Demand for Cannabis Packaging Equipment in Japan | Global Market Analysis Report

November 28, 2025

Demand for Cannabis Packaging Equipment in Japan Forecast and Outlook 2025 to 2035

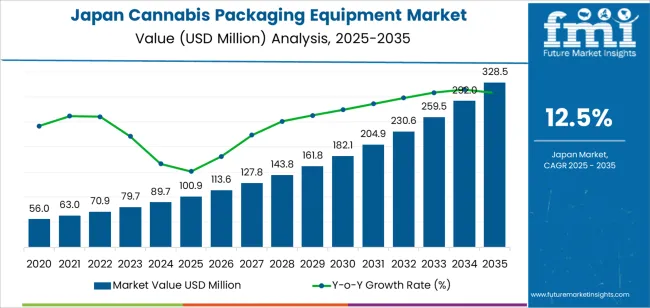

The demand for cannabis packaging equipment in Japan is valued at USD 100.9 million in 2025 and is projected to reach USD 328.5 million by 2035, reflecting a CAGR of 12.5%. In the early years of the forecast (2025–2030), demand is expected to rise significantly from USD 100.9 million to approximately USD 182.1 million by 2030. This growth is driven by the increasing legalization of cannabis products, particularly in the medical and recreational segments, and the need for packaging solutions that meet stringent regulatory and safety standards. The market will see a consistent increase in demand for advanced packaging systems to ensure product integrity, compliance, and efficiency.

From 2030 to 2035, demand for cannabis packaging equipment will continue to rise rapidly, reaching USD 328.5 million by 2035. The acceleration in growth reflects the broader expansion of the cannabis industry and the ongoing innovations in packaging technology. By the later years of the forecast period, the demand curve steepens as the market matures, with more players entering the sector and increased investments in automation. Packaging efficiency, sustainability, and compliance with evolving regulations will drive the adoption of advanced equipment. This robust growth trajectory indicates a solid and sustained expansion for cannabis packaging equipment in Japan throughout 2035.

Quick Stats for Cannabis Packaging Equipment in Japan

- Demand for Cannabis Packaging Equipment in Japan Value (2025): USD 100.9 million

- Demand for Cannabis Packaging Equipment in Japan Forecast Value (2035): USD 328.5 million

- Demand for Cannabis Packaging Equipment in Japan Forecast CAGR (2025-2035): 12.5%

- Demand for Cannabis Packaging Equipment in Japan Leading Equipment Type: Automatic Equipment (64%)

- Demand for Cannabis Packaging Equipment in Japan Key Growth Regions: Kyushu & Okinawa, Kanto, Kansai

- Demand for Cannabis Packaging Equipment in Japan Top Players: Paxiom Group, Canapa Solutions, Aesus Packaging Systems, CoolJarz by Earthwise Packaging, WeighPack Systems Inc.

What is the Growth Forecast for Cannabis Packaging Equipment in Japan through 2035?

Between 2025 and 2030, the demand for Cannabis Packaging Equipment in Japan is expected to grow from USD 100.9 million to USD 113.6 million, marking an increase of USD 12.7 million. This growth phase represents a compound annual growth rate (CAGR) of 12.5%, driven by the expanding cannabis industry. As cannabis consumption increases, there will be heightened demand for specialized packaging equipment that ensures product integrity and compliance with regulatory standards. The surge in production volumes will require manufacturers to invest in advanced packaging technologies to meet both safety and aesthetic requirements, thus supporting market growth during this period.

From 2030 to 2035, the market is forecast to grow significantly from USD 113.6 million to USD 328.5 million, contributing an additional USD 214.9 million. This rapid growth reflects the anticipated broader acceptance of cannabis in Japan, along with further advancements in packaging technology. The demand will be driven by the need for innovative, cost-efficient, and compliant packaging solutions to support an increasingly diverse range of cannabis products, including edibles, oils, and other consumables. The rapid expansion of the cannabis market and the corresponding demand for high-quality packaging solutions will shape the growth trajectory of the cannabis packaging equipment sector in Japan throughout the next decade.

