EssilorLuxottica (ENXTPA:EL): Assessing Valuation After Major Smart Eyewear Launches with

September 24, 2025

EssilorLuxottica Société anonyme (ENXTPA:EL) just took center stage at Meta Connect, announcing major updates alongside Meta Platforms that could shake up how investors think about the stock. The event saw a double launch: an upgraded Ray-Ban Meta and the brand-new Oakley Meta Vanguard, each making a splash with AI-focused features, longer battery life, and fresh styles. It is the sort of moment that has investors asking whether these partnerships will keep EssilorLuxottica ahead of the curve in smart eyewear.

Looking at the numbers, the market seems encouraged. EssilorLuxottica has seen steady gains over the past year, with a 35% total return for shareholders and momentum continuing in recent months. The partnership with Meta has led the conversation, but annual revenue and net income growth—both around 6% and 14%—suggest operational strength is underpinning share price optimism. Still, big launches like these tend to spark questions about what future results are already priced in.

After this latest jump in innovation and year-long rally, is EssilorLuxottica’s stock undervalued based on fundamentals, or does the current price reflect all the promise the market expects?

Advertisement

Most Popular Narrative: 1.2% Undervalued

According to the most widely followed narrative, EssilorLuxottica appears slightly undervalued, with analysts pointing to continued growth in new markets, technology, and vertical integration as the key drivers of this view.

*Investments in smart eyewear, AI-enabled vision solutions, and MedTech (Ray-Ban Meta, Oakley Meta, Nuance Audio, acquisition of Optegra Eye Clinics) capitalize on long-term demand for technologically advanced and personalized eye health platforms. These investments are catalyzing product mix upgrades and higher ASPs, which will benefit gross margin and future earnings.*

Want to know what numbers are powering this bullish thesis? This narrative is built on ambitious projections for revenue, earnings, and profit margins, implying a future profit multiple rarely seen outside fast-growth sectors. Curious about the assumptions behind this seemingly sky-high target? Dive deeper to discover the critical figures that could sway EssilorLuxottica’s valuation story.

Result: Fair Value of €277.61 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, unexpected adoption challenges for new smart eyewear or global inflationary pressures could quickly undermine the bullish outlook that is built into today’s valuation.

Find out about the key risks to this EssilorLuxottica Société anonyme narrative.

Another View: Is the Price Justified?

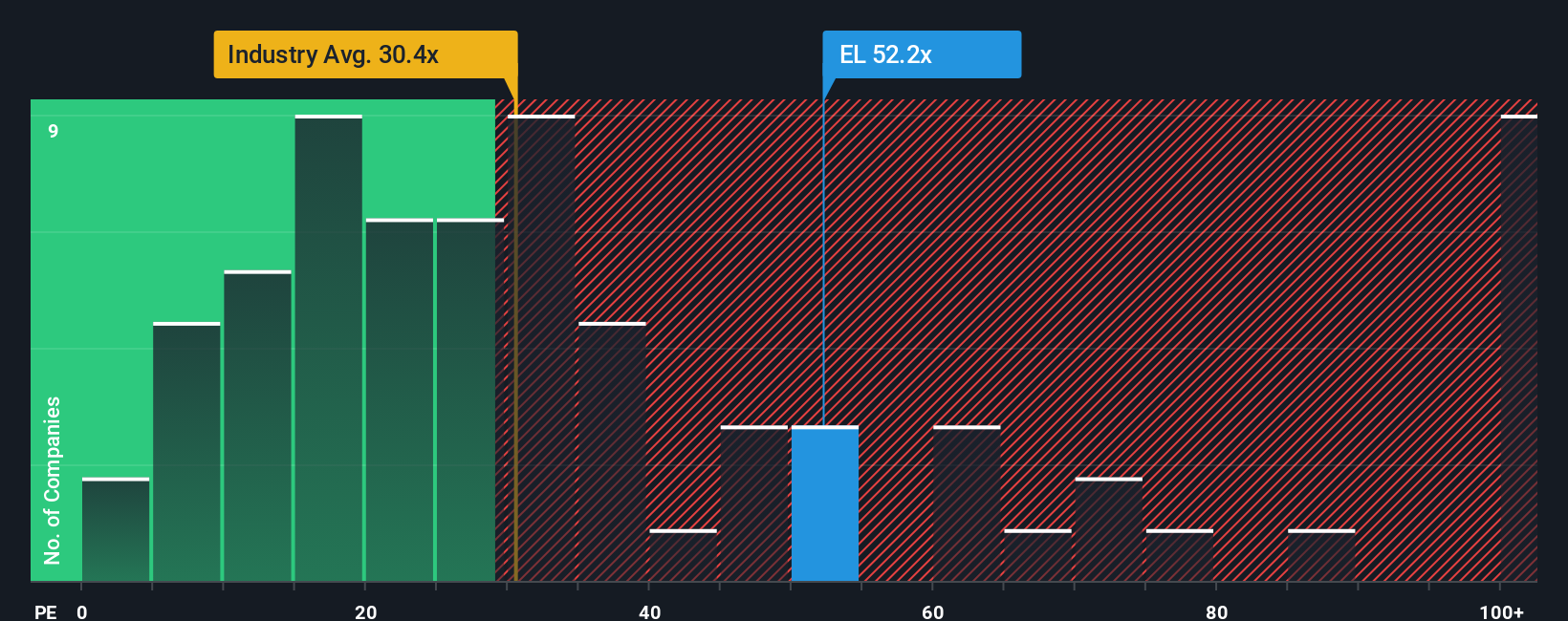

Looking from a different lens, EssilorLuxottica’s valuation is steep when compared to the wider European industry by a common earnings-based metric. This challenges the view that the shares are being overlooked. Could the market be too optimistic here?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding EssilorLuxottica Société anonyme to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own EssilorLuxottica Société anonyme Narrative

If you see things differently, or want to chart your own course using the numbers, you can craft a personalized view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding EssilorLuxottica Société anonyme.

Looking for More Smart Investment Opportunities?

Why limit yourself to just one stock when the market offers a world of exciting trends and possibilities? Let Simply Wall Street be your shortcut to sharper opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if EssilorLuxottica Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post