Ethereum (ETH) Price Prediction: ETH Eyes Massive Rally Beyond ATH as NasdaqBTC CEO Sees I

July 27, 2025

NasdaqBTCS CEO Charles Allen predicts ETH could hit $10,000 if institutional interest mirrors Bitcoin’s ETF rally, signaling a potential breakout to new all-time highs.

Ethereum Price Rally Gathers Pace Amid Institutional Frenzy

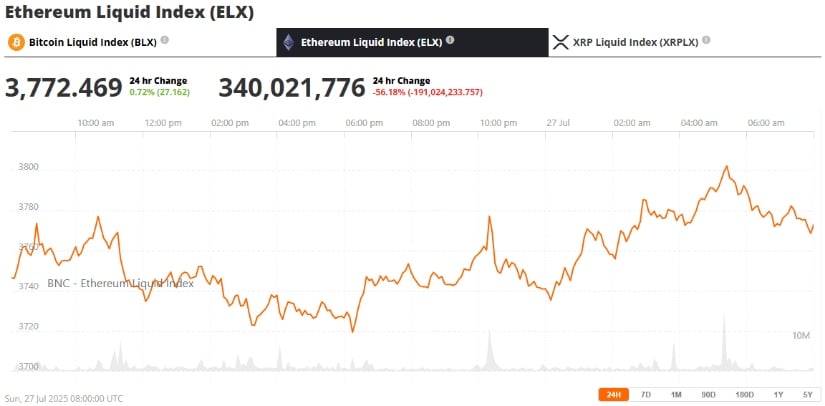

Ethereum has surged nearly 75% since late June, crossing above the critical $3,500 resistance and trading around $3,770 today. The rally comes on the back of accelerating spot Ethereum ETF inflows, a sharp spike in on-chain volume, and growing whale accumulation, all of which are fueling a bullish shift in market sentiment.

Ethereum could reach $10K this year if institutional investors back it like they did with Bitcoin. Source: Milk Road via X

Charles Allen, CEO of Nasdaq-listed blockchain firm NasdaqBTCS, recently predicted that Ethereum could reach $10,000 by the end of 2025—if institutional investment patterns replicate Bitcoin’s previous trajectory. “Ethereum hasn’t hit $10,000 yet,” Allen stated via MilkRoadDaily, “but key market participants are now advocating for ETH, and sentiment is shifting rapidly.”

Market Overview: Ethereum Technical Structure Signals Breakout

Ethereum’s price chart is currently flashing bullish signals. According to multiple analysts, the asset is breaking out of a 3.7-year descending trendline, while also forming a broadening wedge pattern on the weekly timeframe—often a precursor to explosive price moves.

ETH shows strong bullish momentum with 9 green candles, a brief pause, and a fresh push toward $4K. Source: IncomeSharks via X

Currently testing the upper resistance band near $3,779, Ethereum is approaching the psychological $4,000 level—a zone that historically acts as a launchpad for major breakouts. If ETH closes above this threshold with strong volume, a push toward the $4,800 target becomes technically viable, followed by a potential run toward new all-time highs (ATH) above $4,878.

“Ethereum is nearing the final consolidation before breakout,” noted analyst IncomeSharks on X, “The next phase could push us well beyond $4,000.”

ETF Inflows Hit Records, Spark Institutional Supply Shock

The most powerful driver of this rally is Ethereum ETF inflow momentum. In the last week alone, spot Ethereum ETFs attracted $2.4 billion, significantly outpacing Bitcoin ETFs, which brought in $827 million over the same period.

