Ethereum dumped hard in Q1 2025, underperforms Bitcoin and Solana: Here’s why

May 2, 2025

- Ethereum has seen a loss of nearly 50% in 2025, significantly underperforming Solana and Bitcoin.

- The underperformance stems from several factors, including Ethereum L2 centric roadmap, ETF inflows and institutional Bitcoin treasury strategy.

- ETH could flip the narrative with the recent Ethereum Foundation leadership restructuring and upcoming Pectra upgrade.

Ethereum’s (ETH) price growth has slowed over the past year, recording gains of 47% in 2024, far less than the 400% seen in the 2021 bull cycle. While Bitcoin and Solana raged to new highs, the top altcoin’s momentum weakened, dropping its dominance to 7% from 19% in 2024. The underperformance accelerated in 2025 following the general crypto market crash, which pushed ETH to record losses of 47% since the beginning of the year.

This follows the ETH/BTC ratio plunging to all-time lows while SOL/ETH rallied to new all-time highs. The top altcoin’s underperformance of Solana and Bitcoin stems from several developments in the crypto market over the past year.

ETH/BTC & SOL/ETH

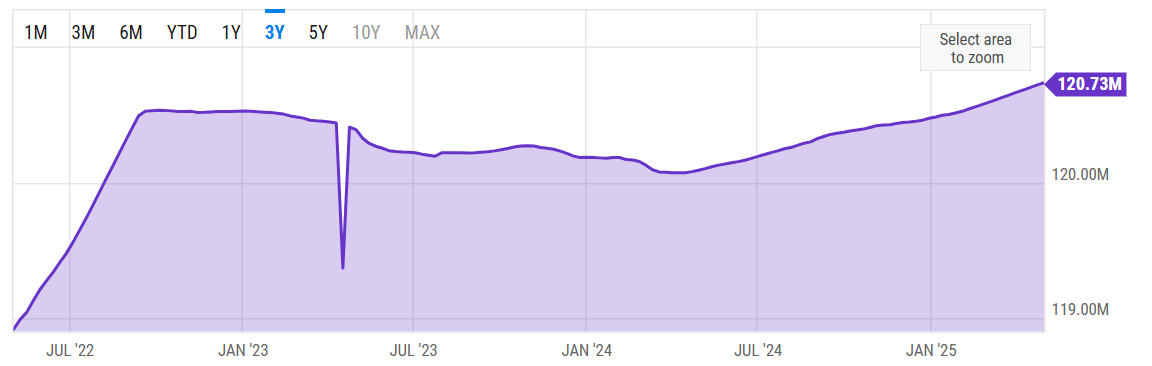

Since the Ethereum Dencun upgrade in March 2024, which introduced blobspace for storing L2 transactions, ETH value accrual and “ultrasound money narrative” have suffered. While blobspace boosted throughput and reduced L2 transaction fees, it triggered a reduction in Ethereum’s revenue and burn rate — a core feature of its value accrual thesis. As a result, ETH supply growth turned inflationary again, rising by over 730K ETH since April 2024.

ETH supply growth. Source: YCHARTS

The rising supply growth and reduced demand have weighed heavily on ETH’s price.

