Ethereum (ETH) Price Prediction: Ethereum Bullish Pennant Targets $5K as Whale Accumulatio

September 19, 2025

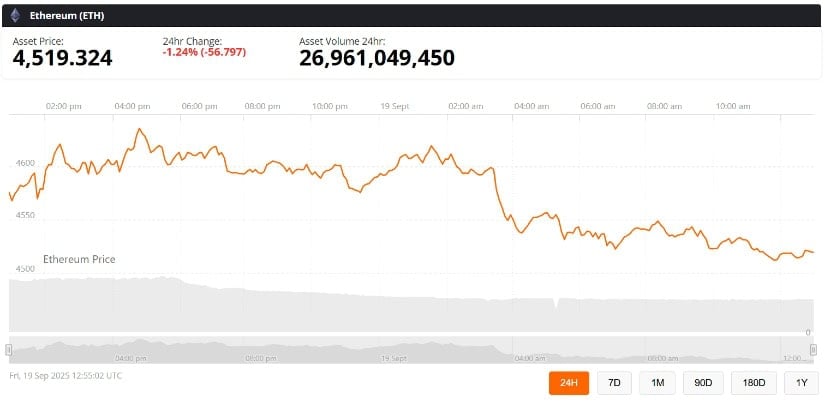

Ethereum price is consolidating near $4,500 as technical patterns and whale accumulation align, fueling speculation that the second-largest cryptocurrency could be gearing up for a breakout toward $5K and beyond.

This potential move comes as Ethereum exchange reserves drop to multi-year lows, while institutional investors steadily increase holdings. The convergence of reduced supply, technical strength, and whale demand is reinforcing the bullish case.

Ethereum Price Holds Firm in Bullish Pennant

Ethereum price today is trading near $4,500, consolidating within a tight range as traders monitor a bullish pennant formation on the charts. This pattern, defined by rising support and falling resistance, often precedes sharp breakouts. ETH has been repeatedly finding buyers between $4,400 and $4,500, while the $4,700–$4,800 zone remains a stubborn resistance.

Ethereum retests $4,400 breakout zone and eyes $5,766 target as bullish pennant breakout gains momentum. Source: @donaldjdean via X

Crypto analyst Mister Crypto stated that if Ethereum closes above $4,800, the price could accelerate toward $5,800, highlighting confidence in the bullish setup despite the need for stronger trading volume to confirm it.

Whales Increase Positions With 820,000 ETH Purchases

On-chain data highlights a surge in Ethereum whale accumulation, with large holders buying 820,000 ETH—worth roughly $3.8 billion—in just 72 hours. This activity pushed whale holdings from around 26.17 million ETH to more than 30 million ETH, underscoring growing institutional confidence.

Whales scoop up 820,000 ETH worth $3.8B in just 72 hours, fueling bullish momentum for Ethereum’s next breakout. Source: @ali_charts via X

According to crypto analyst Ali, such concentrated buying tends to provide strong liquidity support and establish a price floor during consolidation. When whales accumulate at scale, the probability of validating breakouts increases, as heavy buying often coincides with the early stages of significant price moves.

Additional data shows a notable increase in the number of wallets holding over 10,000 ETH, shared by Diana Sanchez. This trend marks a shift after months of limited whale activity and suggests that larger investors may be positioning ahead of Ethereum’s next major move.

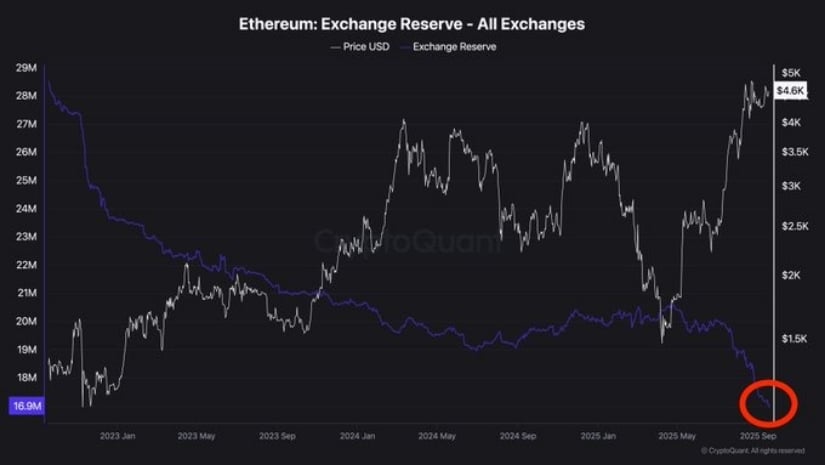

Exchange Reserves Hit Multi-Year Lows

Ethereum exchange balances have fallen to 16.9 million ETH, the lowest level in several years, according to CryptoQuant data. A declining balance on exchanges typically reflects reduced selling pressure, as coins are transferred to private wallets or long-term storage.

Ethereum supply shock intensifies as exchange reserves hit multi-year lows, with whales and institutions buying every dip, creating scarcity that could drive explosive upside. Source: @MerlijnTrader via X

Trader Merlijn described this as evidence of an ongoing supply shock. He observed that institutions and retail buyers continue to take advantage of price dips, reinforcing the notion that demand is rising while the available supply is shrinking. This backdrop strengthens the case for a continuation of the bullish trend.

Technical Levels and Price Targets

Ethereum technical analysis sets the major breakout levels, which will guide the direction of the next movement. Analyst Donald Dean highlighted that ETH needs to close above $4,955 in order to authenticate the bullish momentum. Short-term targets are at $5,766 via Fibonacci retracement models, mid-term estimates at $6,658 and a potential long-term target at approximately $9,547.

Ethereum bullish momentum builds, setting sights on a $6,000 minimum as price action heats up. Source: @crypto_goos via X

Dean also mentioned that trading volume has experienced random surges, supporting the theory of a breakout. But the test would be to maintain the momentum past the $4,955 barrier.

Final Thoughts

The combination of a bullish pennant, all-time whale accumulation, and multi-year-low exchange reserves presents a bullish picture for Ethereum. Traders are eyeing the $4,800–$4,955 resistance level as the point of decision. If this level is breached with huge selling pressure, Ethereum price can quickly test the $5K level and even reach further upside to $5,766.

Ethereum (ETH) was trading at around $4,519, down 1.24% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

As whale confidence grows and supply constricts, Ethereum looks ready to embark on a potentially historic climb if market conditions in coming weeks hold up.

Search

RECENT PRESS RELEASES

Related Post