ETH at Risk? Four Indicators Point to More Pain Ahead

December 25, 2025

Ethereum (ETH) has traded sideways around the $3,000 level for the past two weeks. Although recent buying came from firms such as BitMine and Trend Research, the demand appears insufficient.

The following data reveals the rest of the picture, as selling pressure remains equally strong. As a result, ETH is unlikely to stage a quick recovery in the short term.

SponsoredSponsored

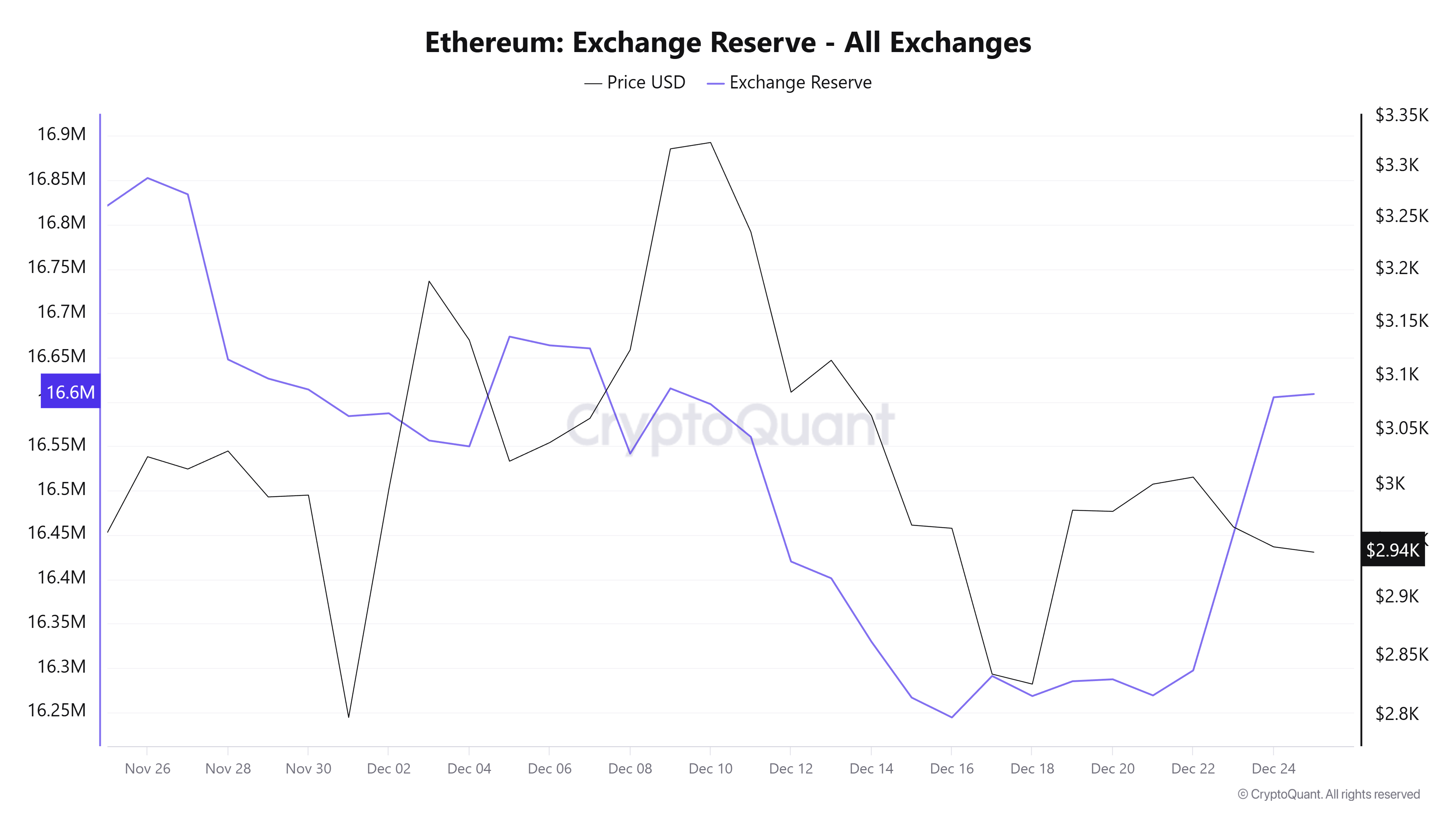

Data from CryptoQuant shows that ETH reserves across all exchanges had declined steadily for several months.

However, the trend reversed in December. This week, ETH exchange reserves increased from 16.2 million to 16.6 million. That rise equals roughly 400,000 ETH transferred onto exchanges.

On-chain data reveals that one “OG whale” alone deposited 100,000 ETH into Binance.

Recent BeInCrypto reports show that BitMine Immersion Technologies bought 67,886 ETH this week. Trend Research also purchased 46,379 ETH. Even so, these figures remain smaller than the amount of ETH moved onto exchanges.

