Does Wall Street’s Sell-Off Have You Interested in Gold? 2 ETFs You’ll Want to Dig Into.

April 27, 2025

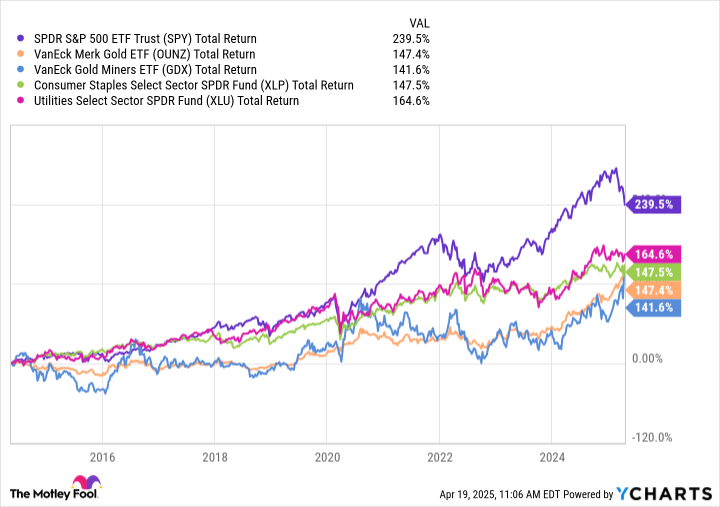

The S&P 500 (^GSPC 0.74%) is down over 10% from highs set earlier this year. The Nasdaq Composite (^IXIC 1.26%) dropped more than 20% from previous highs at one point and currently sits close to 15% down. While both indexes are off of their 2025 lows, uncertainty on Wall Street remains high.

Not helping things any is the fear that geopolitical issues around tariffs could lead to a global recession. In uncertain times, a subset of investors turns to gold as a safe-haven investment. That’s a big part of why gold prices are up almost 25% in 2025.

If you are considering gold as a way to invest during this uncertain economy, there are two easy ways to add the metal to your portfolio that don’t require buying actual gold bars. They involve exchange-traded funds (ETFs).

Investors are running for cover

When uncertainty reigns in the stock market and economy, investors tend to get conservative. That includes things like switching to cash, focusing on sectors perceived to be safe (such as utilities and consumer staples), and buying bonds. There’s one more option that the most concerned investors often take, and that’s buying gold.

Image source: Getty Images.

Gold is a commodity, so it is not without risk. For example, an ounce of gold will only ever be an ounce of gold. It can’t grow like a business that is investing in itself. So the upside potential is limited to the increase in the price of the metal. But there’s also the risk that gold prices will fall, so there’s a downside that has to be considered. That said, gold is assumed to have intrinsic value as a store of wealth. While a stock price can go to zero if a company goes bankrupt, history suggests that gold will always retain some value.

Investors need to think carefully about adding gold to their portfolios. If you do decide to buy gold, you should probably limit your exposure to 10% or less of your overall portfolio. Over the long term, stocks have outperformed gold by a wide margin.

Three ways to buy gold

The most direct way to buy gold is to buy gold bullion. This is a highly inefficient method of adding gold to your portfolio, because there are large transaction costs and you have to store it safely once you have it. Unless you’re worried that the United States’ fiat currency is going to become worthless, you’re better off investing in gold in a less direct way.

Data by YCharts.

The move most similar to buying bullion would be buying an exchange-traded fund like the VanEck Merk Gold Trust (OUNZ -1.09%). This ETF directly owns gold, so its price will largely track the price of gold. However, there’s an interesting twist: Shareholders can exchange their shares for gold bullion. This isn’t likely to be practical for smaller investors because of the costs associated with such an exchange. But having that option may make this a good hybrid choice for investors who would otherwise consider buying bullion. The expense ratio is a reasonable 0.25%, given that the gold the VanEck Merk Gold ETF owns has to be stored and protected.

For investors who don’t like the idea that gold can’t become anything more than what it is when you buy it, the VanEck Gold Miners ETF (GDX -1.89%) might be a good choice. The expense ratio is a bit high at 0.51%, but it has a globally diversified portfolio, so elevated expenses make some sense. (U.S. stocks only make up around 16% of the portfolio.)

It provides diversified exposure to precious metals miners, which, unlike gold, can invest in their businesses and grow. However, because a gold miner’s top and bottom lines are driven by the commodity it sells, gold miners, as a group, tend to track along with gold prices over time.

Data by YCharts.

A gold miner-focused investment like the VanEck Gold Miners ETF is probably the best option for most investors. This is because it effectively provides gold exposure while allowing you to remain true to your larger investment approach, which is likely centered around owning stocks.

Data by YCharts.

You have ample gold options, if you want them

These are just two ETF examples that will allow you to add gold to your portfolio. The VanEck Merk Gold Trust is the most similar to buying gold bullion, while the VanEck Gold Miners ETF invests in gold-related stocks. However, the bigger issue you need to address before buying either is whether or not buying gold makes sense for your portfolio.

For example, if you’re heavily invested in utilities and consumer staples stocks, you may not really need the perceived safety of gold to help you sleep at night. Indeed, the limitations of owning a commodity or having exposure to commodity-driven businesses might not be worth the benefit you think you are going to get.

Search

RECENT PRESS RELEASES

Related Post