Ethereum Drops Below Key MVRV Band as Exchange Reserves Hit Multi-Year Low

April 20, 2025

- ETH dips below the 0.8x MVRV band, a zone tied to past market bottoms since 2019.

- Exchange reserves fall 33% from 2022, hitting a low of 18.9M ETH across all platforms.

- ETH trades near key support in a rising channel, mirroring 2022 and early 2023 setups.

Ethereum (ETH) is trading near $1,610, slipping below a key on-chain valuation threshold. The asset has entered a historically oversold zone while exchange reserves continue to decline. Analysts suggest this combination signals a re-accumulation phase that could set the stage for a larger breakout.

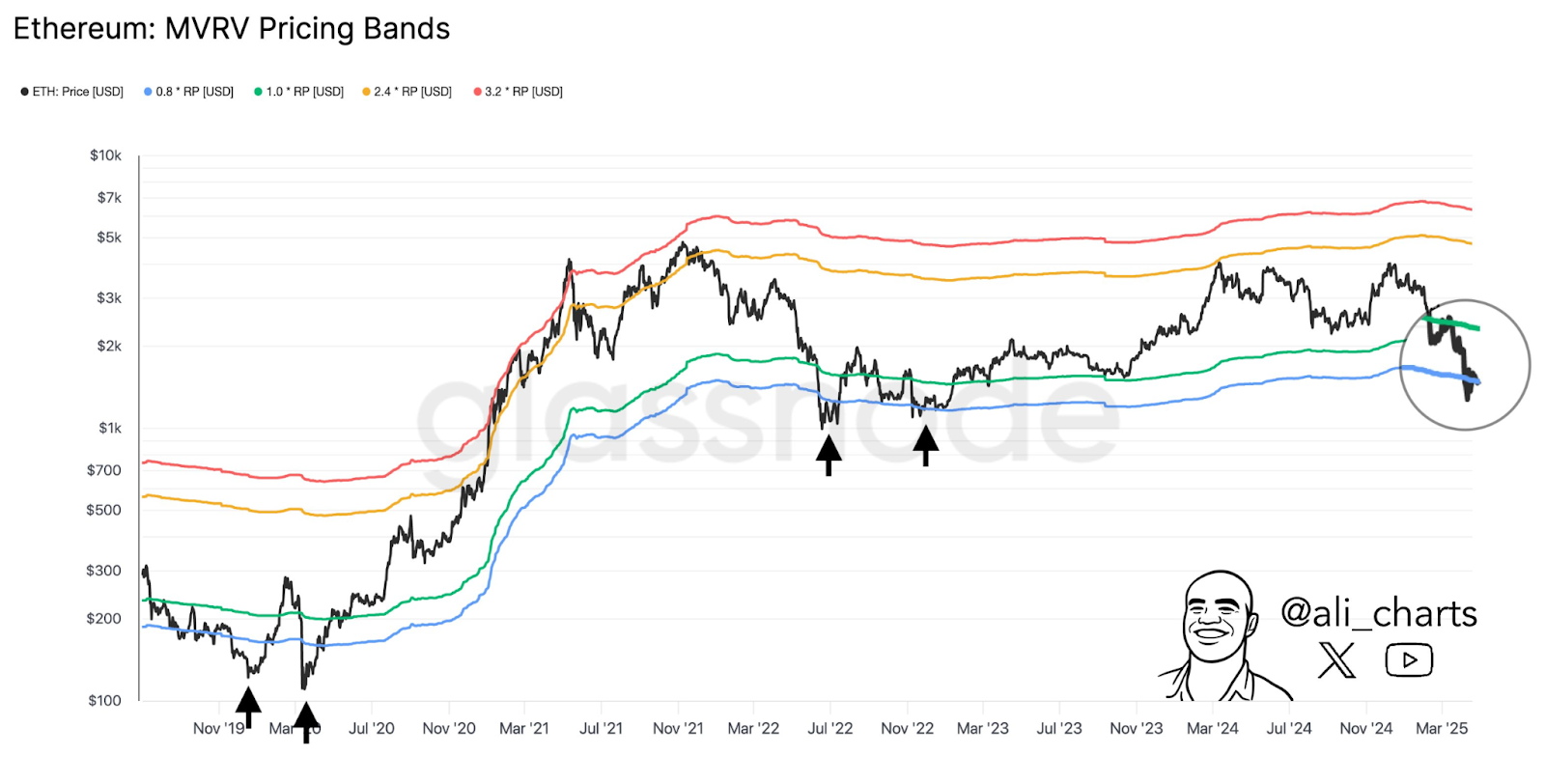

Ethereum (ETH) has dropped below a major on-chain support level called the MVRV Pricing Band. Glassnode tracks this metric, which measures market value to realized value. Historically, it has aligned with market bottoms when the price falls below the 0.8x band.

ETH is currently trading below the 0.8x MVRV band, around $1,610 at the time of the latest reading. This is a position that has only happened a few times since 2019, including the March 2020 crash and the June 2022 cycle bottom. In those past cases, price recoveries came within a few weeks or months.