If ETH is transferred to exchanges for liquidation and exceeds buying absorption, selling pressure could intensify. If this trend continues into the final days of the year, ETH prices may face further downside pressure.

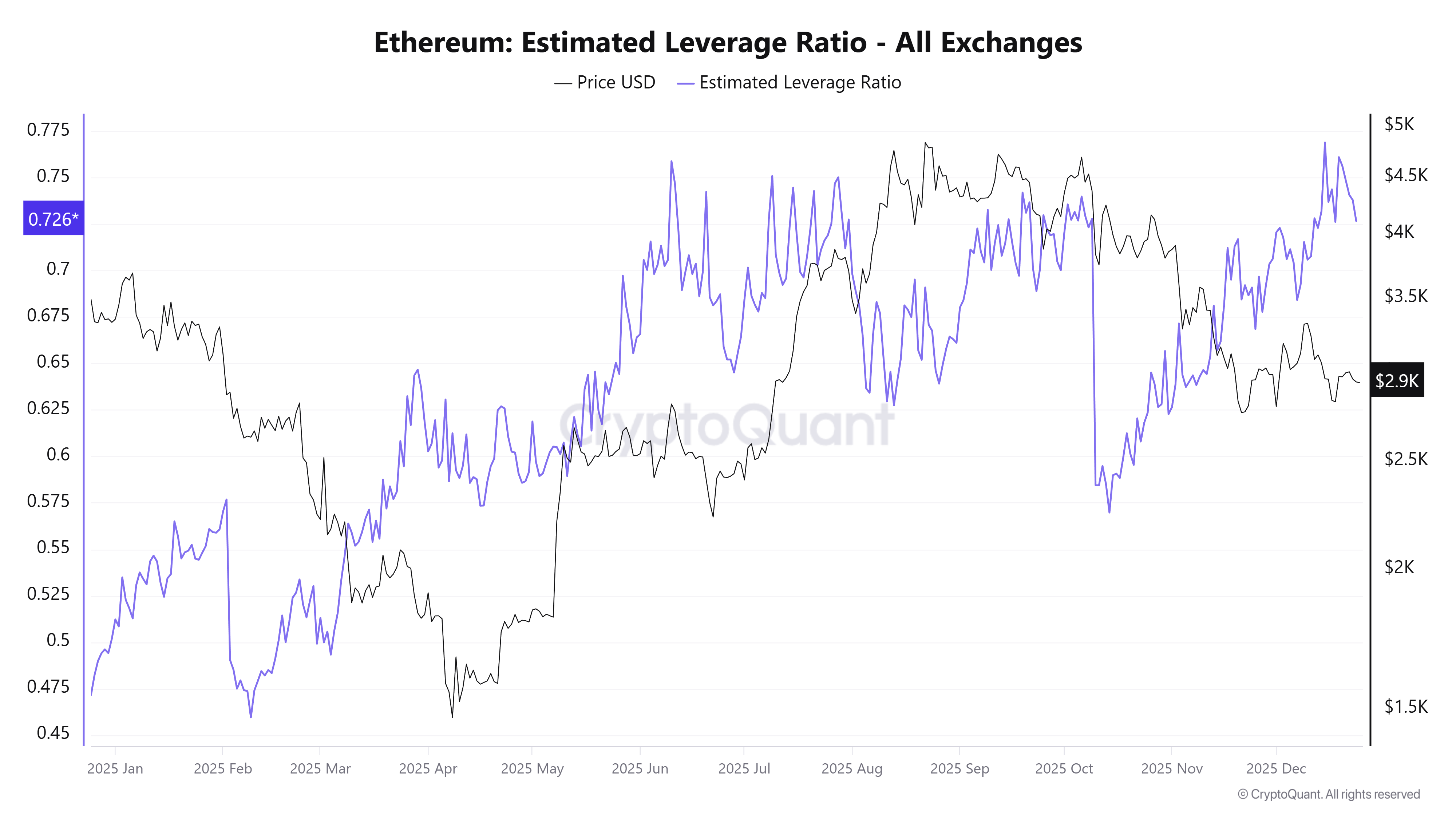

Another key metric is Ethereum’s Estimated Leverage Ratio, which remains at an alarming level, according to CryptoQuant.

SponsoredSponsored

This ratio equals exchange open interest divided by coin reserves. It reflects the average leverage used by traders. Rising values suggest more investors are taking on higher leverage in derivatives markets.

On October 10, the day with the largest liquidation losses in market history, the ratio stood at 0.72. Currently, the ratio has returned to similar levels. Some readings even reach as high as 0.76.

With leverage still elevated, Ethereum remains vulnerable to small price moves. Such moves could trigger cascade liquidations.

