Ethereum (ETH) Price Prediction: ETH Flips $4K Into Support as Short Squeeze Fuels Bullish

September 27, 2025

Ethereum (ETH) surged above the $4,000 level, turning a long-standing resistance into support and signaling potential bullish momentum toward $7,000.

The recovery follows a week of high volatility, profit-taking, and liquidation events that erased billions from the derivatives market. Analysts now see $4,000 as a pivotal support zone, where whale accumulation, institutional flows, and technical retests could determine Ethereum’s next move.

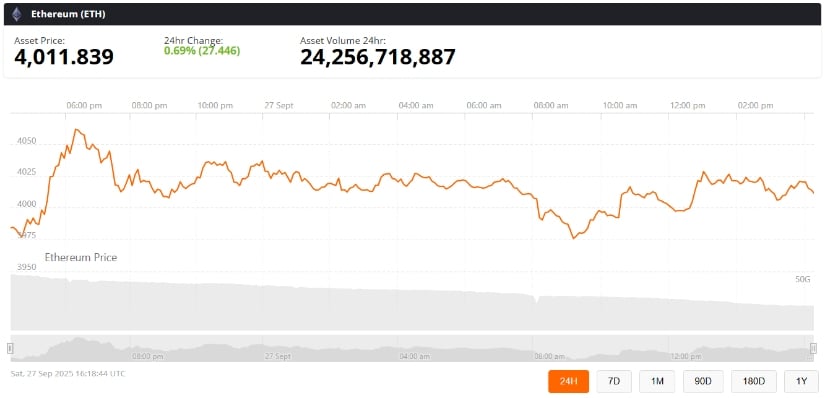

Ethereum Price Today: ETH Flips $4K Into Support

Ethereum (ETH) is trading at $4,011.84, up 0.69% in the past 24 hours, according to Brave New Coin. The recovery above the $4,000 psychological threshold marks a key turning point after a volatile week of profit-taking and large liquidations that erased billions in open interest across major exchanges.

Ethereum flips the $4K resistance into support, signaling a bullish retest and potential upward momentum during the ongoing bull run. Source: @cas_abbe via X

For years, the $4,000 zone acted as a strong resistance level. Analysts now note that ETH has successfully flipped this barrier into support, a development widely viewed as bullish during sustained uptrends.

“A bullish retest is never a bad thing during a bull run,” said crypto analyst Cas Abbé. “For years, the $4K region has been crucial resistance, and now ETH has flipped this into support.”

Such flips are uncommon. A 2022 Journal of Financial Markets study found that only around 3% of assets in bull markets manage to turn major resistance levels into support. Additionally, a 2023 TradingView analysis showed that 60% of successful retests were followed by a 10–15% price surge, emphasizing the potential upside if ETH maintains this support.

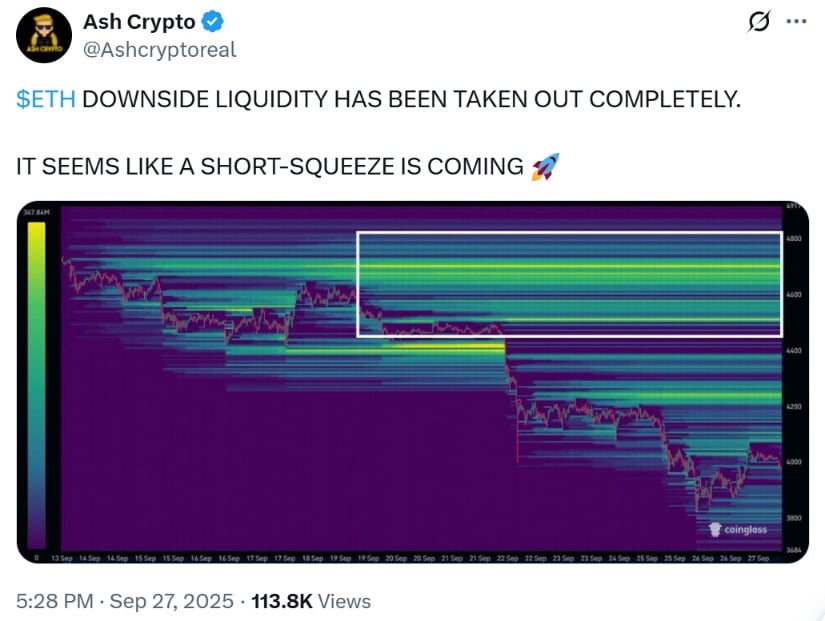

Short Squeeze Momentum Builds

Market structure also points to the possibility of a short squeeze. Ash Crypto highlighted that downside liquidity has been fully cleared, suggesting that stop-losses below $4,000 have been triggered, potentially setting up conditions for a rapid upside move.

Ethereum clears downside liquidity, setting the stage for a potential short squeeze and a rapid upward move. Source: @Ashcryptoreal via X

“It seems like a short-squeeze is coming,” Ash Crypto noted. Short squeezes occur when rising prices force traders betting against ETH to cover their positions, amplifying bullish momentum.

This view aligns with historical crypto rallies. In past cases, like Bitcoin’s 2021 surge, short squeezes have acted as powerful catalysts. Notably, Michaël van de Poppe has previously argued that liquidity sweeps often precede trend reversals, hinting at the potential for Ethereum to resume its climb.

Open Interest Reset Strengthens Bull Case

Recent market turbulence has also resulted in one of Ethereum’s biggest open interest resets since 2024, according to CryptoQuant. Excess leverage was flushed out earlier this week, with more than $3 billion liquidated on Binance alone. Additional declines were seen across Bybit and OKX, reducing the overheated derivatives market.

Ethereum experiences a major open interest reset, signaling the unwinding of an over-leveraged market. Source: @cryptoquant_com via X

This reset has coincided with heavy profit realization, with Santiment reporting that investors booked over $800 million in profits on Friday after ETH briefly dipped to $3,800. Historically, such flushes can remove weak hands from the market, leaving room for more sustainable growth.

Meanwhile, whale accumulation is adding confidence to the bullish thesis. Smart money tracker Lookonchain revealed that 15 wallets accumulated 406,117 ETH (worth $1.6 billion) from institutional platforms like Kraken, BitGo, and Galaxy Digital over the past two days.

Ethereum ETF Outflows and Long-Term Signals

Despite ETF outflows of around $300 million this week, long-term holders appear unfazed. Analysts note that whale buying and historical support levels continue to reinforce the bullish case. At the same time, speculation about a potential BlackRock Ethereum ETF and ongoing institutional demand are adding momentum to Ethereum’s mid-term outlook.

Max Crypto echoed this optimism, writing: “ETH has flipped its weekly resistance trendline into support. Send it to $7,000 by December.” While ambitious, this target reflects confidence that Ethereum could break through resistance levels if current momentum continues.

Final Thoughts

Looking further ahead, Ethereum’s performance will likely depend on a mix of technical resilience, institutional flows, and network fundamentals such as ETH gas fees and ecosystem growth. Analysts see the current retest of $4,000 as a defining moment. A successful defense could open the door to $4,500 and beyond, while failure may pull ETH back toward $3,600–$3,800 support zones.

Ethereum (ETH) was trading at around $4,011, up 0.69% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

If bullish momentum holds, Ethereum’s next challenge will be to retest its all-time high price near $4,878 before aiming for mid-term forecasts in the $6,000–$7,000 range. Longer-term projections, including several Ethereum price prediction 2025 models, suggest ETH could benefit from both ETF approval and expanding adoption in decentralized finance.

Search

RECENT PRESS RELEASES

Related Post