Do AI Stocks Still Offer Investors a Once-in-a-Generation Investment Opportunity?

January 6, 2026

Some companies already are scoring an AI win.

Artificial intelligence (AI) stocks have driven double-digit gains in the S&P 500 over the past three years, with names such as Nvidia (NVDA 0.43%), Alphabet, and Palantir Technologies soaring. Investors have piled into these and other companies developing or using AI in an effort to get in on a once-in-a-generation investment opportunity.

Why is everyone so excited about AI? Because it could transform the way many things are done — from scheduling an appointment to creating a medical treatment or speeding up processes at a factory. And these are just a few examples. This innovation and efficiency may save companies money and significantly boost earnings. So those selling or using AI could win big — and investors have been eager to get in on their shares early in the AI story.

But all of this has led to one problem: high valuation. As share prices have climbed, companies also have seen their valuations increase, and in some cases, they’ve reached levels that might be difficult to sustain. Considering this, it’s reasonable to ask the question: Do AI stocks still offer investors a once-in-a-generation investment opportunity? Let’s find out.

Image source: Getty Images.

The AI story so far

So, first let’s consider the AI story so far. Over the past few years, we started to see the power of AI as companies trained models and even put them to work. For example, virtual assistants such as Alphabet’s Gemini have helped us in our daily lives, and Palantir’s AI-driven software has been helping commercial and government customers aggregate, analyze, and make use of their data.

Chip designers such as Nvidia — the market leader — have fueled this with the AI chips needed for the training process and other purposes. And businesses like Alphabet’s Google Cloud have offered customers access to Nvidia systems as well as other AI platforms.

Advertisement

Nvidia

Today’s Change

(-0.43%) $-0.81

Current Price

$188.03

All of this has created an initial batch of AI winners, companies such as those I’ve mentioned that already are generating significant revenue growth thanks to AI.

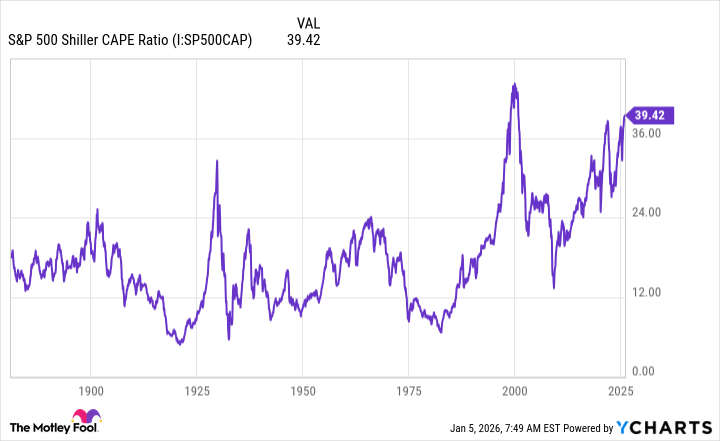

But as the stock prices of these and many other players advanced, worries about valuations grew — and investors late last year even started talking about the possibility of an AI bubble forming. A look at the S&P 500 Shiller CAPE ratio shows us that stocks in general are trading at one of their highest levels ever.

S&P 500 Shiller CAPE Ratio data by YCharts

Too late to buy?

Now, let’s consider our question: Against this backdrop, could AI stocks still offer you a major investment opportunity, or is it too late to get in on this story? The Motley Fool’s 2026 AI Investor Outlook Report offers us some valuable insight.

In a Motley Fool survey, 60% of respondents said they are confident about AI stocks’ performance over the long haul. And 9 out of 10 AI investors say they plan on maintaining or increasing their AI holdings. The Motley Fool surveyed 2,600 American adults over a two-week period in early November.

So, clearly, the majority of investors still see AI as a big opportunity in spite of rising valuations.

Positioned to reap the rewards

This doesn’t mean that the valuations of all AI stocks today are sustainable. But even if you get in on this market today, if you choose quality players, you still may be well positioned to reap the rewards in the long run.

As Donato Riccio, Head of AI at The Motley Fool says, “For investors willing to weather near-term volatility, the AI transformation represents a once-in-a-generation opportunity to participate in technology that’s restructuring how the world works.”

The AI market may be in its early growth chapters as it’s expected to reach into the trillions of dollars by the early part of the coming decade.

So, as an investor, how should you approach the opportunity? It’s important to consider a company’s current market position, earnings track record, financial potential to reach its AI goals, and overall prospects moving forward. Those that are strong in these areas could represent great buys today — and are likely to manage any potential bumps along the path as the AI story develops.

All of this means that AI stocks still offer a once-in-a-generation investment opportunity that long-term investors won’t want to miss.

Search

RECENT PRESS RELEASES

Related Post