Ethereum (ETH) Eyes $4,300 as Whales and Corporate Treasuries Continue to Expand

September 30, 2025

Key Notes

- Ether closes Q3 with over 68% return, eyeing the $4,300 resistance.

- Major wallets and corporate treasuries expand Ethereum holdings.

- Analysts hint at a potential year-end rally, with price targets above $5,700.

ETH

$4 150

24h volatility:

0.4%

Market cap:

$500.88 B

Vol. 24h:

$35.64 B

is steadily moving toward the critical $4,300 level, after recording a 2.2% daily gain on September 30. The world’s second-largest cryptocurrency is currently trading around $4,190, wrapping up the third quarter with a 68% return.

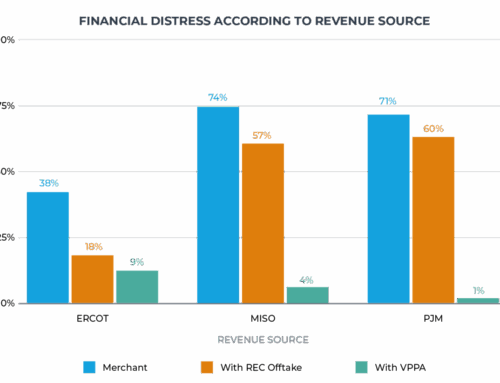

Recall Ethereum’s performance in 2020, when a similar strong Q3 close led to a 104% surge in Q4.

Ether quarterly returns | Source: CoinGlass

If a similar pattern plays out, ETH could climb past $8,000 before the end of the year, aligning with the bullish forecasts from several market bulls.

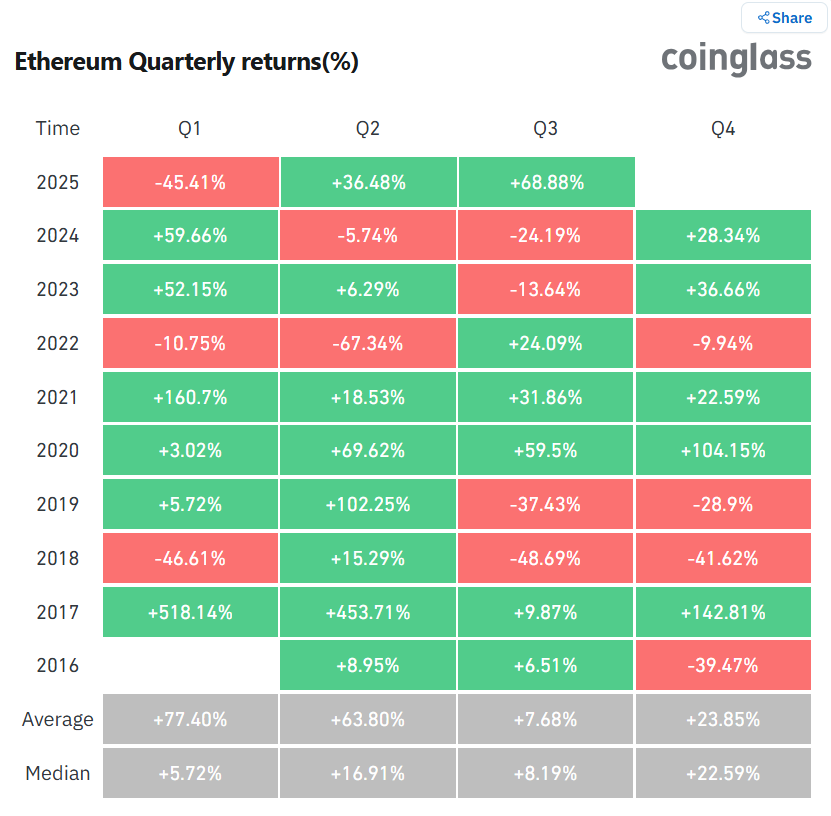

Notably, Ether saw a price dip to $3,850 on Sept. 25, but quickly rebounded. Analysts note that funding rates stayed negative through last week, a signal often linked with market bottoms.

Ethereum Funding Rates on all exchanges | Source: CryptoQuant

According to a CryptoQuant strategist, the funding rates are now turning positive, indicating that a breakout is near.

Large investors and institutions continue to accumulate ETH, making it one of the best crypto to buy right now. LookOnChain revealed that on September 30, a newly created wallet, likely linked to BitMine, acquired 25,369 ETH worth roughly $106.7 million.

BitMine had just announced that its total Ethereum treasury surpassed 2.65 million tokens.

Data confirms that another new wallet withdrew 4,985 ETH, valued at around $21 million, from exchange OKX on the same day.

These accumulations suggest that smart investors could be preparing for a possible price surge.

Related article: Ethereum Price to Hit $12,000-$15,000 Says BitMine’s Tom Lee Despite Recent Correction

Moreover, digital asset firm Bit Digital recently announced plans to raise $100 million through a convertible senior note offering. Net proceeds are primarily for Ether purchases, alongside broader business investments in crypto space.

Popular market analyst Donald Dean set a near-term price target of $5,766. He pointed to $4,300 as a critical “volume shelf,” a potential launch point for further upward movement.

If bullish momentum persists, Ethereum may soon test this level, leading to a stronger finish to 2025.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.

Search

RECENT PRESS RELEASES

Related Post