Demand for Cannabis Packaging Equipment in Japan Key Takeaways

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 100.9 million |

| Forecast Value (2035) | USD 328.5 million |

| Forecast CAGR (2025–2035) | 12.5% |

What Is Driving the Demand for Cannabis Packaging Equipment in Japan?

Demand for cannabis packaging equipment in Japan is constrained yet emerging, driven primarily by the gradual regulatory shift permitting certain cannabis derived and hemp based products. Despite full recreational use remaining illegal, the legal status of low THC hemp and approved medical cannabis use has started to open niche opportunities for compliant packaging machinery. Stringent requirements for child resistant, tamper evident, and serialized packaging formats in pharmaceutical applications increase demand for high precision equipment. Japan’s advanced manufacturing base, strong food and pharmaceutical machinery sector and preference for automated production lines support adoption. However, regulatory complexity and limited market size have historically constrained large scale deployment.

Looking ahead, the outlook for cannabis packaging equipment in Japan is cautiously positive, as growth factors shift from regulatory novelty toward operational scaling. The expansion of medical cannabis channels, growth in cannabis derived wellness products, and increasing need for equipment capable of multi format packaging (pouches, bottles, sachets) will drive investment. Automation, traceability systems and modular machinery will gain traction as manufacturers seek flexible lines to manage low volume high compliance products. Constraints remain in legal uncertainty and high capital costs, but the convergence of packaging machinery expertise and evolving cannabis regulation will sustain steady demand growth.

What Factors Are Affecting the Demand for Cannabis Packaging Equipment in Japan in Terms of Equipment Type and Application?

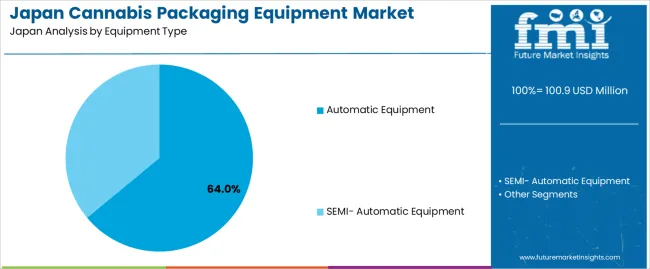

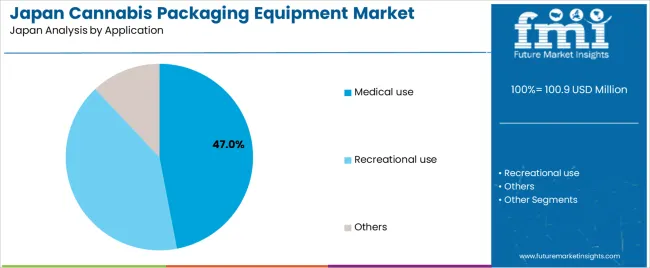

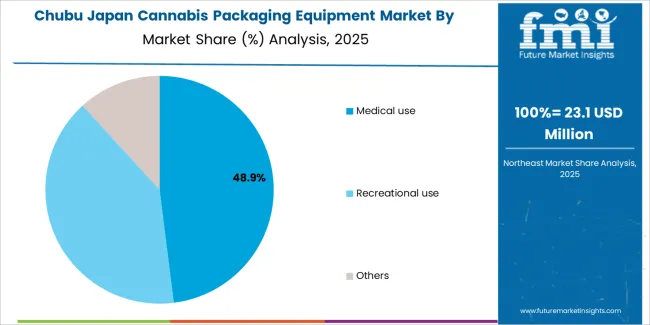

The demand for cannabis packaging equipment in Japan is driven by both equipment type and application. In terms of equipment type, automatic equipment accounts for 64% of the market demand, followed by semi-automatic equipment. Automatic equipment is preferred for its efficiency and high throughput, making it ideal for large-scale operations. In terms of application, cannabis packaging is primarily segmented into medical use, recreational use, and others, with medical use accounting for 47% of the demand. The varying regulatory frameworks and consumer preferences between medical and recreational cannabis use significantly influence the demand for packaging solutions tailored to these needs.

What Drives the Leading Demand for Automatic Cannabis Packaging Equipment in Japan?

