Ethereum (ETH) Price Prediction: Ethereum Breaks $3,500 Resistance Toward $4,000 Amid MACD

November 10, 2025

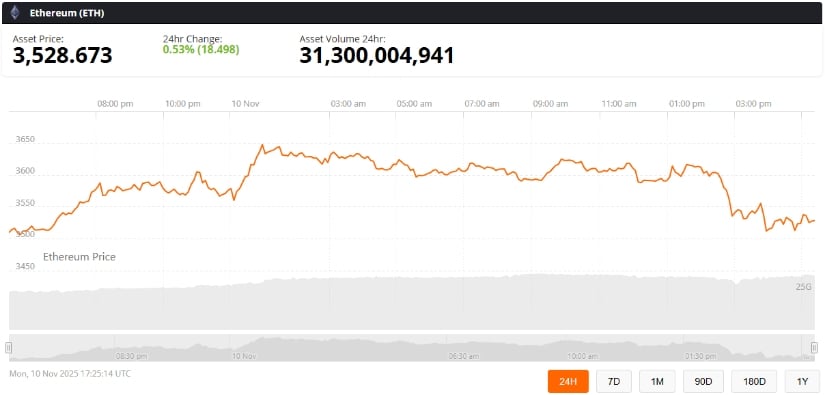

Ethereum (ETH) has regained upward momentum after a challenging start to November 2025, breaking above the crucial $3,500 resistance level.

Analysts suggest that if the current trend holds, Ethereum could test the $4,000 zone in the coming days, highlighting renewed optimism in both retail and institutional markets.

Ethereum Recovers After November Dip

Earlier in November, Ethereum fell sharply, dropping 12% to lows around $3,000. The sudden decline shook investor confidence, but the cryptocurrency has since staged a strong rebound. Tom Tucker (@WhatzTheTicker) observed, “$ETH price bounced back and is now above $3,500. This means buyers are strong. The next target is the $4,000 zone. If $3,425 is lost, the move is over. Watch that level!”

Ethereum (ETH) rebounds above $3,500, eyeing $4,000 as buyers stay strong—$3,425 is the key support to watch. Source: @WhatzTheTicker via X

Ethereum’s current price range of $3,570–$3,600 reflects renewed buying interest and highlights the resilience of the market. Part of this recovery is attributed to institutional inflows, with reports showing $1.37 billion in ETH holdings added recently, underscoring growing interest from larger investors seeking long-term exposure.

Technical Indicators Signal Potential Upside

On the technical front, Ethereum continues to hold a trendline support established in April 2025. Resistance remains at the daily 20 EMA, which has been slowing the pace of upward movement. Lark Davis (@TheCryptoLark) commented, “Support vs. resistance vs. momentum—something’s about to give. Eyes on the triangle.”

Ethereum (ETH) holds April trendline support as 20-day EMA resists and MACD nears a golden cross—a triangle breakout is imminent. Source: @TheCryptoLark via X

The MACD indicator is nearing a golden cross, a widely watched bullish signal in technical analysis. This suggests that Ethereum’s momentum could accelerate, potentially allowing the price to approach $4,000. Traders are watching the narrowing triangle pattern carefully, as its eventual breakout could set the stage for short-term gains.

