Dear Apple Stock Fans, Mark Your Calendars for January 12

January 6, 2026

/Apple%20products%20on%20desk%20by%20Ake%20Ngiamsanguan%20via%20iStock.jpg)

Apple products on desk by Ake Ngiamsanguan via iStock

Apple (AAPL) is a global technology company that designs and sells smartphones, computers, tablets and wearables as well as offers a fast-growing portfolio of high-margin services. Its ecosystem spans iPhone, Mac, iPad, Apple Watch, Apple TV, and more, as well as platforms like the App Store, iCloud, Apple Music, Apple Pay, and Apple TV+, making hardware a gateway into recurring subscription revenue.

Founded in 1976, Apple is headquartered in Cupertino, California. The company operates and sells products across the Americas, Europe, China, Japan, and the rest of the Asia-Pacific region, reaching billions of active devices worldwide.

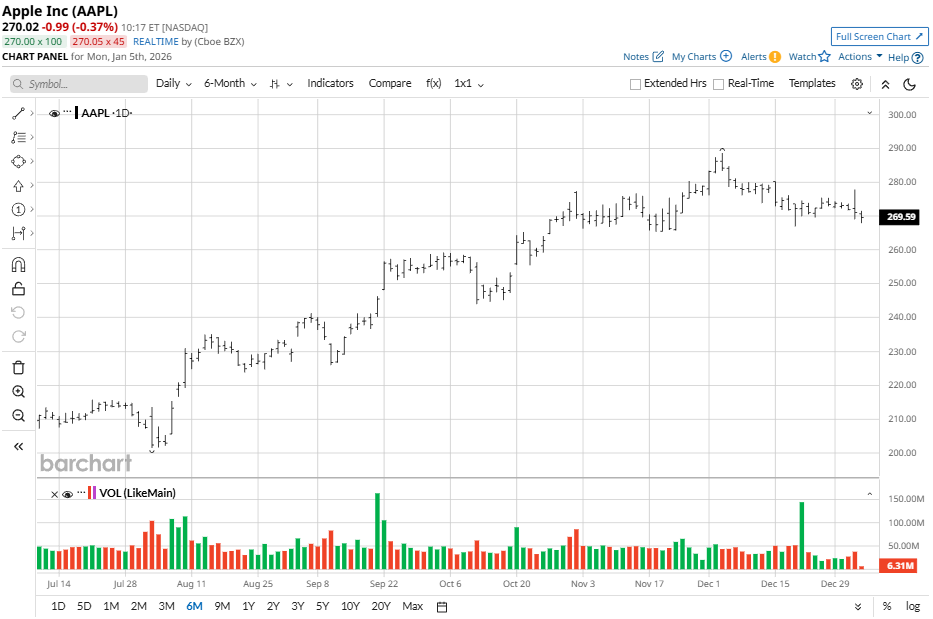

Apple Stock Performance

AAPL stock trades 8% below its 52-week high of $288.62 and well above its $169.21 low, reflecting a strong multi‑month uptrend. Over the last five days, the stock is down almost 4% and down about 5% for the past one month. However, AAPL is up 8% over the last 12 months.

Over that same one‑year period, the S&P 500 ($SPX) has outperformed Apple with a 16% growth rate. Despite this, the company still trades above its 200-day moving average, with a market capitalization of over $4 trillion, exhibiting slightly higher volatility but strong momentum relative to the broader market.

Apple’s Q4 Results

Apple reported fiscal fourth-quarter 2025 results on Oct. 30, seeing revenue of $102.5 billion, up 8% year-over-year (YOY) and beating analyst estimates of $101.2 billion. Adjusted EPS was $1.85, up 13% YOY and exceeding consensus estimates of $1.73.

Gross margin reached 47.2%, with operating income of $32.8 billion and net income of $27.5 billion. Operating cash flow was $29.7 billion while capital expenditures came to $12.7 billion. Cash and equivalents stood at $35.9 billion during the quarter. Apple’s installed base reached all‑time highs across devices while iPhone revenue grew 6% YOY to $49 billion despite China softness.

