Ethereum Breaks Below $4,000—Is This The Start Or The Shakeout?

October 31, 2025

November is almost here — and so is the debate over what lies ahead for the world’s second-largest cryptocurrency. Experts remain divided on Ethereum’s trajectory, leaving the market with a pivotal dilemma: is shorting ETH a wise move or a risky bet?

Recent research and the performance of exchange-traded funds suggest caution. However, on-chain and derivatives data paint a different picture.

Why Some Analysts Recommend Shorting Ethereum

10x Research positions Ethereum as a better hedge than Bitcoin for short sellers in the current climate. Their analysis, shared amid ETH’s recent slide to below $4,000, highlights a major weakness that could likely amplify downside risks.

The bearish thesis centers on Ethereum’s eroding “digital treasury” narrative, once a magnet for institutional capital. This model, exemplified by BitMine’s strategy of accumulating ETH at cost and offloading it to retail at premiums, fueled a self-reinforcing cycle throughout the summer. However, 10x Research claimed that the loop has fractured.

“Market narratives don’t die with headlines — they die in silence, when new capital stops believing. Ethereum’s institutional treasury story convinced many, but the bid behind it wasn’t what it seemed. Institutional options positioning is quietly choosing a side, even as retail looks the other way,” the post read.

Additionally, spot ETFs have been experiencing significant outflows. Data from SoSoValue showed that the ETH ETFs recorded outflows of $311.8 million and $243.9 million in the third and fourth weeks of October, respectively.

“ETH ETF outflow of $184,200,000 yesterday. BlackRock sold $118,000,000 in Ethereum,” analyst Ted Pillows added.

From a technical standpoint, an analyst pointed out that ETH is forming a bearish crossover. This is a technical analysis signal indicating a potential downward trend. He noted that the last time this pattern emerged, Ethereum’s price fell from about $3,800 to $1,400.

Bearish Sentiment Meets Bullish Data: Can Ethereum Rebound in November?

However, not all signals align with the bearish outlook. Some suggest a potential rebound for Ethereum in November.

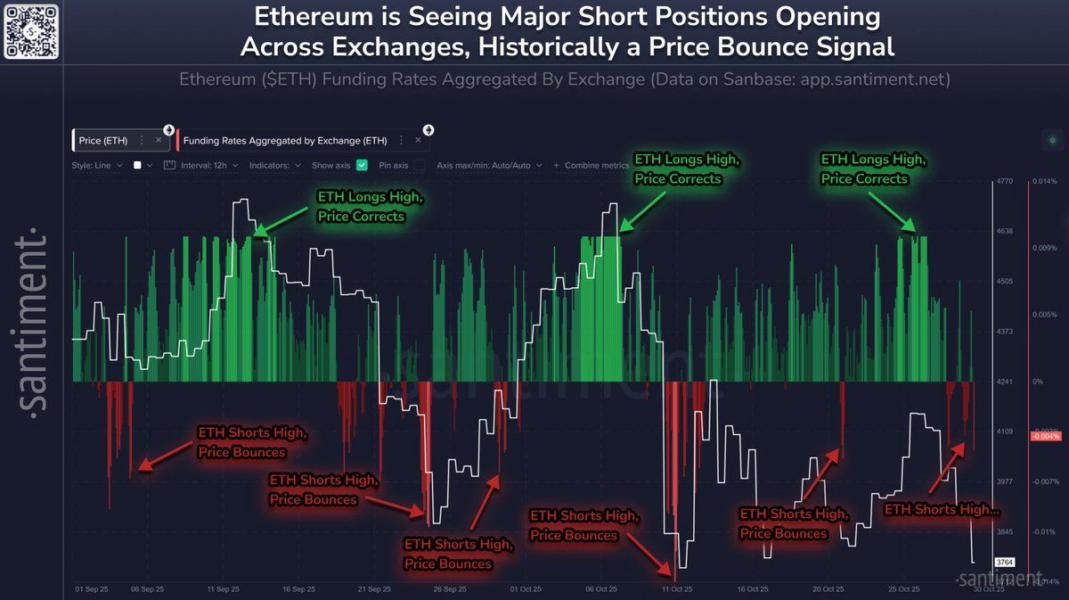

Santiment noted that as Ethereum slipped to $3,700, traders began opening short positions once again — a behavior that, paradoxically, precedes a price rally. The post emphasized that over the last two months, funding rates across exchanges have become a key indicator of where ETH might head next.

When funding rates turn positive, signaling that long positions dominate, prices often correct as excessive optimism builds up. Conversely, when shorts prevail and funding rates turn negative, the likelihood of a rebound increases.

“When major longs dominate (greed), prices correct. When major shorts dominate, there’s a high probability of a bounce.” Santiment highlighted.

Another analyst noted that the Ethereum “Ecosystem Daily Activity Index” has reached a record high, signaling strong network engagement.

This surge in on-chain activity provides a solid fundamental foundation for Ethereum, suggesting that the market’s strength is being driven by genuine user growth rather than speculation.

“This high level of participation has the potential to provide strong support for further price appreciation in the future.,” CryptoOnchain stated.

Thus, Ethereum’s outlook heading into November remains finely balanced. On one hand, institutional dynamics, ETF outflows, and bearish technical patterns suggest caution. On the other hand, strengthening on-chain activity and derivatives data point to growing user engagement and potential recovery.

Whether ETH extends its decline or stages a rebound may ultimately depend on which force proves stronger in the weeks ahead.

Search

RECENT PRESS RELEASES

Related Post