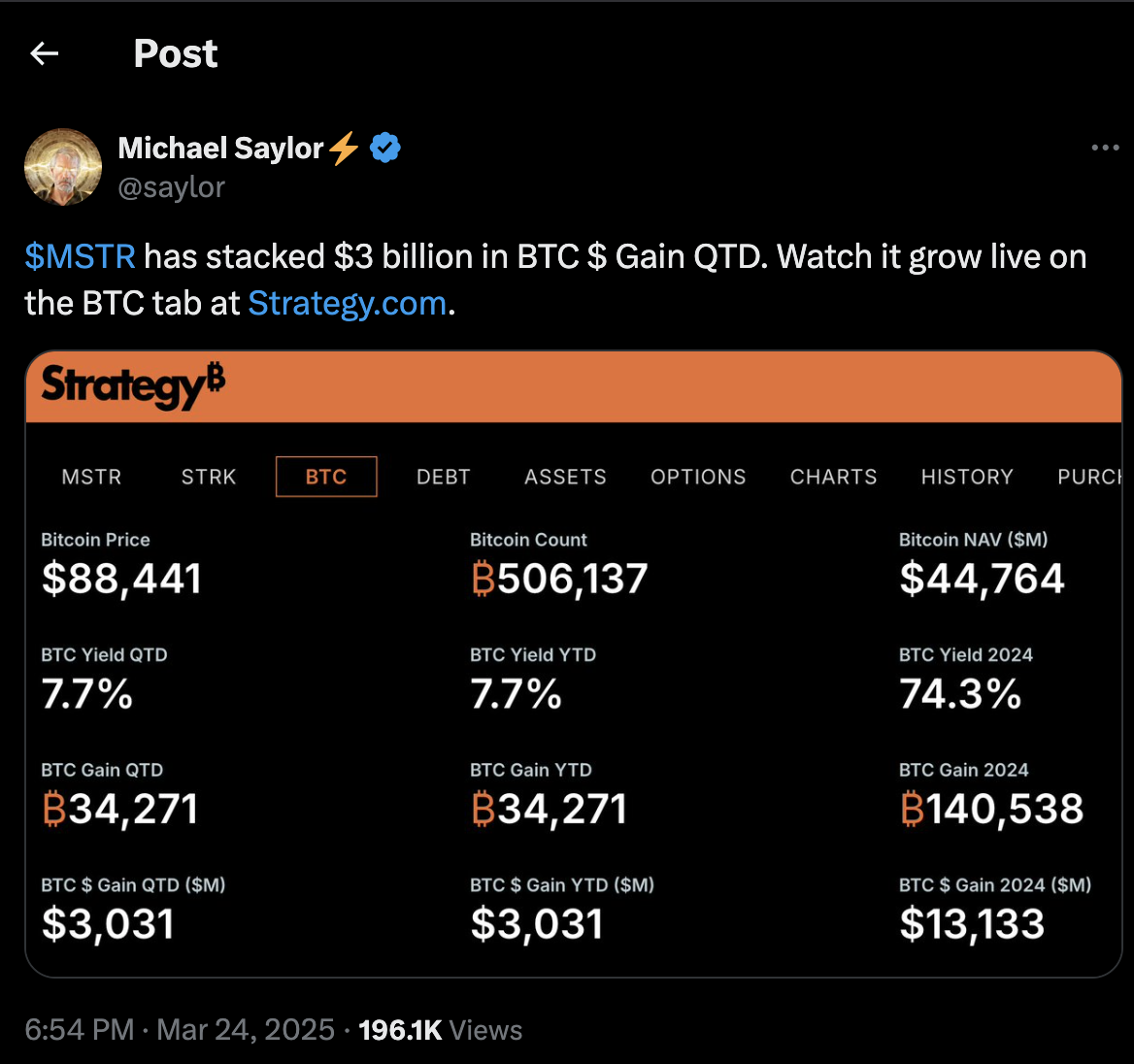

- Michael Saylor announced that Strategy had acquired $3 billion in profits in Q1 2025.