For Q1 fiscal 2026, Apple guided for revenue growth of 10% to 12% YOY, led by iPhone and services, with gross margin projections of 47% to 48%. CFO Kevan Parekh highlighted record fiscal 2025 revenue of $416 billion and double‑digit EPS growth, with artificial intelligence (AI) investments and capex expansion continuing.

What Should Investors Look for in January?

Apple CEO Tim Cook recently emphasized health and well-being integration in devices as the company launches new Fitness+ programs to kick off 2026. Available in 48 countries, Fitness+ now offers a four-week restart plan featuring strength, high-intensity interval training, and yoga workouts, launching Jan. 12 for users. Fitness+’s Artist Spotlight is also set to add Karol G and Bad Bunny music sessions on Feb. 2.

The Jan. 12 rollout is designed to combat “Quitter’s Day” resolution fatigue. Apple Watch data shows that 60% of users boost their daily exercise by more than 10% in early January, with 80% maintaining gains through mid-month and 90% holding through the first quarter of the year. The new additions to Fitness+ will help further support Apple’s Services segment, which reached all-time high revenue of $28.75 billion in Q4.

Should You Lock AAPL Stock?

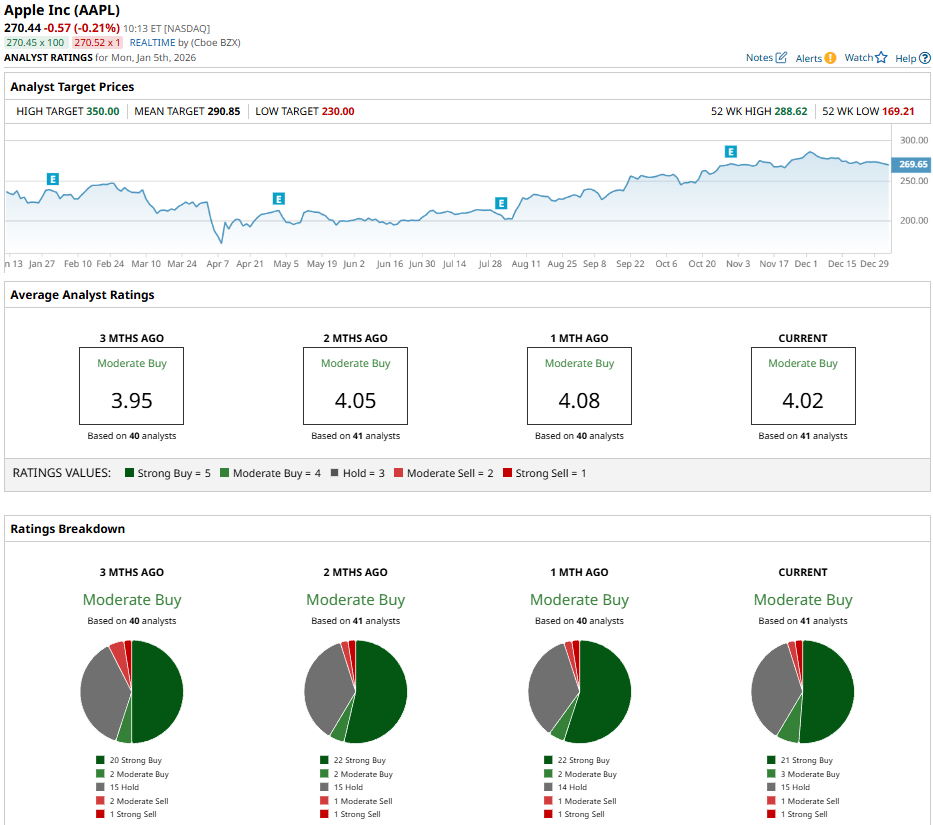

AAPL stock, as part of the legendary FAANG group of stocks, experiences high demand throughout the year. Market experts give AAPL a consensus “Moderate Buy” rating with a mean price target of $290.85, reflecting upside potential of 10% from current levels.

Based on coverage from 41 analysts, AAPL stock has 21 “Strong Buy” ratings, three “Moderate Buy” ratings, 15 “Hold” ratings, one “Moderate Sell” rating, and one “Strong Sell” rating.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Search

RECENT PRESS RELEASES

Related Post