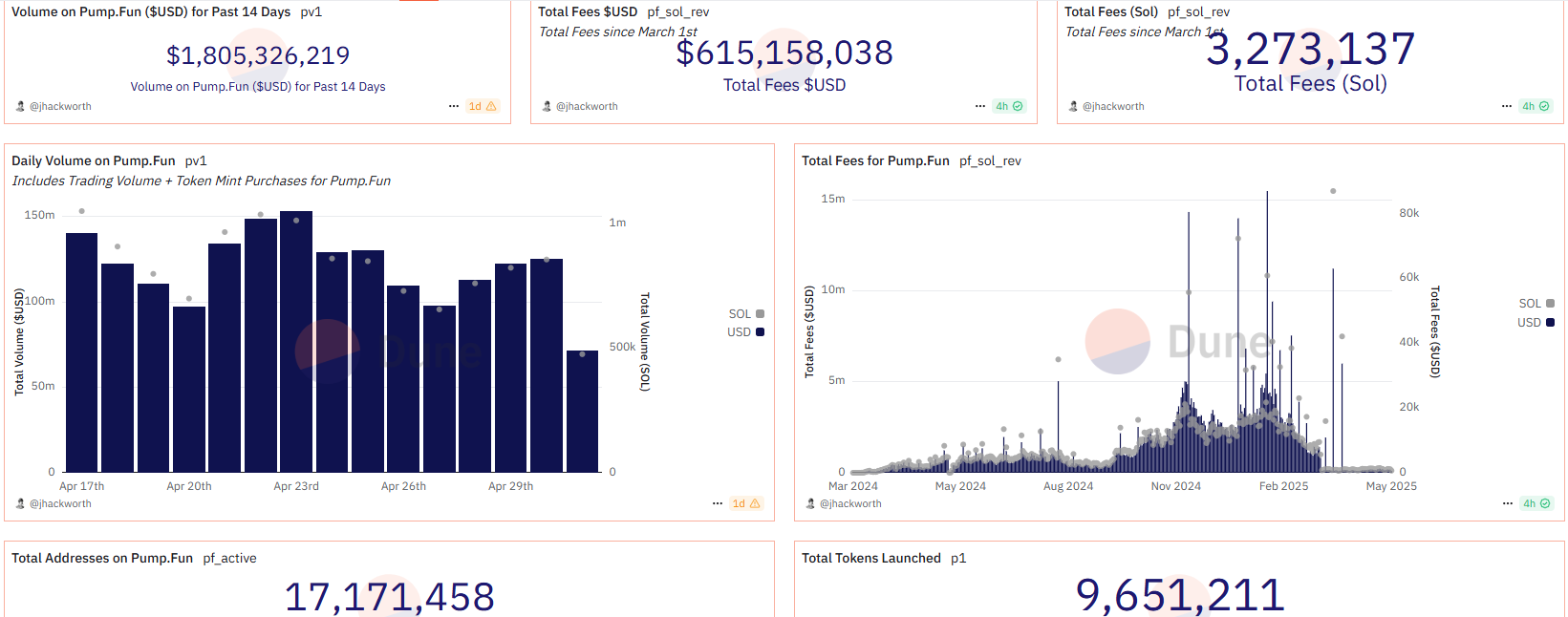

While ETH’s revenue plunged, Solana’s surged, propelled largely by meme coin trading. Since the debut of token launchpad Pumpfun in January 2024, over 17 million new addresses have joined Solana and launched more than 9.6 million tokens through the platform. The increased meme coin activity combined with volume from its top protocols saw Solana’s revenue and price outpacing Ethereum’s

Pumpfun key metrics. Source: Dune (@jhackworth)

US spot Bitcoin ETFs have sparked heavy institutional buying pressure into the top crypto, attracting record-breaking net inflows of $39.56 billion since launch, per SoSoValue data. The inflows are partly responsible for BTC’s 130% rise since 2024.

Compared to the heavy inflows in BTC ETFs, ETH ETFs’ cumulative inflows sit at $2.49 billion and haven’t shown much positive effect on Ether’s price.

One of the reasons for the inflow difference in both products stems from Bitcoin’s digital gold narrative rapidly gaining acceptance across the TradFi space. In contrast, ETH has no clear narrative among institutional investors yet.