Automatic cannabis packaging equipment leads the demand in Japan, representing 64% of the market. This is primarily due to its efficiency and suitability for large-scale packaging operations. Automatic machines can handle high volumes of product packaging with minimal manual intervention, which is crucial as the cannabis industry in Japan expands. These systems offer speed, precision, and consistency, essential qualities for maintaining product quality and meeting regulatory standards. As the demand for both medical and recreational cannabis grows, manufacturers are investing in automatic packaging systems to ensure cost-effective, scalable operations.

The demand for automatic cannabis packaging equipment is also driven by the increasing complexity of cannabis products, which require specialized packaging for different formats such as oils, edibles, and flower. Automatic systems are capable of managing a wide variety of packaging types, from jars and vials to flexible pouches, making them versatile for different cannabis products. Furthermore, the need for compliance with stringent health and safety regulations in Japan drives the adoption of high-performance automatic systems that ensure consistent quality and regulatory adherence in the packaging process.

What Is Driving the Demand for Medical Cannabis Packaging Equipment in Japan?

Medical cannabis packaging represents 47% of the total demand for cannabis packaging equipment in Japan. This demand is driven by the increasing adoption of medical cannabis products in Japan, fueled by growing recognition of their therapeutic benefits. Medical cannabis products require packaging that meets strict quality and safety standards, which in turn drives the demand for advanced packaging solutions. Packaging equipment used in this sector must ensure product integrity, secure handling, and compliance with regulatory requirements, which are critical in medical applications. As the medical cannabis market continues to develop, the demand for specialized packaging equipment is expected to increase.

The rising demand for medical cannabis in Japan is also supported by the expanding patient base seeking cannabis-based treatments for conditions such as chronic pain, nausea, and anxiety. Medical cannabis packaging must maintain the product’s efficacy, which requires high-quality, secure packaging systems. As Japan’s regulatory landscape continues to evolve, particularly regarding medical cannabis use, packaging solutions must adapt to meet new requirements, further driving demand for medical cannabis packaging equipment. The growing focus on quality, safety, and compliance continues to fuel the demand for packaging solutions in the medical cannabis sector.

What Are the Key Drivers, Restraints, and Trends Shaping the Demand for Cannabis Packaging Equipment in Japan?

The demand for cannabis packaging equipment in Japan is driven by evolving legislation that permits medical cannabis products, increasing focus on compliance and safety in packaging, and growing interest in product differentiation in the emerging market. However, legal restrictions on recreational cannabis and strict licensing requirements limit the scale and delay investment in high volume equipment. Key trends include a shift towards enhanced child resistant and tamper evident packaging, as well as automation technologies tailored for low volume, high compliance runs. These drivers, restraints, and trends will shape the demand for cannabis packaging equipment in Japan.

What Recent Regulatory Reforms Are Driving Demand for Cannabis Packaging Equipment in Japan?

Japan’s regulatory shift toward allowing medical cannabis products and research use has prompted a need for specialized packaging equipment to meet the country’s stringent laws. Packaging lines that can deliver secure, traceable, and tamper-evident packaging are becoming essential as medical cannabis products enter the market. These legal reforms are creating demand for packaging equipment that can ensure compliance with local regulations and cater to the unique needs of cannabis product packaging, further driving the growth of the sector.

What Legal and Market Scale Constraints Are Restricting Demand for Cannabis Packaging Equipment in Japan?

Japan’s strict regulations on cannabis, including the prohibition of recreational use and the tight control of medical cannabis cultivation and distribution, restrict the scale of the market for cannabis packaging equipment. The limited market size and high regulatory risk discourage large scale investments in packaging lines. Many companies are cautious about committing to high capacity production equipment due to uncertain demand and regulatory complexities. These legal and market scale constraints act as significant barriers to the growth of the cannabis packaging equipment market in Japan.

What Packaging Technology and Process Trends Are Emerging In Japan’s Cannabis Equipment Market?

