ETH to hit $12,000? Ethereum Price Prediction August 2025

August 11, 2025

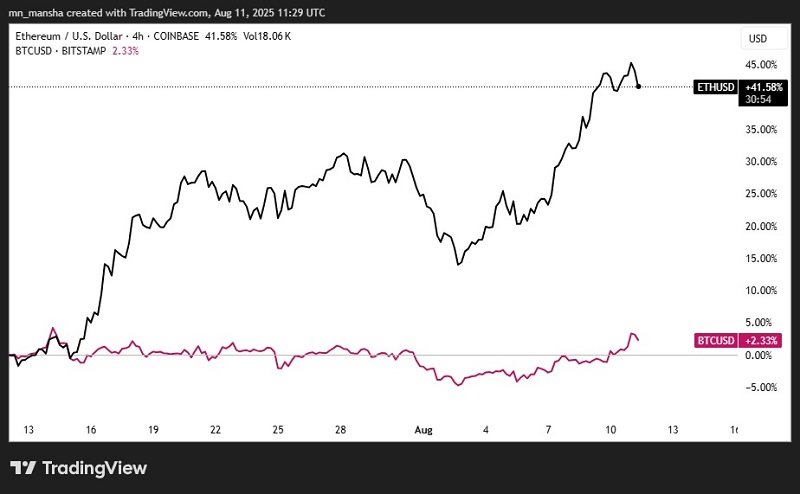

The Pectra upgrade is now active on Ethereum, and the market has reacted with clear strength. As of August 11, 2025, ETH has outperformed Bitcoin over the last 30 days. Bitcoin is up about 2.5% in that time, while ETH has gained more than 42%.

Lower friction for developers and users supports more on-chain activity, and recent data already reflects that change. Capital has also moved into ETH through funds and spot products, which adds a second layer of support. With these drivers in place, analysts now discuss higher targets for the months ahead and ask whether August can serve as the base for the next advance.

Spot Ethereum ETF flows by The Block sit near yearly highs. Several sessions posted net inflows that approached or exceeded $500 million. Persistent inflows of this size point to steady institutional demand rather than short bursts of speculation. Open interest and venue activity also remain firm, which strengthens the quality of the move.

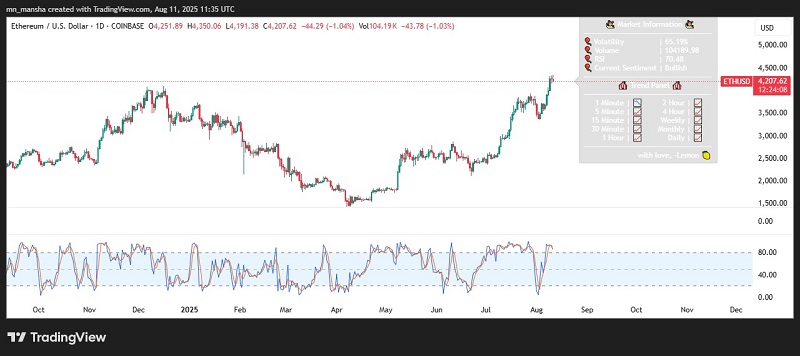

On the daily chart, ETH trades near the top of its yearly range after a clean advance from June levels. The RSI sits around 70. That level confirms strong demand, and it also warns that brief pauses can appear. The stochastic oscillator remains in its upper zone, with %K and %D close together near overbought territory. Momentum still favours buyers, while a short consolidation would be normal after such gains.

Volume has expanded alongside price. That alignment supports the view that committed buyers drove the trend. Combined with robust ETF inflows and a constructive structure of higher lows, the setup keeps the bias positive into late August 2025, while disciplined risk control near recent support remains sensible.

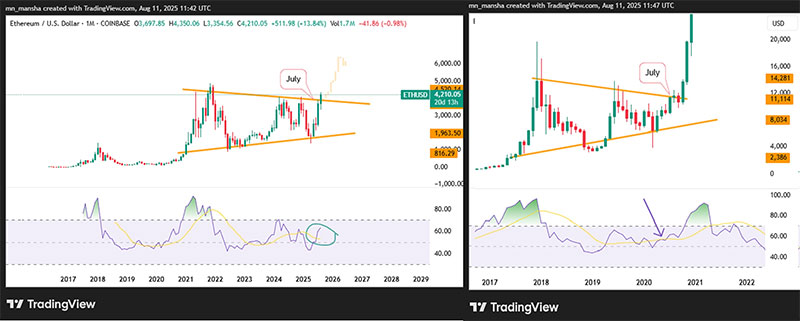

Ethereum’s monthly chart now resembles Bitcoin’s structure before its 2020 advance. Bitcoin broke from a long consolidation in July 2020 and then moved toward new highs. Ethereum printed a similar breakout in July 2025. Price cleared a multi-year diagonal cap after a sequence of higher lows. This combination often marks the early stage of a trend that can extend for several months.

The parallel with Bitcoin’s past breakout does not guarantee equal magnitude, yet it lifts the probability that ETH can challenge levels well above its prior peak.

Ethereum’s market capitalization is close to $500 billion today. A price of $12,000 requires a market value near $1.5 trillion, which means a threefold increase from the current level. Such growth demands consistent inflows from institutions and retail participants over an extended period.

Ethereum holds about 12.7% market dominance, while Bitcoin controls nearly 60%. If ETH were to receive an additional 200% inflow while maintaining its current dominance, its market capitalization would approach $1.5 trillion.

This level of valuation is highly optimistic and would require sustained institutional interest, consistent ETF inflows, and continued network growth without significant market pullbacks.

Despite these hurdles, Ethereum’s price prediction for August 2025 remains bullish. Technical patterns, ETF inflows, and market sentiment all suggest that Ethereum is positioned to reclaim its previous all-time high and potentially set new records. The breakout structure that mirrors Bitcoin’s 2020 surge adds further weight to the bullish case, making ETH one of the most closely watched assets in the market right now.

Search

RECENT PRESS RELEASES

Related Post