Curve Finance Strengthens Its Position as a Leading Ethereum DEX With 44% Fee Share

December 19, 2025

Zug, Switzerland, December 19th, 2025, FinanceWire

Ethereum’s market is one of the most competitive corners of DeFi, and it has virtually no “meme”-driven trading activity. This makes it easier to measure the more organic market volumes, where low fees and the trading of core assets such as ETH, BTC (wrapped), and stablecoins are predominant.

This week, Curve Finance delivered one of the clearest signals that it stands among the top players in this scene.

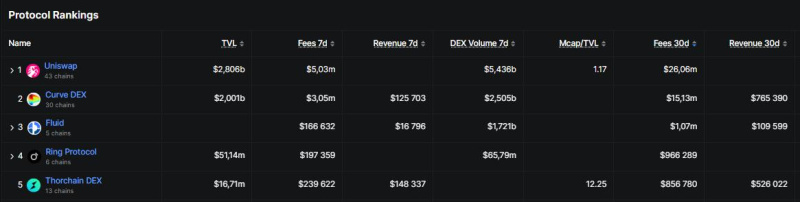

Top Ethereum DEXs by fees (30-day view, DeFiLlama)

Top Ethereum DEXs by fees (30-day view, DeFiLlama)

According to DeFiLlama’s data, Curve now ranks among the top Ethereum DEXs in terms of fees metrics over the past 30 days, overtaking other long-standing leaders in the space.

One thing that is particularly notable here is how much the scale has shifted. Around this time last year, Curve accounted for roughly 1.6% of all DEX fees charged on Ethereum. Today, its share stands at about 44%, marking the most significant overturn in fee dominance that DeFi has seen in 2025.

These figures highlight rising trader activity and fees paid by users on Curve. But it should be noted that this is not a reflection of profit or yield distributed among liquidity providers or the protocol itself.

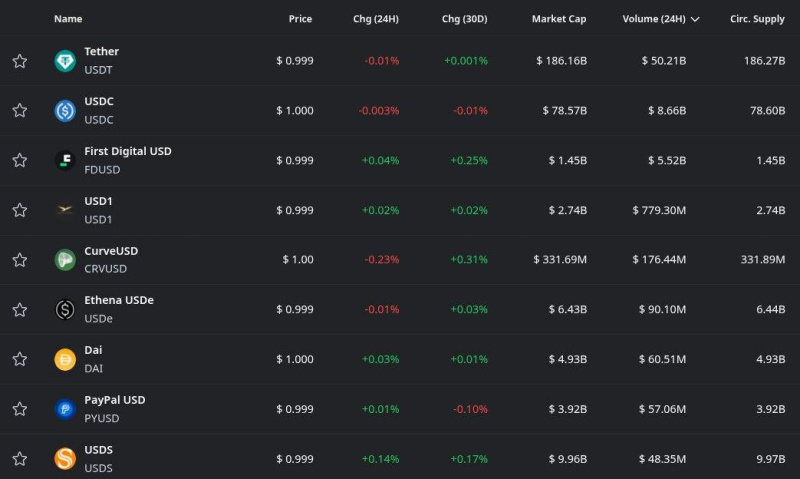

There are several factors that drove this growth. Trading activity around Curve’s native crvUSD stablecoin has increased sharply, pushing volumes higher and reinforcing the protocol’s position as a core venue for on-chain stablecoin liquidity. By trading volume (24H), crvUSD has moved into the top 5 stablecoins, superseded only by major leaders like USDT and USDC. This reflects its rapid adoption and growing role in on-chain liquidity.

Top stablecoins by trading volume (24H) (CryptoRank.io)

At the same time, integration with Yield Basis has concentrated the largest on-chain Bitcoin liquidity in DeFi on Curve, with the protocol now hosting three of the deepest on-chain BTC liquidity pools used by Yield Basis protocol. The pools rank at the very top by both TVL and depth, well ahead of BTC pools on other DEXs.

Here’s how Michael Egorov, founder of Curve Finance, has commented on this shift: “DeFi users are increasingly prioritising sustainable revenue models over short-term speculation. We’re seeing a clear move away from hype-driven trading and towards protocols with transparent economics and real yield. This change in long-term behaviour is reshaping where liquidity and volume ultimately settle.”

About Curve Finance

Curve Finance is one of the largest DeFi protocols, specializing in stablecoin trading with minimal fees and slippage. Launched in 2020, it has grown into a full ecosystem with liquidity pools, lending markets, its own stablecoin (crvUSD), and DAO governance, becoming a key infrastructure layer for Ethereum and other EVM networks.

Contact

Curve Finance

press@curve.finance

Search

RECENT PRESS RELEASES

Related Post