In Japan, there is increasing demand for packaging equipment featuring child resistant closures, tamper evident seals, and serialization systems to meet regulatory standards. Even with the relatively small market, there is a growing emphasis on automation and flexible manufacturing capabilities that can accommodate small batch production while maintaining high compliance standards. Additionally, equipment that is compact and adaptable to Japan’s manufacturing context is becoming increasingly popular. These technological trends suggest that cannabis packaging equipment in Japan will continue to evolve towards flexible, compliant solutions designed for specialized and low volume production.

What is the Demand for Cannabis Packaging Equipment in Japan by Region?

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 15.7% |

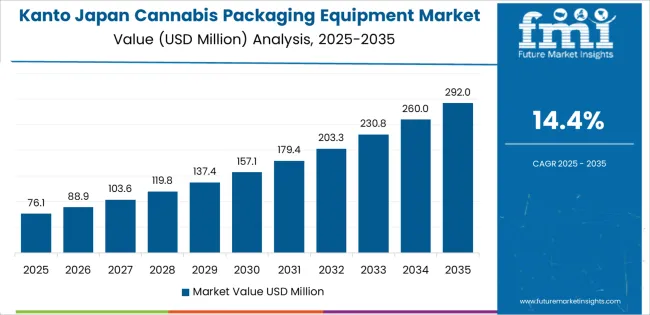

| Kanto | 14.4% |

| Kansai | 12.7% |

| Chubu | 11.1% |

| Tohoku | 9.8% |

| Rest of Japan | 9.3% |

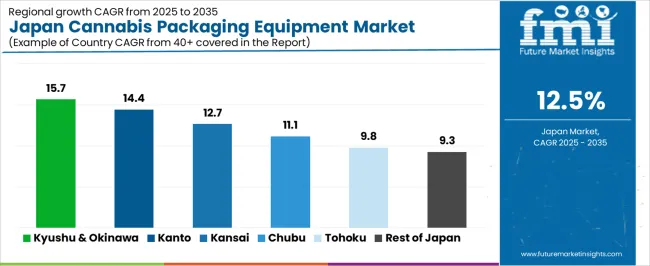

The demand for cannabis packaging equipment in Japan shows strong regional variation, with Kyushu & Okinawa leading with a 15.7% CAGR. That region’s growth is supported by emerging regulatory frameworks, increasing interest in packaging solutions that meet compliance requirements, and regional manufacturing readiness. The Kanto region follows at 14.4%, driven by its concentration of industrial infrastructure, importers of cannabis-derived products, and packaging machinery firms. In the Kansai area, the CAGR is 12.7%, aided by local production clusters and distribution channels. Chubu’s 11.1% growth reflects mid-level industrial adoption and evolving regulatory trends. Tohoku at 9.8% and the Rest of Japan at 9.3% show slower uptake, linked to lower population density and fewer cannabis industry ecosystem players. This regional spread points to strong momentum in urban and industrial hotspots, tapering off toward more peripheral zones.

What is the Demand for Cannabis Packaging Equipment in the Kyushu & Okinawa Regions of Japan?

In Kyushu & Okinawa, the demand for cannabis packaging equipment is growing at a CAGR of 15.7% through 2035. This rapid growth is primarily driven by increasing interest in cannabis-based products and the rising demand for efficient and compliant packaging solutions. As Japan’s regulatory framework around cannabis evolves, Kyushu & Okinawa are seeing greater investment in the cannabis industry, particularly in packaging technologies to meet both domestic and international market standards. The local agricultural sector, along with emerging cannabis cultivation, is also contributing to the demand for advanced packaging solutions.

- Increased investment in the cannabis industry is boosting packaging equipment demand.

- The evolving regulatory landscape in Japan supports growth in cannabis packaging.

- Local cannabis cultivation in Kyushu & Okinawa is driving packaging technology adoption.

- Rising consumer demand for cannabis-based products is further fueling market expansion.

What is the Demand for Cannabis Packaging Equipment in Kanto Region of Japan?

In Kanto, the demand for cannabis packaging equipment is projected to grow at a CAGR of 14.4% through 2035. As Japan’s largest and most economically significant region, Kanto is a key driver of the cannabis sector’s growth. Tokyo and other major cities are witnessing an increasing need for specialized packaging solutions to cater to both medicinal and recreational cannabis markets. The growing regulatory support and investment in research and development are creating a favorable environment for packaging equipment adoption in Kanto, particularly as the cannabis market continues to expand.

