Ethereum drops below its Realized Price after 2 years: What now?

March 12, 2025

- ETH has declined by 29% over the past month.

- Ethereum dips below its Realized Price as bearish sentiments persist.

Over the past day, Ethereum [ETH] has experienced strong downward pressure, dropping to reach the October 2023 level of $1754.

However, since then, the altcoin has made a moderate recovery to reach $1876 as of this writing. This marked a 29.01% decline over the past months.

As ETH declined, it dropped below its realized price for the first time in two years. This decline suggests that average investors are now holding ETH on unrealized loss.

Ethereum’s drop to this level risks capitulation, as long-term holders start to panic sell fearing further decline.

Equally, the drop suggests that ETH is experiencing extreme bearish sentiment, with investors continuing to sell, leading to strong downward pressure.

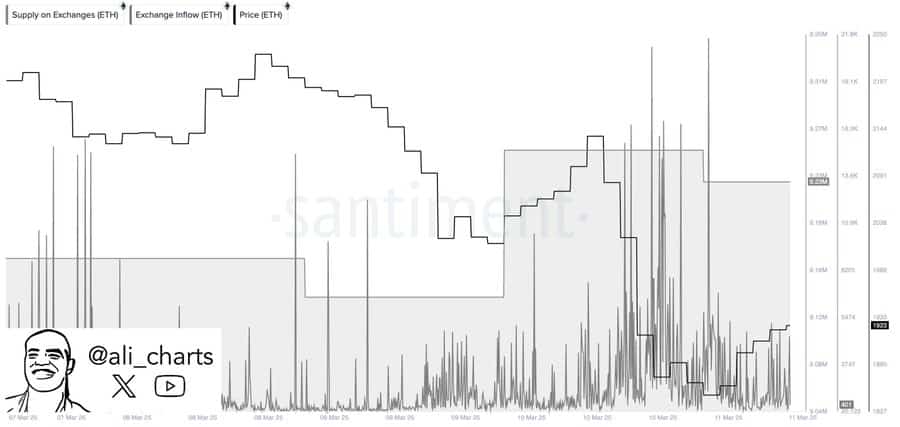

Looking at exchange flows, it seems this dip arises from significant selling activity. As such, over the past two days, ETH has recorded positive exchange inflows with over 100k ETH tokens sent to exchanges.

This suggests that investors have been actively selling the altcoin to cut their losses.

As such, the markets have recorded two consecutive days of positive exchange netflow. When this turns positive, it suggests that there are more inflows to exchanges than withdrawals reflecting strong bearish sentiments.

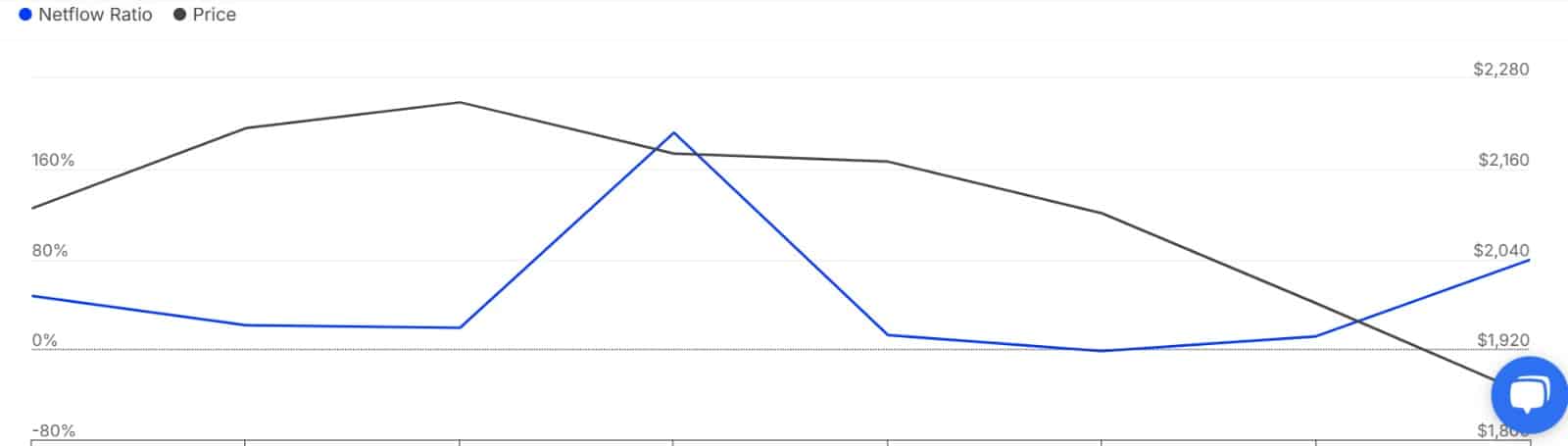

This sentiment is also highly prevalent among whales. In fact, Ethereum’s Large Holders Netflow to Exchange Netflow Ratio has surged over the past day to hit 79%.