According to this metric, Ethereum could be at a deep value point compared to the average price that current holders bought their tokens at. The data proves that many holders are now in an unrealized loss position. These periods have historically triggered new accumulation phases by long-term investors.

Technical indicators mirror past accumulation patterns. A MACD-style momentum oscillator shows multiple low cycles aligning with earlier bottom formations. These setups—seen in 2019 and 2020—preceded major upward moves.

The upper chart is divided into two phases: Accumulation and Re-Accumulation. For over a year, the current price range has been from $1,200 to $4,000. Technical support is now forming near $1,500, at the bottom edge of this zone where Ethereum’s price has now dropped.

It is similar to the cycle seen between 2019 and 2020. Prices moved sideways during that time and rallied in late 2020. If the current setup continues, ETH could be on the rise in the coming months. This also fits with the broader market trends and macro investor behaviour where long periods of low volatility often precede big moves.

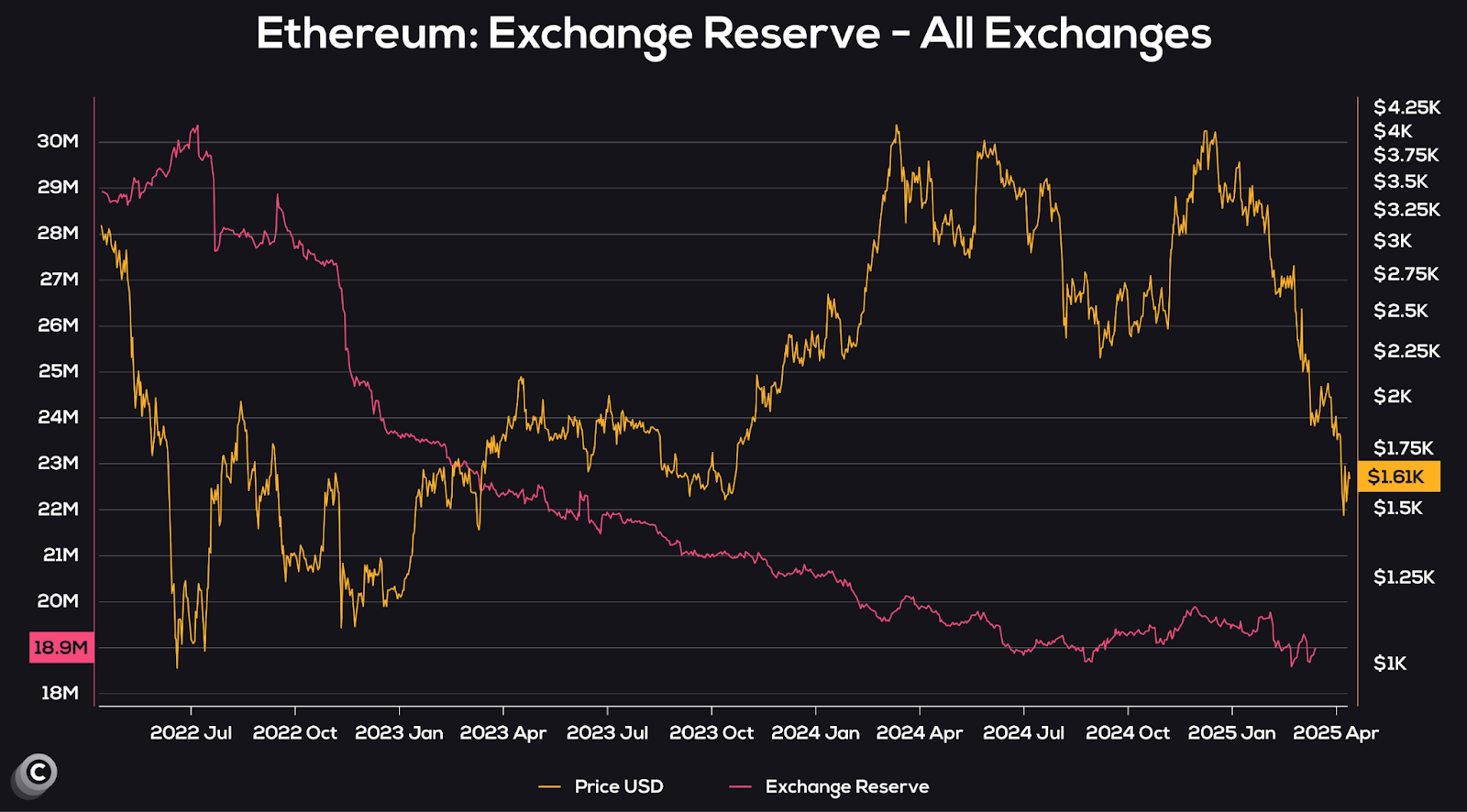

According to data from Coinvo, Ethereum’s exchange reserves have plummeted. The total ETH held on exchanges has declined from over 28 million to 18.9 million since mid-2022. In less than two years, this is a 33% decrease, which means more holders are opting for self-custody.