- Tokyo’s demand for cannabis products is driving packaging equipment adoption.

- Kanto’s regulatory and R&D support are accelerating the cannabis packaging market.

- The evolving cannabis sector in Kanto is leading to advanced packaging solutions.

- Investment in cannabis cultivation and distribution in Kanto contributes to growth.

What is the Demand for Cannabis Packaging Equipment in Kansai Region of Japan?

In Kansai, the demand for cannabis packaging equipment is expected to grow at a CAGR of 12.7% through 2035. With cities like Osaka and Kyoto growing as key centers for business and innovation, Kansai is emerging as an important region for the cannabis industry. The increasing interest in cannabis products for medicinal and wellness purposes is pushing the need for specialized packaging solutions. As local cannabis producers focus on meeting quality and safety standards, the demand for efficient packaging technologies is expected to rise in this region.

- Cities like Osaka and Kyoto are driving cannabis packaging adoption.

- The growing medicinal and wellness cannabis sectors are pushing demand.

- Local producers are focusing on meeting stringent packaging standards.

- Increased interest in cannabis products in Kansai is boosting packaging equipment demand.

What is the Demand for Cannabis Packaging Equipment in Chubu Region of Japan?

In Chubu, the demand for cannabis packaging equipment is projected to grow at a CAGR of 11.1% through 2035. The region’s growing agricultural sector and increasing interest in cannabis cultivation are contributing to the need for specialized packaging. As cannabis production expands, there is a rising demand for packaging technologies that ensure compliance with evolving regulations. The Chubu region’s focus on innovation and technology in various industries is also fostering growth in cannabis packaging, helping local producers enhance the quality and safety of their products.

- Chubu’s growing agricultural sector supports cannabis packaging demand.

- Cannabis cultivation expansion in the region drives packaging technology adoption.

- Focus on quality control and compliance in Chubu is boosting equipment demand.

- Technological innovations in Chubu are supporting cannabis packaging growth.

What is the Demand for Cannabis Packaging Equipment in Tohoku Region of Japan?

In Tohoku, the demand for cannabis packaging equipment is expected to grow at a CAGR of 9.8% through 2035. While Tohoku’s cannabis industry is still developing compared to other regions, increasing interest in medicinal cannabis and hemp products is driving demand for packaging solutions. As local cannabis cultivation initiatives grow, there is a push for more advanced and compliant packaging systems to meet both domestic and potential export market requirements. The growing acceptance of cannabis-based wellness products is also contributing to the rising demand in Tohoku.

- Tohoku’s emerging cannabis industry is driving packaging technology adoption.

- Medicinal cannabis and hemp product demand is fueling the packaging market.

- The region’s cultivation efforts are pushing for compliant and efficient packaging.

- Increasing consumer interest in cannabis wellness products is supporting market growth.

What is the Demand for Cannabis Packaging Equipment in Rest of Japan?

In the rest of Japan, the demand for cannabis packaging equipment is projected to grow at a CAGR of 9.3% through 2035. As regional markets outside the major hubs continue to develop, cannabis producers are adopting packaging solutions to meet both local and national standards. With the growing acceptance of cannabis products in wellness and medicinal applications, the demand for high-quality packaging equipment is expected to rise. Local producers are increasingly seeking efficient and compliant packaging technologies to serve the evolving market for cannabis-based products.

- Growing acceptance of cannabis wellness products is driving demand.

- Local cannabis producers are seeking efficient packaging technologies.

- Increased focus on compliance with regulatory standards is boosting market growth.

- The development of regional cannabis markets supports packaging equipment demand.

