Denison Mines (TSX:DML) Is Up 15.9% After Major US Nuclear Investment and New Industry All

October 30, 2025

-

In late October 2025, Denison Mines saw heightened attention after the US government announced an $80 billion commitment for nuclear power development through partnerships with leading energy companies, sparking renewed optimism across uranium producers.

-

Sector momentum was further supported by news that Cosa Resources appointed Denison Mines’ CEO, David Cates, as strategic advisor to advance collaborative uranium projects in the Athabasca Basin.

-

We’ll examine how US backing for nuclear energy and the expanded industry collaboration could impact Denison Mines’ investment story.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Anyone looking at Denison Mines today is really weighing the case for uranium as a cornerstone of global clean energy, now with major tailwinds following the US government’s $80 billion commitment to nuclear power and the sector rally that followed. The stock’s strong recent run reflects a surge in optimism, but it also raises questions about whether this U.S. boost will translate into lasting demand and project growth for Denison specifically. Short-term catalysts are now more focused on leveraging regulatory approvals at Wheeler River, progress on high-grade discoveries, and deeper partnerships like the recent Cosa Resources announcement, which could speed up project timelines. However, Denison’s persistent losses, expensive valuation relative to peers, short cash runway, and insider selling still present real risks, not all of which are swept aside by supportive market sentiment. The evolving sector backdrop could reduce regulatory and market hurdles but doesn’t remove the company’s operational risks or execution challenges, which need to be front of mind for every investor here.

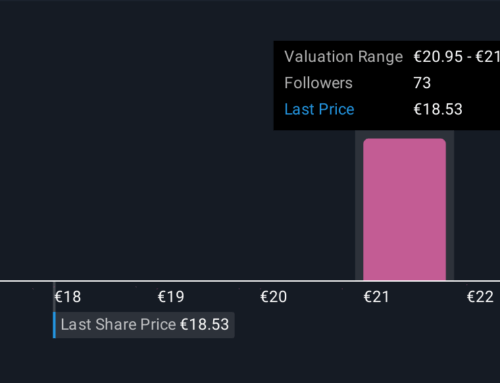

But with the share price running well ahead of consensus targets, valuation risk can’t be ignored.

Nine member estimates from the Simply Wall St Community range from as little as CA$0.05 to CA$5.00 per share, showing both major optimism and skepticism. This wide range suggests investors are split, especially as Denison’s operational risks and strong recent price gains feed into very different outlooks on the company’s next chapter.

Explore 9 other fair value estimates on Denison Mines – why the stock might be worth as much as 13% more than the current price!

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

-

Our free Denison Mines research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Denison Mines’ overall financial health at a glance.

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

-

Find companies with promising cash flow potential yet trading below their fair value.

-

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

-

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DML.TO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post