Ethereum Drops Below Realized Price for First Time in Two Years

March 12, 2025

Ethereum Drops Below Realized Price for First Time in Two Years

Home Altcoins News Ethereum Drops Below Realized Price for First Time in Two Years

Ethereum Drops Below Realized Price for First Time in Two Years

Steven Anderson

March 12, 2025

Ethereum (ETH) has experienced significant downward pressure, dropping below its Realized Price for the first time in two years. This drop comes after a 29% decline in the past month, highlighting the persistent bearish sentiment surrounding the cryptocurrency. As ETH dipped to $1,754, the same level it reached back in October 2023, investors and analysts are beginning to assess the potential consequences of this price drop.

However, since reaching this low, Ethereum has shown some signs of recovery, bouncing back to $1,876 as of this writing. Despite the moderate recovery, the decline is still significant, and the cryptocurrency remains under intense pressure. This article explores the factors contributing to Ethereum’s recent price movements, the implications of dropping below its Realized Price, and what investors might expect in the coming weeks.

What Does Ethereum’s Drop Below Realized Price Mean?

Ethereum’s drop below its Realized Price marks a crucial moment in the market. The Realized Price is the average price at which all coins were last moved on the blockchain. It serves as a crucial metric for understanding the overall health of the market and provides insight into whether investors are holding profits or losses.

When the price of ETH falls below its Realized Price, it suggests that the majority of holders are now at a loss. For the first time in two years, Ethereum has reached this level, signaling extreme bearish sentiment across the market. This situation often results in a wave of panic selling, as investors who are holding on to their ETH for long-term gains might start to capitulate, fearing further losses.

This scenario can lead to even more selling pressure, further exacerbating the downward trend and creating a vicious cycle of losses.

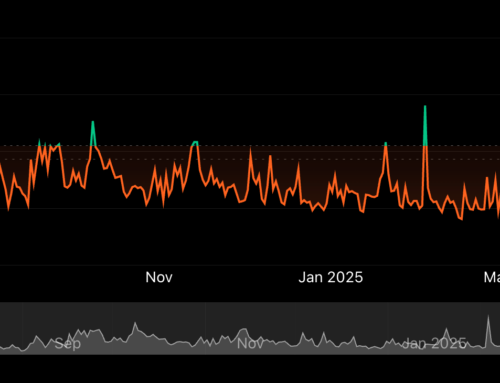

Exchange Flows Show Growing Bearish Sentiment

One of the most telling signs of Ethereum’s bearish momentum comes from its exchange flows. Over the past two days, Ethereum has experienced a surge in exchange inflows, with more than 100,000 ETH being sent to exchanges. This indicates that many investors are actively selling their holdings to cut their losses, further contributing to downward pressure.

The exchange netflow ratio, which measures the difference between inflows and outflows to exchanges, has also turned positive. This suggests that the current market sentiment is predominantly bearish, as more Ethereum is being deposited into exchanges than withdrawn. Such behavior is typical in a market where investors lack confidence in price recovery and are instead preparing to sell off their assets.

Moreover, the Large Holders Netflow to Exchange Netflow Ratio has surged to 79%, signaling that whales (large Ethereum holders) are also sending their ETH to exchanges. This surge in whale inflows highlights a lack of confidence among long-term holders, with many fearing that ETH could face further price declines.

The Impact of Negative Fund Market Premium

Ethereum’s fund market premium has remained negative for an extended period, reinforcing the bearish sentiment that has overtaken the market. The fund market premium is an indicator of institutional and whale demand for Ethereum, and its negative reading shows that these investors have not shown much interest in ETH at current levels.

As a result, there is a clear risk-off sentiment in the markets, with investors preferring to stay on the sidelines rather than betting on a potential rebound in Ethereum’s price. This negative sentiment has further compounded Ethereum’s price struggles and suggests that a broader market recovery may be required for ETH to regain upward momentum.

What’s Next for Ethereum?

Given the current market conditions, Ethereum is facing further risk of price declines. Unless positive news or events trigger renewed demand and speculation in the market, ETH could continue to experience downward pressure.

However, historically, when an asset drops below its Realized Price, it often presents a buying opportunity for long-term investors. This pattern suggests that Ethereum could be poised for a rebound if it manages to reclaim key price levels in the coming weeks. The Realized Price for ETH currently stands at $2,058, and if Ethereum can reclaim this level, it could signal the start of a bullish reversal.

On the other hand, if Ethereum fails to reclaim the $2,058 level and continues to struggle, the next major support level for ETH is around $1,440. Should the price fall to this level, it could prompt further selling and potentially lead to more losses in the short term.

Conclusion

Ethereum’s drop below its Realized Price signals a significant shift in market sentiment, with bearish trends dominating the landscape. The surge in exchange inflows, growing whale activity, and the negative fund market premium all point to a lack of confidence in Ethereum’s immediate price recovery. While there remains the possibility for a rebound if ETH reclaims key levels, the market will continue to closely watch Ethereum’s movements in the coming weeks to assess whether it can overcome the current bearish trend.

Post Views: 2

Crypto newsletter

Get the latest Crypto & Blockchain News in your inbox.

Search

RECENT PRESS RELEASES

Related Post