Ethereum at a Tipping Point: How Likely Is a Sub-$4,000 Slide?

October 10, 2025

As sentiment across the broader crypto market cools, leading altcoin Ethereum has fallen below the crucial $4,426 support level.

With bullish momentum slowing marketwide, ETH could slip below the $4,000 mark, further testing traders’ confidence.

SponsoredSponsored

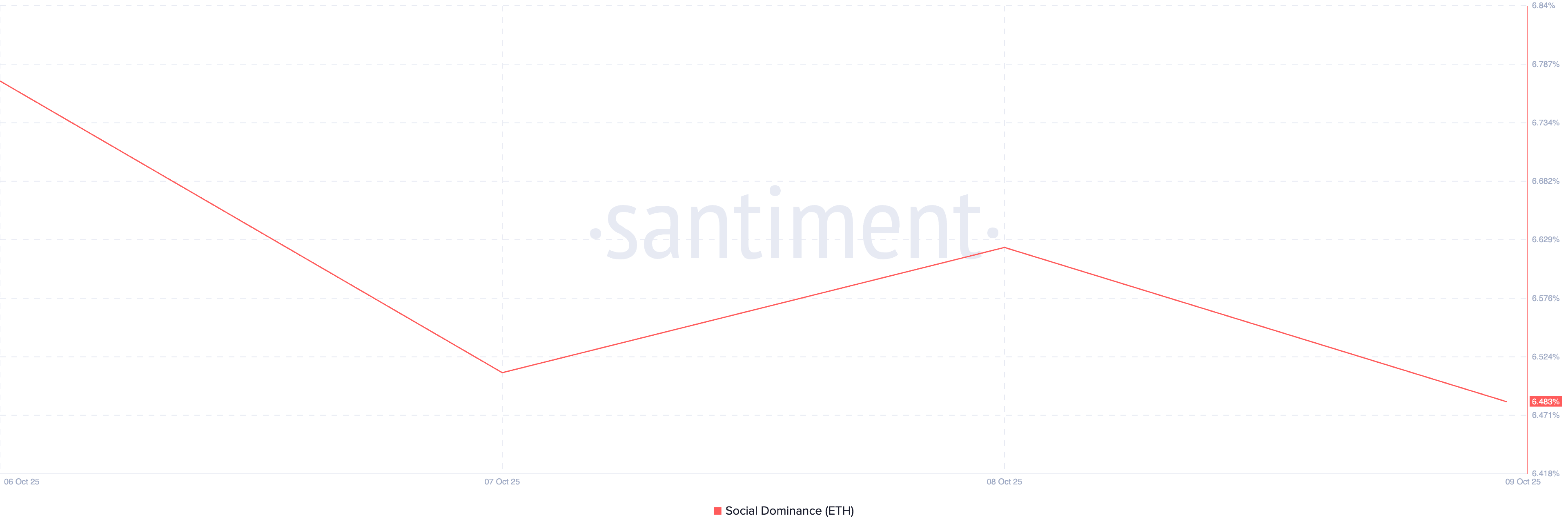

ETH’s price decline since the beginning of the week has triggered a lackluster attitude toward it from investors, and this is reflected by the dip in its social dominance since then. According to Santiment, this metric currently stands at 6.48%, down by 5% in the past five days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

An asset’s social dominance measures its share of online discussions compared to the total conversations around the top 100 cryptocurrencies by market capitalization.

When it surges, discussions about the asset in question suddenly become a much more significant part of the overall crypto market chatter than before.

However, when it falls and is accompanied by falling prices like this, it signals that trader interest is fading, and speculative attention is shifting elsewhere. Declining visibility often leads to reduced demand, further weighing on ETH’s price performance.