A fall in exchange balances generally means that investors are not keen on selling. Rather, they could be moving tokens to long-term storage or staking contracts. The reduction in the supply available for trading can ease short-term selling pressure.

ETH’s price, meanwhile, has dropped to $1,610 from highs of over $4,000 in early 2024. However, exchange outflows have continued, indicating that investor confidence is still there. The combination of lower prices and reduced supply could lead to a stronger recovery once demand comes back.

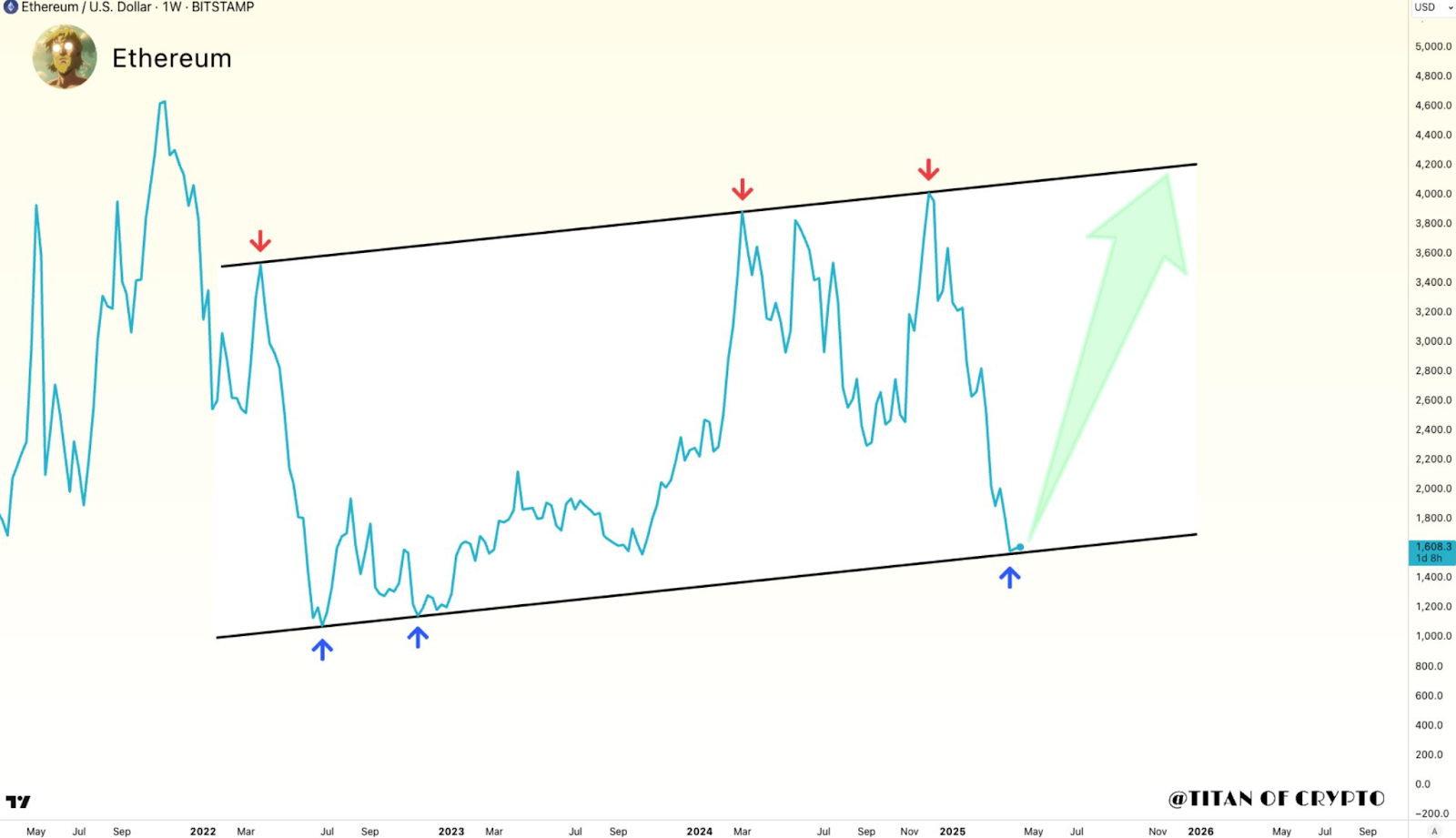

Furthermore, as per a long-term chart shared by Titan of Crypto, Ethereum has been trading inside an ascending channel since 2022. This chart is a weekly timeframe chart, where we can see repeated touches of both upper and lower trend lines.

The channel is now near the lower boundary of the channel. When the price hits this support zone the last two times, it bounced strongly. The current position could again be a launch point for a rally based on the pattern.

The chart also includes red and blue arrows indicating past tops and bottoms. The blue arrow at the current moment could be a turning point. A bounce from this level could take the upper boundary at $4,000, pending volume and broader market support.

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Search

RECENT PRESS RELEASES

Related Post