Current State of the Ethereum Market

November 9, 2025

Current State of the Ethereum Market – OneSafe Blog

Share this

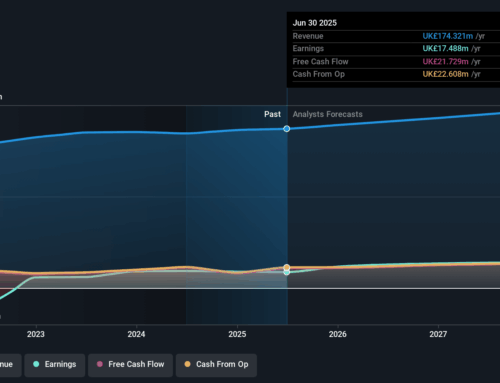

So the Ethereum market is going through a huge change right now. We’re moving from a pretty stable trading environment to one full of speculative trading. This shift is highlighted by a big uptick in trading volumes and open interest. For example, Binance’s ETH trading volume has hit over $6 trillion this year—two to three times higher than last year—and open interest is over $12.5 billion, which is five times what we’ve seen before. This change is crucial for understanding the new landscape startups have to navigate in crypto banking.

How Speculation is Impacting Ethereum Trading Dynamics

The current Ethereum market is all about speculation, and that’s leading to a lot more volatility. This creates both opportunities and challenges for traders. Unlike the last market, which was driven by actual sales and purchases, this one is focused on quick profits, resulting in bigger price swings. Sure, this volatility can mean big gains, but it can also lead to substantial losses. So, startups entering the crypto banking scene will have to adjust their investment strategies and risk management to fit this new market reality.

Opportunities for Startups in a Speculative Market

The speculative nature of the Ethereum market opens up new paths for fintech startups to explore in crypto banking. Startups can use Ethereum’s infrastructure to build decentralized applications and smart contracts, laying the groundwork for new financial products and services. The surge in stablecoins—accounting for a significant chunk of crypto payroll payouts—lets startups offer compliant and efficient payroll solutions that can handle volatility. Plus, if Ethereum becomes a reserve asset, that could improve liquidity and operational efficiency, giving startups an edge in this fast-changing financial landscape.

Risks Startups Must Consider

But it’s not all sunshine and rainbows. The speculative environment comes with its own set of risks. Volatile markets can lead to unpredictable financial outcomes, affecting cash flow and stability. Compliance issues are another big concern, especially since regulatory demands differ across Asia and other regions. Startups will have to stay on their toes and keep updated on regulations to ensure their solutions are compliant. And let’s not forget about the competition—it’s heating up, so startups will need to find ways to stand out.

Managing Volatility in Crypto Payroll

To handle the ups and downs in Ethereum salaries, startups have a few strategies at their disposal. One good approach is to use stablecoins for payroll, so employees get a steady value, no matter what happens to Ethereum’s price. Startups can also mix their treasury assets—cryptos, stablecoins, and fiat currencies—to soften the blow from market swings. Automating risk management, like instantly converting crypto to stablecoins or fiat when they receive it, can also help keep payroll running smoothly. By using these strategies, startups can keep employees happy, even in a volatile market.

Strategies for Compliance

Navigating the regulatory waters is essential for startups in crypto banking. They should stay on top of local laws and regulations, especially those related to anti-money laundering (AML) and know-your-customer (KYC) rules. Connecting with institutional investors and other players in the ecosystem can provide useful insights and resources for compliance. Startups might also want to explore decentralized governance models to boost transparency and accountability. By addressing compliance head-on, startups can foster trust with customers and regulators.

category

Last updated

November 10, 2025

Subscribe to our newsletter

Get the best and latest news and feature releases delivered directly in your inbox

Oops! Something went wrong while submitting the form.

Dont miss these

Discover how crypto payroll integration and stablecoins are transforming salary payments for SMEs, addressing regulatory challenges and employee preferences.

The ZK Casino incident reveals critical lessons on investor trust, transparency, and the implications of anonymous founders in the crypto space.

Open your account in

10 minutes or less

Begin your journey with OneSafe today. Quick, effortless, and secure, our streamlined process ensures your account is set up and ready to go, hassle-free

0% comission fee

No credit card required

Unlimited transactions

Search

RECENT PRESS RELEASES

Related Post