Ethereum (ETH) Price Prediction: ETH Reclaims $3K as SharpLink Expands Treasury, ETF Inflo

July 12, 2025

Ethereum (ETH) reclaimed the $3,000 price level on Friday for the first time since February, buoyed by strategic treasury moves from Nasdaq-listed SharpLink Gaming and surging institutional demand through spot ETFs.

With price breaking above key resistance levels, traders are now watching for a potential continuation toward $3,470 in the short term.

ETH Back Above $3K After OTC Treasury Purchase, ETF Inflows Spike

Ethereum surged past the $3,000 mark Friday morning, gaining over 8% in 24 hours amid renewed institutional activity. The rally follows SharpLink Gaming’s announcement of a 10,000 ETH OTC acquisition from the Ethereum Foundation (EF), valued at approximately $25.72 million. The deal brings the company’s ETH reserves to 215,957 ETH, worth over $600 million at current prices.

Sharplink Gaming has acquired 10,000 ETH directly from the Ethereum Foundation, signaling a bold institutional move. Source: HodlFM Team via X

“This isn’t a trade — it is a commitment to our long-term vision,” said Joseph Lubin, SharpLink Chairman and CEO of Consensys, in a press statement. The Ethereum Foundation confirmed the sale was made to fund protocol development, grants, and operations.

The transaction, structured as an over-the-counter deal, was seen by market participants as a strategic move to mitigate the impact of EF sales on price. “Guess that’s one way to fix EF dumping,” commented Nansen CEO Alex Svanevik on X.

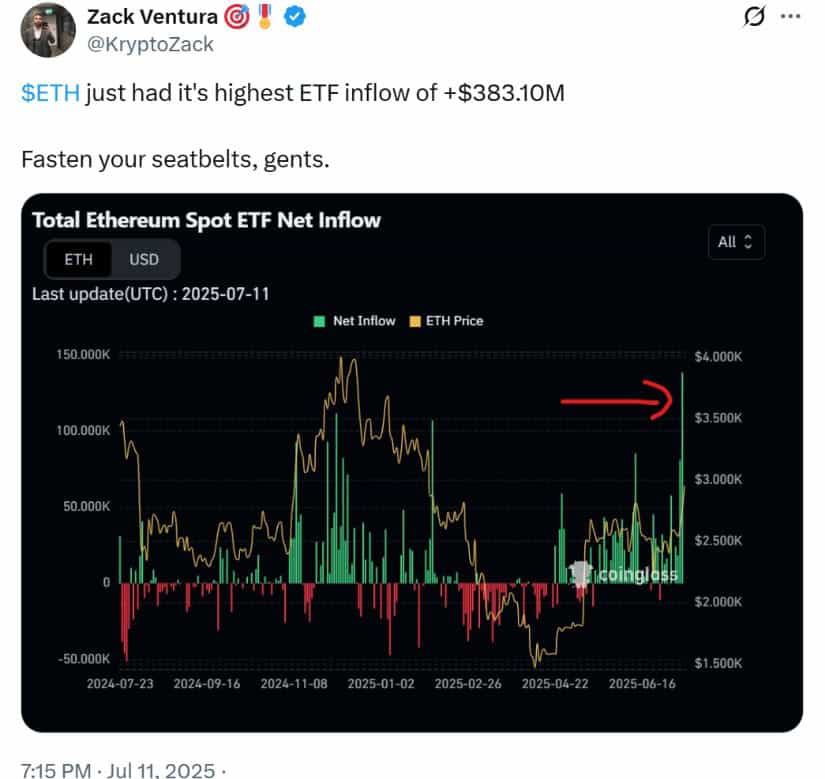

Ethereum just recorded its largest ETF inflow to date, totaling $383.10 million. Source: Zack Ventura via X

The announcement came alongside $383.1 million in net inflows into U.S.-listed spot ETH ETFs on Thursday — their second-highest daily total on record. Data from SoSoValue shows that BlackRock’s iShares Ethereum Trust (ETHA) led the inflows, attracting over $300.9 million in a single session. ETH ETFs have now crossed $5 billion in cumulative net inflows ahead of their one-year anniversary on July 23.

Technical Setup: ETH Eyes $3,470 if Breakout Confirms

Ethereum has broken above multi-week resistance near $2,745, establishing higher support at $2,850. The asset briefly touched $2,998 on Friday before consolidating beneath the psychological $3,000 threshold. ETH is currently challenging the upper boundary of an ascending broadening wedge pattern.

Ethereum (ETH) could break above the $3,400 resistance as the price continues to defend the $2,800 support. Source: Varifiedtrader07 on TradingView

A successful breakout above $3,080 — which coincides with the 61.8% Fibonacci retracement from November 2024 highs — could open the door for a 17% rally toward $3,470. Stronger resistance lies near $3,525, the upper limit of a long-term symmetrical triangle dating back to 2022.

Immediate support is now located at $2,945, with deeper pullbacks finding demand at $2,710 and $2,500, where over 3.45 million ETH were previously accumulated, per Glassnode data.

ETH derivatives markets are also seeing heightened activity. CoinGlass data reveals over $256 million in ETH liquidations over the last 24 hours, with $194 million in shorts closed, amplifying the upward move.

The Relative Strength Index (RSI) is currently in overbought territory, suggesting potential short-term exhaustion. However, bullish daily candle structure and declining exchange reserves — now around 18.9 million ETH — continue to support a constructive technical outlook.

Fundamentals: ETF Demand, Treasury Allocations, and L2 Momentum

Ethereum’s latest rally is underpinned by broader macro and ecosystem fundamentals. The SharpLink acquisition is the latest in a trend of public firms adopting Ethereum treasury strategies — joining BitMine, BTCS, Bit Digital, and GameSquare. SharpLink also recently raised $425 million in a Consensys-led private placement to support its ETH-focused initiatives.

On the ETF front, ETH products have demonstrated persistent demand since launching. According to ETF Store President Nate Geraci, “18 straight days of inflows into spot ETH ETFs… Nearly $250M just today. And there’s still no staking or in-kind creation/redemption. So early.”

Meanwhile, Ethereum Layer 2 ecosystems such as Arbitrum and Optimism continue to report increased transaction volume and TVL. Recent upgrades, including the Dencun proto-danksharding improvements, have further reduced gas fees and improved data availability, enhancing network efficiency and utility.

Outlook: Ethereum’s Bull Case Strengthens Above $3K

Ethereum’s break above $3,000 marks a key psychological and technical milestone. With ETF flows accelerating, corporate treasuries expanding, and Layer 2 activity increasing, the broader setup favors bulls. A daily close above $3,080 would complete a critical breakout and potentially set the stage for a move toward $3,525 or even $4,075 — Ethereum’s 2024 peak.

Ethereum has broken above strong daily resistance and is now awaiting a retest for potential buy entries targeting $4,000. Source: Otimothyy on TradingView

Failure to sustain this level, however, may see ETH re-enter a range between $2,800–$3,000, with strong structural support below. Traders are advised to monitor RSI conditions and macro sentiment as Ethereum approaches potential breakout levels.

Key ETH Levels to Watch:

- Immediate Resistance: $3,080 → $3,220 → $3,470

- Support Zones: $2,945 → $2,865 → $2,710 → $2,500

- Bullish Breakout Target: $3,525–$4,075

- Bearish Breakdown Risk: $2,500 → $2,110

Search

RECENT PRESS RELEASES

Related Post