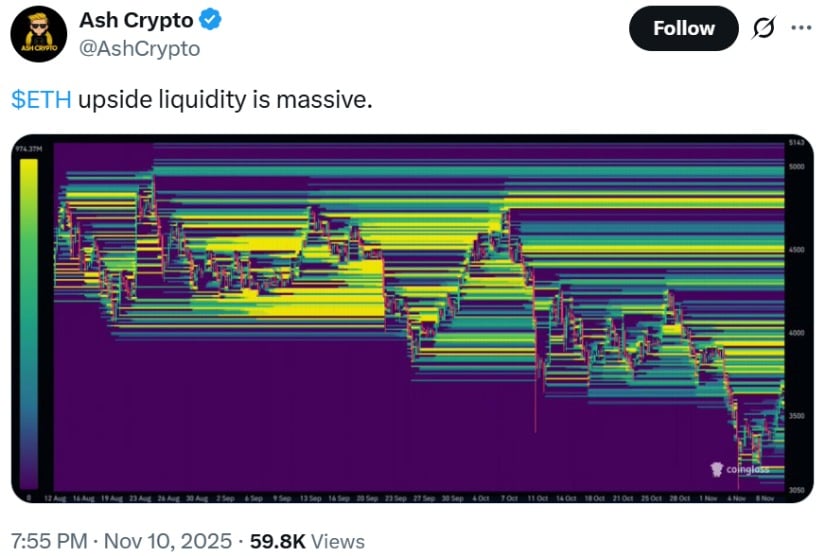

Massive Liquidity and Institutional Support

Ethereum’s upside potential is further reinforced by strong liquidity in the market. Ash Crypto (@AshCrypto) highlighted, “$ETH upside liquidity is massive.” Coinglass liquidity heatmaps reveal dense clusters of buy orders stretching from $3,500 to $5,000. These levels indicate that a significant number of investors are prepared to buy Ethereum if prices continue to rise, providing a solid foundation for a bullish squeeze.

Ethereum (ETH) shows massive upside liquidity, signaling strong buying potential above $3,500. Source: @AshCrypto via X

Institutional support has been a key driver of confidence. Early November saw $12.5 million flow into Ethereum ETFs, helping stabilize the market despite a 21% decline in DeFi TVL to $136 billion. These inflows reflect both long-term commitment from institutional players and confidence in Ethereum’s future growth prospects.

Market Forecasts and Expert Outlook

Market experts remain cautiously optimistic. Fundstrat’s Tom Lee predicts that Ethereum could reach $10,000–$12,000 by December 2025, with a long-term target of $60,000. Analysts emphasize that the $3,425 support level is critical; a break below this point could halt the current rally and trigger a correction.

Investors and traders are closely monitoring Ethereum’s price action, liquidity, and technical indicators. Short-term activity, including ETH gas fees and network transactions, may also provide insight into adoption trends. With key resistance at $4,000 in sight, Ethereum could continue its upward trajectory if current market conditions remain favorable.

Final Thoughts

Ethereum (ETH) is showing signs of renewed strength after a volatile start to November 2025. The recent break above the $3,500 resistance level, combined with institutional inflows and strong market liquidity, indicates a potentially bullish phase ahead. Technical signals, including the approaching MACD golden cross and the sustained trendline support, further support the possibility of a rally toward the $4,000 zone.

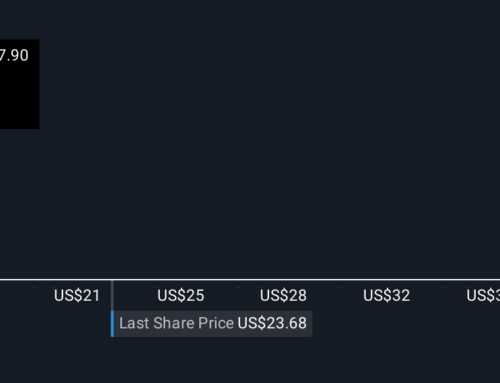

Ethereum (ETH) was trading at around $3,528, up 0.53% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

However, analysts caution that the $3,425 support remains a critical level. A breach below this point could slow momentum and trigger a short-term correction. Traders and investors are advised to monitor Ethereum’s price action, network activity, and institutional movements closely.

Overall, while volatility remains a characteristic of the crypto market, Ethereum’s combination of technical strength, institutional backing, and growing liquidity provides a solid foundation for continued growth. For those tracking Ethereum price prediction and broader market trends, the coming days could be decisive in shaping Ethereum’s near-term trajectory.

Search

RECENT PRESS RELEASES

Related Post