Electric Bus Delivery and Buyback Plan Might Change The Case For Investing In Blue Bird (B

August 17, 2025

- Blue Bird Corporation recently announced the delivery of 25 electric school buses to the Little Rock School District in Arkansas, marking a significant step in school transportation electrification backed by nearly US$9.88 million in EPA funding.

- This milestone adds to Blue Bird’s position as the only U.S.-owned school bus maker and strengthens its leadership with over 2,500 electric buses in operation nationwide.

- We’ll explore how Blue Bird’s $100 million buyback plan and major EV contract support the company’s future earnings outlook.

AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

Blue Bird Investment Narrative Recap

To be a Blue Bird shareholder today, you need to believe in the accelerating shift to electric school transportation, continued government backing through programs like the EPA Clean School Bus initiative, and Blue Bird’s ability to leverage its leading U.S.-owned status and operating scale. The delivery of 25 electric buses to Little Rock underscores the company’s catalyst of rising EV demand, though the biggest short-term risk, policy or funding volatility, remains largely unchanged by this event.

Among recent announcements, the newly authorized US$100 million share buyback stands out, potentially signaling confidence in Blue Bird’s earnings resilience and future cash generation capacity, though its near-term impact on backlogs or demand is limited compared to policy-driven EV orders.

On the other hand, investors should also keep in mind the persistent uncertainty around federal and state incentives for electric buses, especially with…

Read the full narrative on Blue Bird (it’s free!)

Blue Bird’s outlook forecasts $1.6 billion in revenue and $152.3 million in earnings by 2028. This projection assumes a 4.0% annual revenue growth and an increase in earnings of $36.4 million from the current $115.9 million.

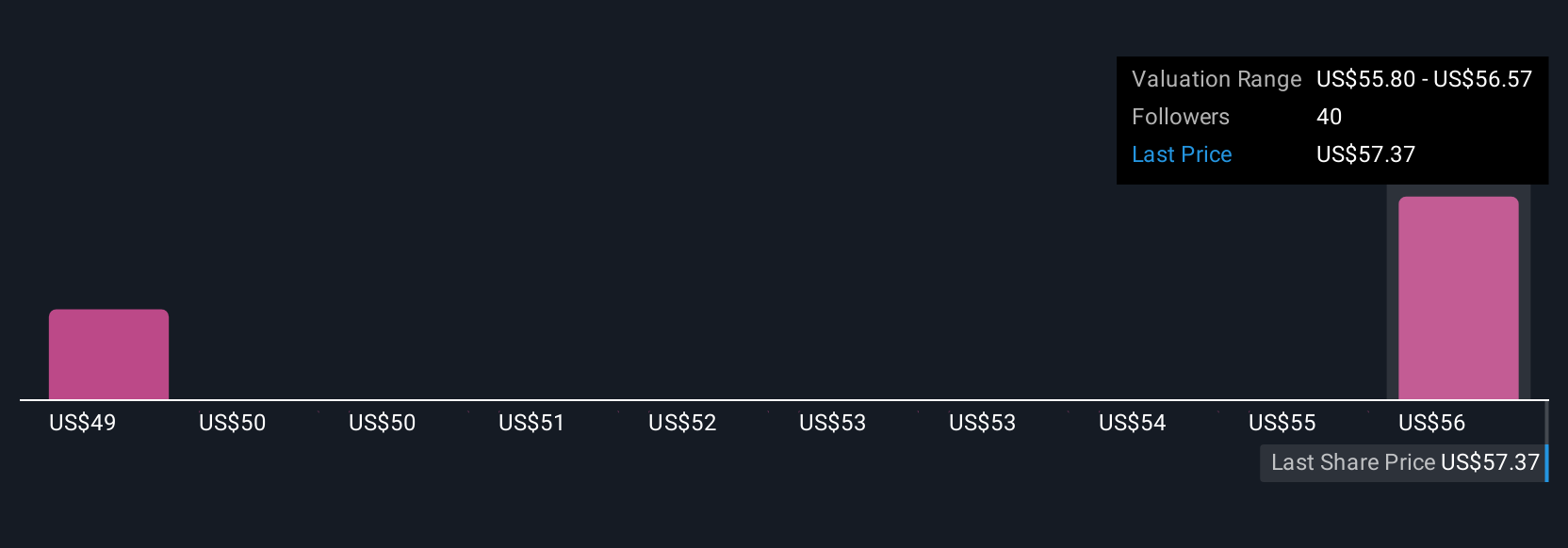

Uncover how Blue Bird’s forecasts yield a $56.57 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members provided fair value estimates for Blue Bird ranging from US$48.81 to US$56.57 across two unique analyses. While several perspectives exist, the enduring risk remains the company’s reliance on government incentive programs for supporting electric bus sales and future earnings, which may affect both short-term sentiment and long-term growth expectations.

Explore 2 other fair value estimates on Blue Bird – why the stock might be worth 15% less than the current price!

Build Your Own Blue Bird Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Blue Bird research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Blue Bird research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Blue Bird’s overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Blue Bird might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post