Derive Researcher: Ethereum Poised for $12K Surge with Trump’s Support and Pectra Upgrade

January 9, 2025

The price of Ether (ETH) could skyrocket to $12,000 in 2025, representing a 257% increase from its current value, according to Dr. Sean Dawson, head of research at the decentralized finance (DeFi) protocol Derive.

According to Cointelegraph, this optimistic outlook is built on multiple factors, including the anticipated Pectra upgrade for Ethereum, a favorable regulatory environment under a pro-crypto U.S. president like Donald Trump, and broader market adoption. All factors contribute to the bold price prediction for ETH in 2025.

Ethereum’s Pectra Upgrade: A Game-Changer for Scalability

Ethereum’s Pectra upgrade, scheduled for release in the first quarter of 2025, is central to the bullish forecast for Ether. The update aims to enhance Ethereum’s scalability and efficiency, addressing critical network bottlenecks that have hindered the blockchain’s full potential. Dawson emphasized that for Ether to reach $12,000, Ethereum would need to achieve widespread adoption, particularly through real-world assets (RWAs), and see substantial inflows into exchange-traded funds (ETFs).

Source: The Wolf of All Streets via X

Ethereum’s integration into emerging sectors like decentralized physical infrastructure networks (DePIN) and artificial intelligence (AI) could also play a pivotal role in its growth. Matt Hougan, head of research at Bitwise, recently highlighted that Ethereum and Base, its layer-2 scaling network, are already platforms of choice for many AI agents. “The broader adoption of Ethereum in such sectors would help position Ether for continued price growth,” said Dawson.

A Potential Trump Effect

Beyond Ethereum’s technical upgrades, Dawson also pointed to political factors, including a regulatory-friendly environment under a potential second Trump presidency, which could provide a favorable backdrop for the crypto industry. This sentiment aligns with other industry experts who suggest that a pro-crypto government could accelerate growth for digital assets like Ether. Dawson noted, “A supportive regulatory environment could be the catalyst for accelerating Ether’s adoption and pushing its value higher.”

The Bullish Sentiment in the Options Market

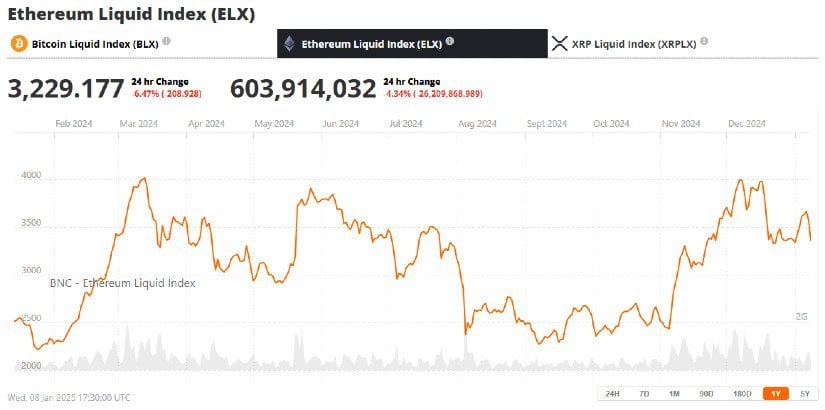

While Ethereum has been consolidating around $3,500 since December 2024, the options market is telling a more bullish story. Dawson pointed out that on the Derive.xyz platform, open interest in call options (bets on price increases) is significantly higher than puts (bets on price drops), with a 250% skew toward calls. This signals strong confidence among traders that Ether’s price will rise in the coming months.

Ethereum (ETH) price chart. Source: Ethereum Liquid Index (ELX) via Brave New Coin

However, Dawson also cautioned that a bearish scenario could see Ether’s price fall below $2,000. “If the spot Ether ETF fails to attract institutional interest, Ether could lose ground to other projects like Solana,” he said. Such a development could dampen the optimism surrounding Ethereum, particularly if competing layer-1 blockchains offer more attractive risk-reward opportunities for investors.

Another key indicator of Ether’s potential strength is the growing number of long-term holders. Data by IntoTheBlock indicated that the Ether held for more than a year increased from 59% in January 2024 to 75% at the end of the year. This could show a developing confidence in the long-term value of Ether, with many investors choosing to hold rather than sell.

Ethereum Competitive Landscape

Despite Ether’s positive momentum, the cryptocurrency still faces stiff competition from other blockchain projects elbowing their way up for market share. Mr. Dawson warned that Ethereum’s dominance could be challenged by newer high-risk layer-1 blockchains that might attract more speculative investors seeking dramatic short-term gains. Hyperliquid is a good example of a new chain that has dominated investor attention recently, and the price predictions for its native HYPE token reflect this.

Nevertheless, with its Pectra upgrade, growing adoption in AI and DePIN, and favorable political conditions, Ether has the potential to see significant price gains in 2025. However, achieving the $12,000 target will depend on aligning both technical and market factors to drive further growth.

Bottom Line

The road ahead for Ether looks promising, but it will require a delicate balance of technological innovation, market adoption, and political support. Whether Ethereum can hit $12,000 in 2025 remains to be seen. Still, the combination of the Pectra upgrade, a favorable regulatory environment, and strong market sentiment suggests that significant price growth is within reach.

Search

RECENT PRESS RELEASES

Related Post