SponsoredSponsored

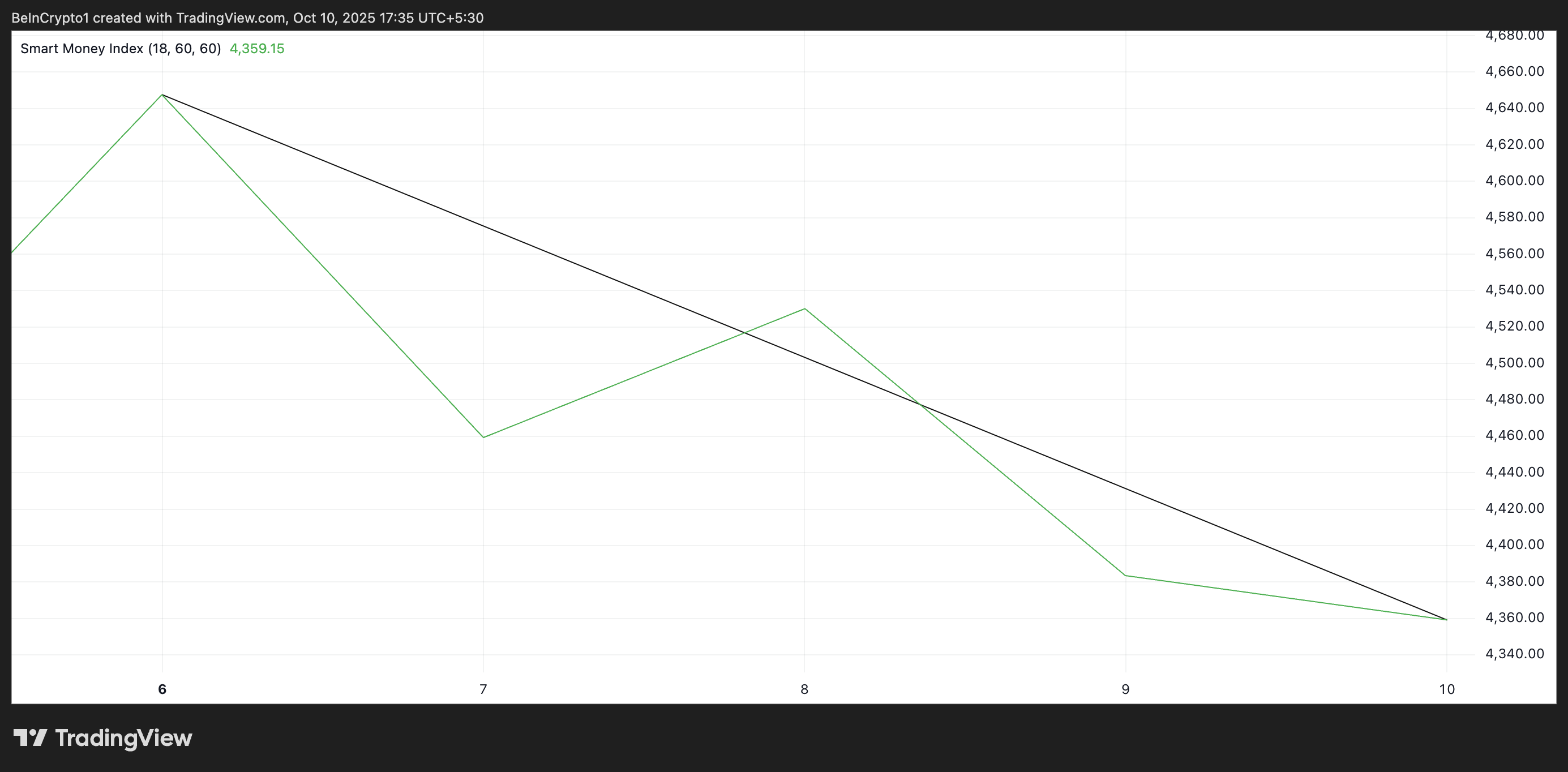

Furthermore, readings from the ETH/USD one-day chart confirm the decrease in the coin’s Smart Money Index (SMI) since Monday. At 4,359 at press time, this indicator has since fallen by 6%.

Smart money refers to capital controlled by institutional investors or experienced traders who understand market trends and timing more deeply. The SMI tracks the behavior of these investors by analyzing intraday price movements. A rising SMI indicates that smart money is accumulating an asset, often ahead of major price moves.

Conversely, when it dips like this, these key investors are taking profits, possibly in anticipation of a short-term correction. If this trend continues, it could worsen the bearish pressure on ETH, particularly as retail sentiment and social activity also wane.

When both smart money exits the market and broader coin demand falls, it usually precedes a period of consolidation or decline. This means ETH could establish a sideways trend or fall toward $4,211.

Should this support level fail to hold, the altcoin risks plunging under $4,000 to trade at $3,875.

However, if demand returns to the market, it could drive ETH’s price back above $4,426 toward $4,742.

Search

RECENT PRESS RELEASES

Related Post