Does This News Make Meta Platforms Stock a Buy?

June 11, 2025

Several years ago, Facebook parent Meta Platforms (META 1.20%) changed its name, partly to reflect its newfound focus on its metaverse ambitions. Although the company is still working on that project, its initiatives in artificial intelligence (AI) garnered more headlines recently.

Meta is looking to transform its business through AI, and recent news suggests it may take a significant step in that direction by the end of 2026. Let’s examine these developments and determine whether they make Meta Platforms stock a buy.

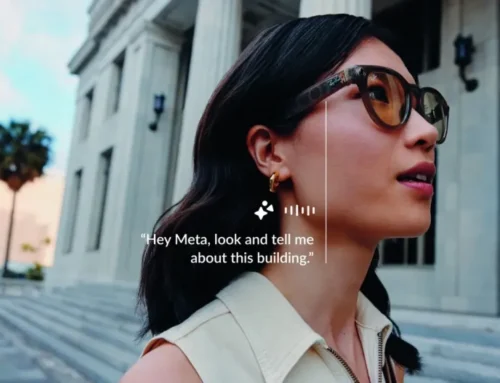

Image source: Getty Images.

Meta is looking to automate its ad business

Meta Platforms makes most of its money from advertising to its massive user base. As of the end of the first quarter, Meta boasted 3.43 billion daily active users across its websites and apps, which include Facebook, Instagram, Messenger, and WhatsApp.

However, Meta’s ad business could become even better if it could provide more value to advertisers by improving their ad creation and launch processes. It already started to do that with the use of AI-powered tools — for instance, helping advertisers define their target audience using AI. While businesses typically need to conduct research to figure that out, AI is making the job faster, easier, and cheaper.

However, Meta is looking to take the next steps. According to a report from The Wall Street Journal, it aims to automate the process with AI from start to finish. Businesses will be able to use the technology at every step of the way — to create images, tweak them, generate appropriate text, define the target audience, and more.

Meta Platforms aims to complete this by the end of next year. What does this mean for investors?

One more reason to buy the stock

If successful, Meta Platforms’ new AI tools for ads could reduce advertising expenses for companies while they achieve similar (or perhaps even better) results. If that’s the case, demand for Meta’s AI-powered tools to post ads across its websites and apps would increase significantly, leading to even more impressive sales.

To be clear, Meta’s ad business would be a key growth driver anyway. The digital ad market is still growing, and the tech leader’s deep ecosystem of users makes it a valuable target for business clients. However, these new initiatives would further enhance this already highly profitable offering.

Meanwhile, Meta is also improving engagement thanks to AI. Its algorithms have helped increase the amount of time users spend on Facebook and Instagram, so the company is working on both sides of the commerce equation with AI.

These efforts should pay off in the long run, especially considering it has other potential growth drivers. It has been ramping up commercial messaging on WhatsApp, as well as working on the metaverse.

Now, Meta Platforms isn’t without risk. U.S.-China trade tensions could impact its financial results. During the first quarter, it received less advertising revenue from Asia-based retailers after the Trump administration ended a loophole that allowed some imports from China to enter the U.S. tax-free.

Still, despite this headwind, Meta Platforms’ first-quarter results were excellent. Revenue increased by 16% year over year to $42.3 billion, while net earnings per share came in at $6.43, 37% higher than the year-ago period. There might be more uncertainty if the trade wars continue, but Meta Platforms is showing that it can perform reasonably well despite that.

Some might also point to the company’s valuation as a reason to avoid the stock. Meta’s forward price-to-earnings (P/E) ratio is 27.4 as of this writing, much higher than the average of 19.1 for the communication services industry. But given the Facebook parent’s excellent results and strong prospects, it seems worth a premium. In my view, Meta Platforms will more than justify its relatively steep valuation in five years or more, which still makes it a stock worth owning for a long time.

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post