Such a huge spike suggests that whales are actively sending their holdings to exchanges in preparation to sell.

When whale exchange inflow rises, it implies a lack of market confidence where long-term large holders are fearing more losses.

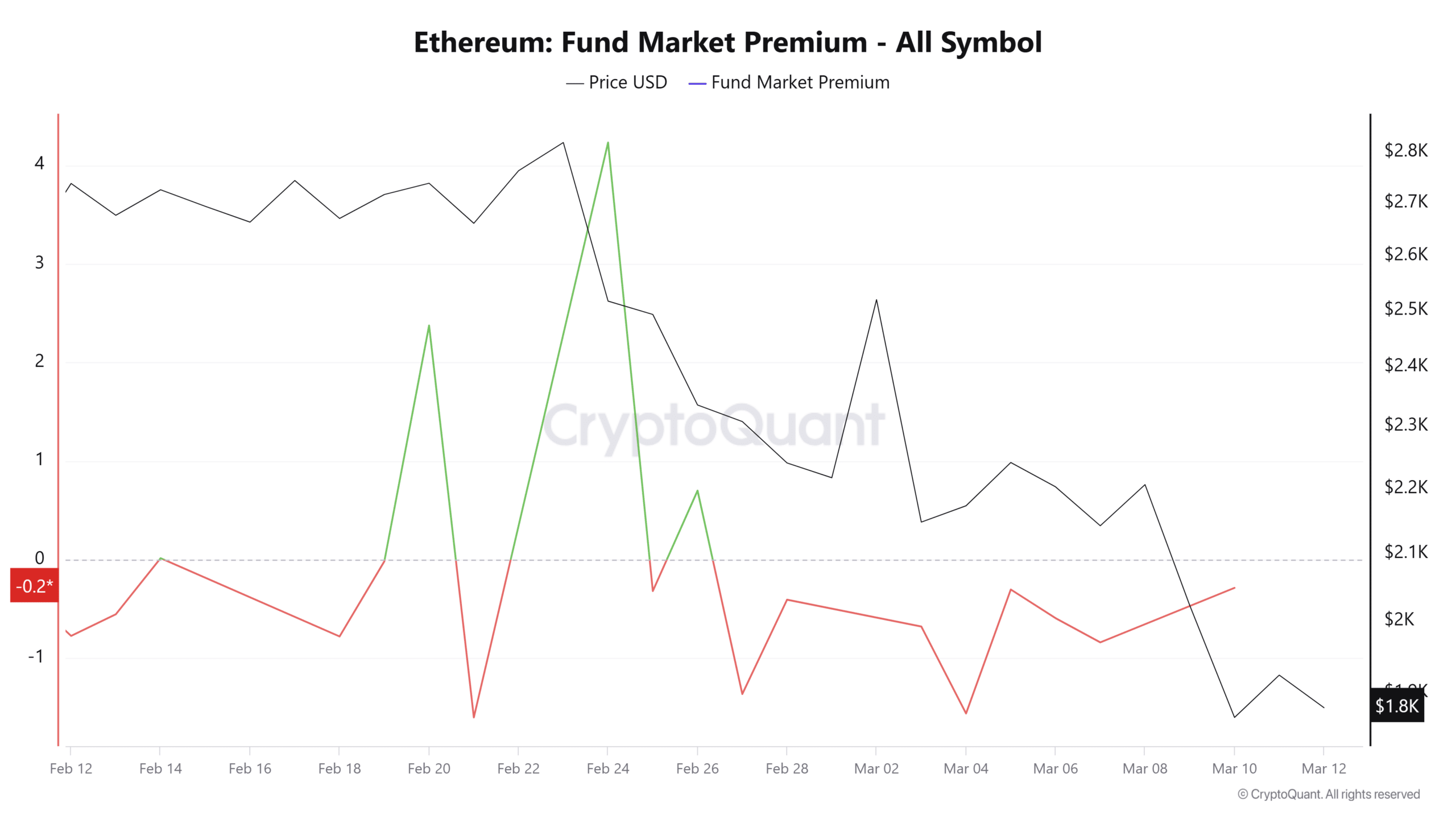

Finally, Ethereum’s fund market premium has remained negative for a sustained period. Investors have remained bearish, and there’s a low institutional or whale demand for ETH.

Thus, markets are seeing a risk-off sentiment.

The current market conditions position ETH for more losses on its price charts unless positive events bring speculative demand for a rebound.

However, when prices drop below realized price, it offers a perfect buying opportunity and has historically offered significant returns.

Thus, with strong bearish sentiments holding in the market, ETH must reclaim $2058 which is the realized price for a potential upside reversal. Failure to reclaim this level, the next support for the altcoin is $1440.

Search

RECENT PRESS RELEASES

Related Post