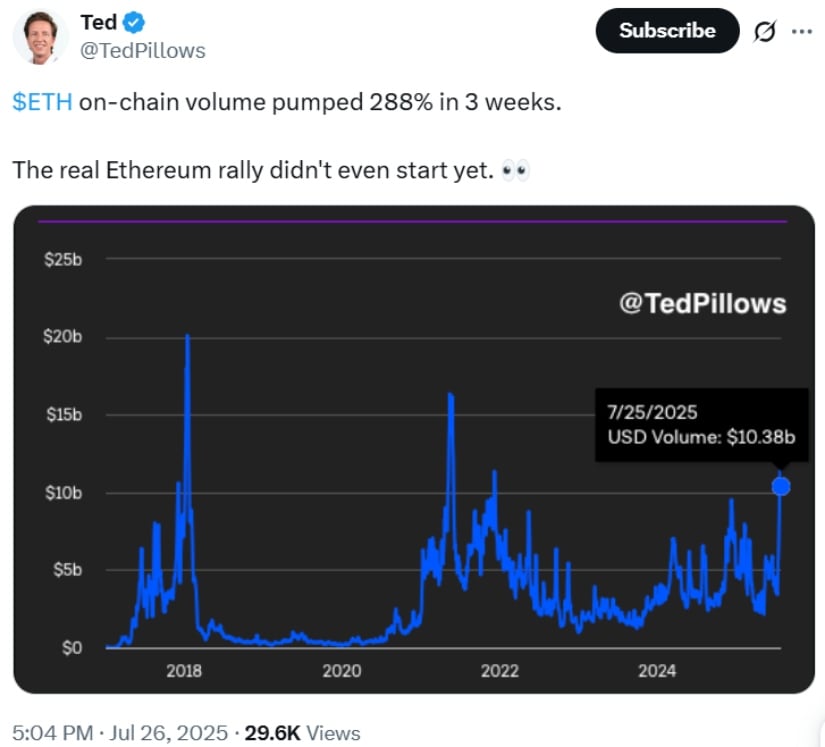

ETH on-chain volume surged sharply in weeks — the real Ethereum rally is just getting started. Source: @TedPillows via X

On July 25th, ETFs purchased 1.36 million ETH, while only 72,513 ETH were minted—effectively absorbing 18 months’ worth of new supply in just three weeks. This rare supply shock, paired with historic short positions on CME futures (reaching -13,236 contracts), is fueling aggressive short covering and sustained upward momentum.

According to analyst Ted Pillows, BlackRock’s ETHA ETF accounted for $440.1 million of inflows in a single day, with Fidelity’s FETH adding another $12.7 million. “This is the strongest institutional signal we’ve ever seen for Ethereum,” Pillows said. “And the real breakout hasn’t even started yet.”

Whale Accumulation Signals Smart Money Confidence

Supporting the institutional surge, on-chain data from Glassnode shows that over 170 new Ethereum whale addresses—each holding more than 10,000 ETH—have emerged since July 9th. This growth in “mega whale” addresses confirms that long-term players are positioning for a continued move higher.

Over the past month, 170 new whales holding more than 10,000 $ETH have joined the network, signaling rising institutional interest. Source: Ali via X

“Whales are buying the dip and loading up on Ethereum,” said analyst Ali Martinez. “Their activity aligns perfectly with ETF buying and hints at a broader accumulation phase that could support the next leg up.”

Additionally, Ethereum’s on-chain transaction volume has increased 288% in three weeks, now surpassing $10.38 billion, highlighting robust network activity and confidence in Ethereum’s mid-to-long-term trajectory.

Layer 2 Ecosystem and Network Activity Add Bullish Pressure

Ethereum’s fundamentals are also strengthening thanks to explosive growth across its Layer 2 ecosystem. Solutions like Arbitrum, Optimism, and zkSync are experiencing rising TVL (Total Value Locked) and transaction throughput, easing mainnet congestion and lowering gas fees.

According to recent data, Ethereum validator rewards have increased alongside these developments, encouraging more network participation and decentralization. The Dencun upgrade, expected later this year, is also projected to improve scalability and reduce gas costs further—making Ethereum more attractive for institutional and retail users alike.

Ethereum vs Bitcoin 2025: Could ETH Flip BTC?

As Ethereum’s price continues to rise, some analysts are revisiting the Ethereum vs Bitcoin narrative. With ETH outperforming BTC by over 4% last week, speculation is growing that Ethereum could challenge Bitcoin’s dominance by year-end.

one

ETH takes the spotlight as Galaxy Digital softens on Bitcoin, hinting at a shift in conviction. Source: @VORTEX_Promos via X

Galaxy Digital CEO Mike Novogratz weighed in during a recent CNBC interview: “I own both. But Ether feels destined to knock on the $4,000 ceiling several times. If it breaks out, it enters price discovery, and ETH could go mainstream.”

Ethereum Price Prediction: $10,000 Still in Sight?

While short-term resistance remains at $4,000, analysts suggest Ethereum’s next major milestone could be $4,500, followed by $5,000 as ETF inflows and whale activity compound. Technical indicators like Ethereum RSI today also show bullish momentum, while the Fear & Greed Index hovers around 71 (Greed), according to CoinCodex.

Ethereum breaks out of consolidation, reclaiming $3,500 as the launchpad for a potential wave 3 rally toward $9K–$10K. Source: Wavervanir_International_LLC on TradingView

In terms of long-term forecasts, Changelly expects ETH to hit $4,274 by August 2025, while CoinCodex projects a climb toward $6,184 by October—marking a 60%+ upside from current prices.

Final Thoughts: Ethereum’s Future Outlook Brightens

With Ethereum’s market cap nearing $400 billion, the blend of technical strength, institutional inflows, whale accumulation, and Layer 2 expansion paints a bullish picture. The $10,000 prediction by NasdaqBTCS CEO may seem ambitious, but the growing momentum suggests it’s within reach—especially if macro conditions remain favorable and ETF demand holds.

Ethereum (ETH) has been trading at around $3,772, up 0.72% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

For now, Ethereum traders are eyeing a weekly close above $4,000 as the next critical milestone. If successful, it could open the door to new price discovery—and possibly a historic breakout for the world’s second-largest cryptocurrency.

Search

RECENT PRESS RELEASES

Related Post