SponsoredSponsored

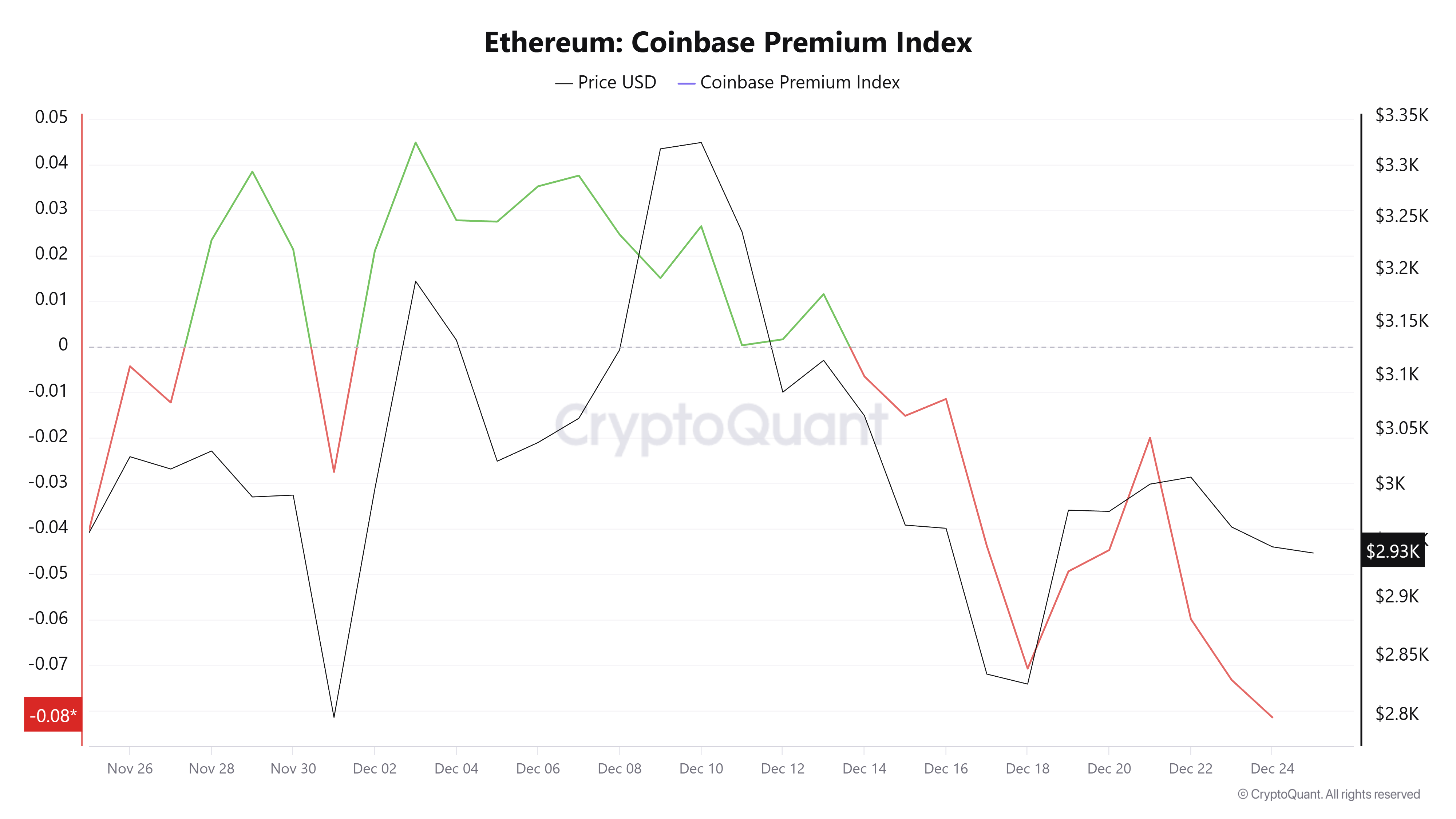

BeInCrypto previously reported that Ethereum’s Coinbase Premium turned negative in December.

During Christmas week, the indicator moved further into negative territory. It currently stands at -0.08, the lowest level in the past month.

This indicator measures the percentage price difference between ETH on Coinbase Pro (USD pair) and Binance (USDT pair). Negative values indicate lower prices on Coinbase.

This trend suggests that US investors continue selling at discounted prices. ETH may struggle to recover in the short term until the Coinbase Premium turns positive again.

SponsoredSponsored

December is nearing its end, and ETH ETF flows are likely to close with a second straight month of net outflows.

Last month, net flows across all ETH ETFs reached -$1.42 billion. This month, outflows have already exceeded $560 million.

Without fresh inflows, ETH lacks upward momentum. If outflows persist, especially during low-volume year-end holidays, prices may retest lower support levels.

“Since early November, the 30D-SMA of net flows into both Bitcoin and Ethereum ETFs has turned negative and remained so. This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market,” Glassnode reported.

In summary, four signals—rising exchange reserves, elevated leverage, deeply negative premiums, and sustained ETF outflows—suggest that ETH may remain in a consolidation phase or face further downside.

Maintaining proper stop-loss levels for derivatives positions and using prudent capital allocation for spot buying can help traders reduce risk amid unexpected volatility.

Search

RECENT PRESS RELEASES

Related Post