The US Fed decision to maintain rates unchanged last week ignited risk-on appetite across global risk assets markets. This saw demand for the US weaken 4% from its January peaks, according to Bloomberg.

Total Crypto Market Capitalization | Source: TradingView

Total Crypto Market Capitalization | Source: TradingView

Secondly, the Trump administration has hinted at another round of exclusions from reciprocal tariffs on April 2, with the possibility of excluding sector-specific tariffs.

This incentivized investors to place large bullish bets in expectations that tariff rollbacks could further lower inflation.

These two major macro events have sparked increased demand for risk assets globally as investors rotate out of USD-backed securities, expecting interest rates to remain low for longer.

Mirroring the bullish backdrop in the global markets, cryptocurrencies started the week strongly. At press time on Monday, the total cryptocurrency sector valuation has increased by $2.83, reflecting a $200 billion uptick within the last 24 hours, per TradingView data.

Two key macro factors are driving the cryptocurrency market’s strong start to the week.

Capital allocation within the crypto space has been uneven, driving surges in specific sectors.

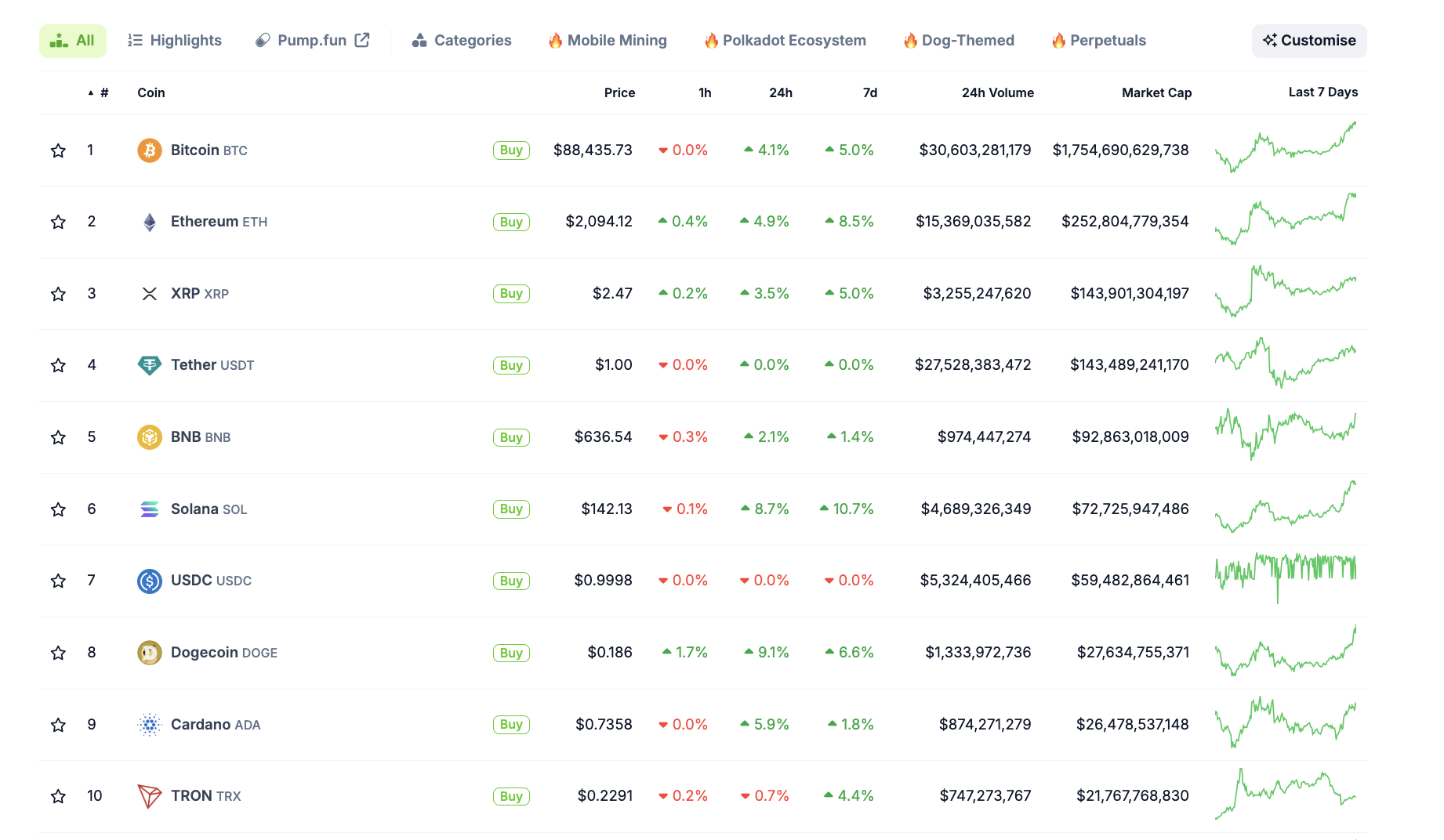

Crypto market performance | Source: Coingecko

Crypto market performance | Source: Coingecko

At press time, mid-cap altcoins, Trump-associated tokens, and memecoins have emerged as top performers.

- Avalanche (AVAX) price surges 10%

Avalanche (AVAX) has seen a 10% price increase, as reflected in the chart. A major catalyst behind this rally is the accumulation by the US President’s firm,

WLFI. Blockchain analytics platform Lookonchain reported that WLFI has been purchasing AVAX in recent weeks, with its most recent acquisition exceeding $7 million around March 16.

- Chainlink (LINK) gains 6% on WLFI links

Chainlink (LINK) has also recorded a 6% increase, driven by news that WLFI has entered into a partnership to utilize Chainlink’s data feeds for decentralized finance (DeFi) and traditional finance (TradFi) integration.

Trump memecoin rises 3%, crossing the $2 billion mark

The Trump memecoin has climbed 3%, pushing its market valuation above $2 billion. Earlier this month, following unpopular trade policies, the token had plummeted nearly 80% from its all-time high of $12.5 billion.