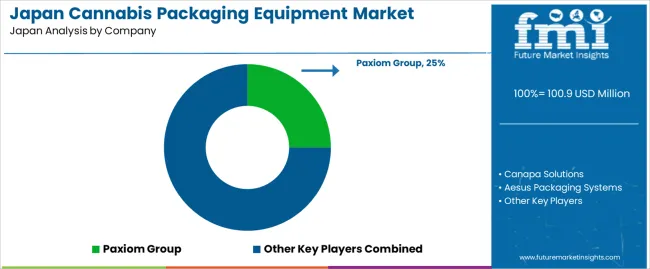

What Is Driving the Demand for Cannabis Packaging Equipment in Japan and Who Are the Key Players Shaping the Industry?

The demand for cannabis packaging equipment in Japan is gradually increasing due to the growing interest in CBD products and the potential for future regulatory changes. While cannabis remains largely illegal for recreational use, Japan’s expanding market for hemp-derived products, particularly CBD, is creating a need for specialized packaging equipment. This includes systems that can provide child-resistant, tamper-evident, and compliant packaging solutions. As the market for CBD products continues to grow, businesses require efficient, automated, and customizable packaging solutions to meet stringent regulations and ensure product safety and quality. Additionally, packaging systems that accommodate small batch production are gaining traction, especially as the market for cannabis-derived products remains in a nascent stage.

Key players such as Paxiom Group, Canapa Solutions, Aesus Packaging Systems, CoolJarz by Earthwise Packaging, and WeighPack Systems Inc. are shaping the cannabis packaging industry in Japan. Paxiom Group and WeighPack Systems Inc. offer high-speed automated packaging solutions, including filling, sealing, and labeling systems tailored for the cannabis sector. Canapa Solutions provides turnkey packaging solutions that cater to the needs of cannabis product manufacturers. Aesus Packaging Systems specializes in vacuum and barrier packaging for products requiring high-level protection, while CoolJarz focuses on child-resistant and odor-proof packaging solutions. These companies are instrumental in supporting the development of the cannabis packaging market in Japan as the country’s regulatory environment and market demand continue to evolve.

Key Players in Cannabis Packaging Equipment Industry in Japan

- Paxiom Group

- Canapa Solutions

- Aesus Packaging Systems

- CoolJarz by Earthwise Packaging

- WeighPack Systems Inc.

Scope of the Report

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Equipment Type | Automatic Equipment, Semi-Automatic Equipment |

| Application | Medical Use, Recreational Use, Others |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Paxiom Group, Canapa Solutions, Aesus Packaging Systems, CoolJarz by Earthwise Packaging, WeighPack Systems Inc. |

| Additional Attributes | Dollar by sales by type, application, and region; regional CAGR and adoption trends; volume and value growth projections; regulations surrounding cannabis product packaging; advancements in automation and traceability systems; demand for child-resistant, tamper-evident packaging; increasing market adoption of high-speed equipment; role of packaging in ensuring product integrity and safety; market influenced by evolving cannabis legalization; investment in specialized, customizable packaging systems; demand for scalable, modular equipment for multi-format products. |

Cannabis Packaging Equipment Industry in Japan Segmentation

Equipment Type:

- Automatic Equipment

- SEMI-Automatic Equipment

Application:

- Medical use

- Recreational use

- Others

Region:

- Kyushu & Okinawa

- Kanto

- Kansai

- Chubu

- Tohoku

- Rest of Japan

Frequently Asked Questions

How big is the demand for cannabis packaging equipment in Japan in 2025?

The demand for cannabis packaging equipment in Japan is estimated to be valued at USD 100.9 million in 2025.

What will be the size of cannabis packaging equipment in Japan in 2035?

The market size for the cannabis packaging equipment in Japan is projected to reach USD 328.5 million by 2035.

How much will be the demand for cannabis packaging equipment in Japan growth between 2025 and 2035?

The demand for cannabis packaging equipment in Japan is expected to grow at a 12.5% CAGR between 2025 and 2035.

What are the key product types in the cannabis packaging equipment in Japan?

The key product types in cannabis packaging equipment in Japan are automatic equipment and semi- automatic equipment.

Which application segment is expected to contribute significant share in the cannabis packaging equipment in Japan in 2025?

In terms of application, medical use segment is expected to command 47.0% share in the cannabis packaging equipment in Japan in 2025.

Search

RECENT PRESS RELEASES

Related Post