DTE Energy (NYSE:DTE) Unveils Pine River Solar Park, Highlighting Renewable Energy Expansi

April 26, 2025

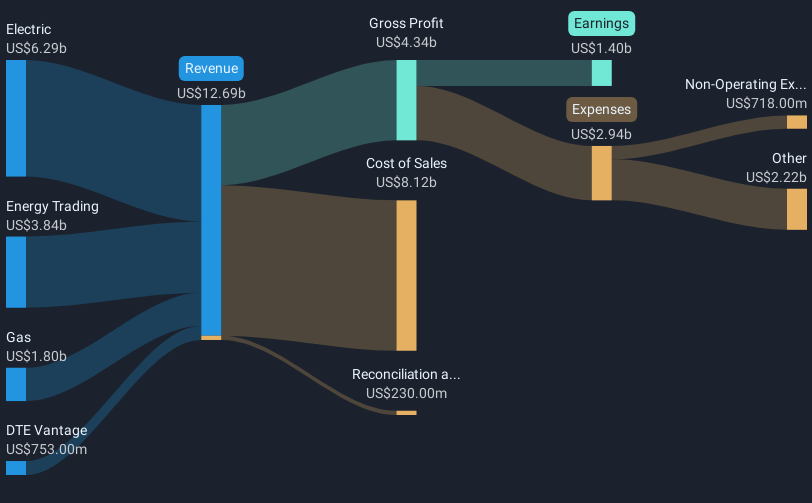

DTE Energy (NYSE:DTE) celebrated the completion of the Pine River Solar Park, marking its commitment to renewable energy and sustainability, aligning with Michigan’s clean energy goals. Over the last quarter, the company’s stock recorded a 13% increase, which outpaced the broader market’s 5% rise over the last week and 8% over the past year. While the groundbreaking of the Cold Creek Solar Park and the Pine River project underscored DTE’s clean energy initiatives, these developments added weight to the company’s upward trajectory, complementing broader market gains and a positive outlook for earnings growth.

The completion of DTE Energy’s Pine River Solar Park aligns with its broader clean energy initiatives, potentially strengthening its future revenue and earnings growth. This development, coupled with the groundbreaking of the Cold Creek Solar Park, signals a commitment to renewable energy, supporting the company’s planned investment of $30 billion to enhance grid reliability. This focus could lead to increased revenue streams by attracting environmentally conscious consumers and meeting progressive regulatory standards.

Over the past five years, DTE Energy’s total return, including share price and dividends, was 85.85%. This notable long-term performance can be seen against the backdrop of a 13% share price increase over the last quarter, compared to the broader market’s recent rise. However, over the past year, DTE’s growth has outshone the market with its one-year return exceeding the US Market, which achieved a 7.9% return.

The recent news around the company’s transition toward clean energy is likely to underpin its revenue and earnings forecasts. Analysts expect DTE’s revenue to grow at an annual rate of 4.3% over the next three years, with earnings potentially reaching US$1.7 billion by 2028. With a current share price of US$135.8 and a consensus price target of US$139.84, the stock appears to trade at a slight discount, suggesting potential room for price appreciation if the company meets or exceeds these growth expectations.

Understand DTE Energy’s earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post