Concerns intensified when controversy surrounding the Libra memecoin led to speculation that the President’s team might abandon the project, further accelerating the sell-off. However, on Monday, Trump reaffirmed his support for the initiative, sparking a renewed rally and making it one of the most-searched tokens of the day, according to Coingecko data.

DWF Labs has launched a $250 million Liquid Fund to support mid and large-cap crypto projects, aiming to enhance liquidity and accelerate industry growth. The initiative follows the firm’s recent commitment of $11 million to blockchain projects, with an additional $35 million in investments planned. The fund will focus on strategic venture capital, ecosystem expansion, and liquidity provisioning across decentralized finance (DeFi) and lending markets.

The fund is designed to bolster public relations, go-to-market strategies, and broader crypto adoption efforts. DWF Labs aims to drive innovation within the industry by providing financial support and strategic resources to promising projects. This move reinforces the firm’s ongoing role as a major player in the crypto investment landscape, actively deploying capital to strengthen blockchain ecosystems.

The dYdX community has introduced its first DYDX Buyback Program, allocating 25% of net protocol fees to repurchase DYDX tokens from the open market on a monthly basis. The acquired tokens will be staked to enhance network security and reinforce the protocol’s economic model.

This initiative is part of a broader strategy to align tokenomics with dYdX’s long-term growth. By integrating buybacks into the ecosystem, the program aims to boost sustainability and strengthen the role of DYDX tokens within the decentralized trading platform.

World Network, formerly known as Worldcoin, is in talks with Visa to integrate card features into its self-custody crypto wallet.

According to a CoinDesk report, the partnership would enable stablecoin payments across

Visa’s global merchant network, expanding crypto accessibility for users.

The initiative follows earlier discussions with PayPal and OpenAI to enhance World Network’s digital payment infrastructure.

Tools for Humanity, the company behind the project, has reportedly reached out to card issuers and crypto card facilitators like Rain, signaling active progress toward implementation.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post