Crypto’s slump may be a cultural problem as much as a financial one

December 18, 2025

A version of this story appeared in CNN Business’ Nightcap newsletter. To get it in your inbox, sign up for free here.

New York

—

Crypto managed to make it through the year without a systemic collapse or a major scandal. Yet it’s still shaping up to be one of the industry’s worst years ever.

Until October, bitcoin had been riding high, hitting a peak of $126,000 — up more than 30% since January. But a combination of forces has wiped out all of the bellwether token’s gains for the year. It’s now down 7% since January, badly underperforming the S&P 500 stock index, which is up 15% for the year.

There are no more bogeymen for the industry to blame: The Biden-era regulators that suppressed crypto’s expansion in the US are long gone, replaced by an openly pro-crypto regime appointed by the self-styled “crypto president.” Congressis advancing industry-approved legislation. Institutional adoption has surged, bringing in billions through bitcoin exchange-traded funds.

And still, crypto can’t seem to find its footing. After holding somewhat steady around the $90,000 level in recent weeks, another steep selloff sent bitcoin tumbling to around $86,000 on Wednesday.

If Team Crypto is looking to point its finger for this bear market, it might consider a mirror.

There are technical reasons for the slump, most notably an extreme buildup of leveraged positions — speculative bets that can turbocharge gains but come with extreme downside risks — that were liquidated in an early October flash crash. But the protracted slump appears to be about more than just a hangover from that crash.

Risk appetite hasn’t gone away, as the tech-heavy Nasdaq has done even better than the broader stock market. So why are investors shunning this particular flavor of risk?

One explanation is that crypto culture has refused to grow up, and it’s keeping would-be investors on the sidelines.

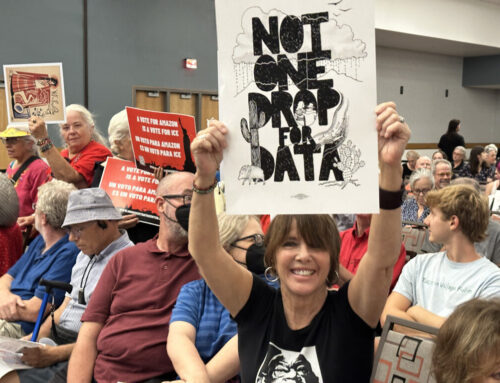

Looking back on a year when crypto advocates got everything they could have dreamed of from a legal and regulatory standpoint, the industry still hasn’t figured out what to do with its problem children — the scammers, thieves and internet trolls who haven’t gotten the memo that crypto is trying to clean up its act.

Over the summer, memecoin pushers claimed responsibility for an orchestrated effort to throw dildos onto the court during WNBA games, claiming it was an effort to “make memes funny again.”

Then there are the garden variety scammers, who find in crypto a means to separate people from their money via crypto ATM schemes — an epidemic that has cost Americans more than $330 million this year.

And in extreme cases, kidnappers have targeted crypto investors to compel them to turn over their digital wallet passwords. There have been more than 30 of those so-called “wrench attacks” this year, according to industry researcher Chainalysis, though it notes many of the crimes go unreported. One of those attacks made national news over the summer, when a 28-year-old crypto investor escaped from a luxury Manhattan apartment, accusing two men of holding him captive for weeks while he was beaten and threatened with death.

None of that means crypto investing is wrong, per se, but it’s certainly not reassuring, particularly for those who may have bought bitcoin near the peak just a few months ago and are now sitting on giant losses.

“Retail investors are teetering between their fear of missing out on a juicy investment and concerns about the unsavory aspects of crypto and its promoters,” Cornell University economist Eswar Prasad told me. “Such investors will invariably amplify the volatility of crypto prices in both directions, and I think that’s what we are seeing right now.”

Bitcoin’s rally, sparked by President Donald Trump’s re-election, attracted new investors to crypto who cared more about the number going up than the cultural or political associations. But when the financial upside began to sour, Prasad said, there wasn’t a lot keeping investors in the market.

“While they’re eager to dip their toes,” he added, “they’re equally ready to pull back the moment the waters turn a little dark … all the underlying concerns that retail investors might have had about crypto are coming back to the surface now.“

Search

RECENT PRESS RELEASES

Related Post