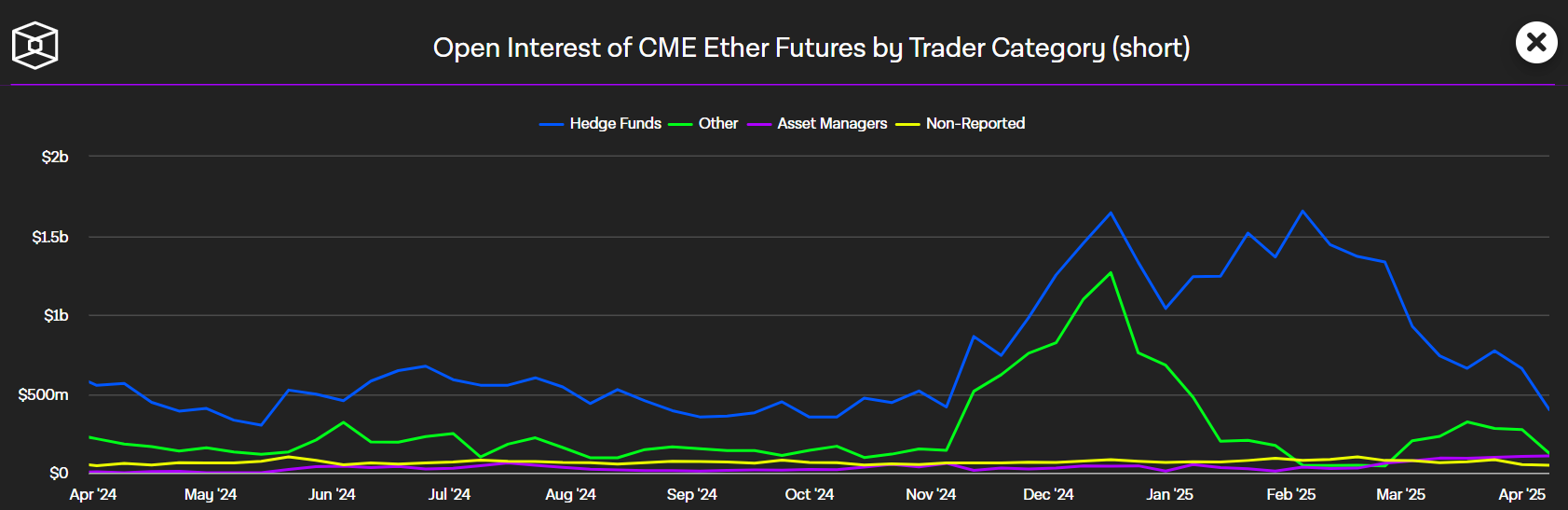

Additionally, a large percentage of the inflows into ETH ETFs in 2024 were used by hedge funds to initiate the ETH basis trade to earn yield from its high positive funding fees. Following the crypto market plunge in Q1 ’25, these short positions unwound, causing ETH to fall faster than Bitcoin and Solana.

ETH CME Futures Shorts OI. Source: The Block

Several publicly traded firms are increasingly adopting a Bitcoin treasury strategy, with Michael Saylor’s Strategy leading the way. The company holds 553,555 BTC — about 2% of Bitcoin supply — purchased at an average price of $37.9 billion. Strategy is also seeking to expand its Bitcoin holdings with an $84 billion offering in equity and debt.

In addition to Strategy, many other firms, including Metaplanet and Tesla, also hold Bitcoin in their treasuries. The buying pressure from these firms — and subsequent positive sentiment surrounding their purchase — has partly been responsible for keeping BTC’s price elevated.

Firms are gradually replicating a similar strategy with Solana, with DeFi Development Fund (formerly Janover) and Solana Strategies expanding their holdings and rebranding to show commitment toward a SOL treasury.

In contrast, the publicly traded firms holding ETH own a negligible amount of their supply and haven’t indicated a long-term commitment to expanding their holdings.

Ether has been the favored target of attackers lately, accounting for over 50% of stolen cryptocurrencies since 2024. Notably, the Bybit hack in February saw attackers stealing and dumping about $1.4 billion worth of ETH. This contributed to the rapid decline that ETH experienced in February.

Additionally, applications on the Ethereum chain saw a higher number of crypto hacks compared to other chains, per Immunefi data. As a result, ETH’s price has been the most affected by crypto hacks in the past year.

Following Ether’s underperformance and criticism from community members, the Ethereum Foundation (EF) is looking to initiate a turnaround by establishing a new leadership structure and reiterating its commitment to scaling and building Ethereum.

Ethereum developers will also introduce several features to the mainnet via the upcoming Pectra upgrade slated for May 7. These features will boost Ethereum’s scalability, privacy and, most importantly, user experience.

In addition, the launch of Ethrealize, spearheaded by Vivek Raman and Danny Ryan — who led Ethereum’s transition to POS — aims to change the narrative for Ethereum on the institutional level. The company is marketing Ethereum on Wall Street and is building Ethereum-based product suites for institutions.

Amid the latest development, the ETH/BTC ratio has shown signs of a bottom, and SOL/ETH is hinting at a price top after a slight recovery across crypto assets over the past two weeks.

Share:

Cryptos feed

Search

RECENT PRESS RELEASES

Related Post