Ethereum (ETH) Price Prediction: Ethereum Cup-and-Handle Breakout Targets $7,500 as ETF In

October 6, 2025

Ethereum (ETH) is gearing up for a major breakout as ETF inflows and bullish technicals align, signaling a potential surge toward $7,500 by the end of 2025.

After weeks of consolidation, Ethereum’s market structure now mirrors setups that historically preceded strong upward moves, driving renewed optimism among traders anticipating a late-2025 bull wave.

Cup-and-Handle Breakout in Motion

Ethereum (ETH) is flashing a powerful technical setup as the Ethereum price today hovers near $4,550, marking a 2% daily gain. Analysts say the world’s second-largest cryptocurrency is breaking out of a textbook cup-and-handle pattern, with projections suggesting a potential rally toward $7,500 by the end of 2025. The breakout comes amid growing Ethereum ETF inflows and renewed institutional demand.

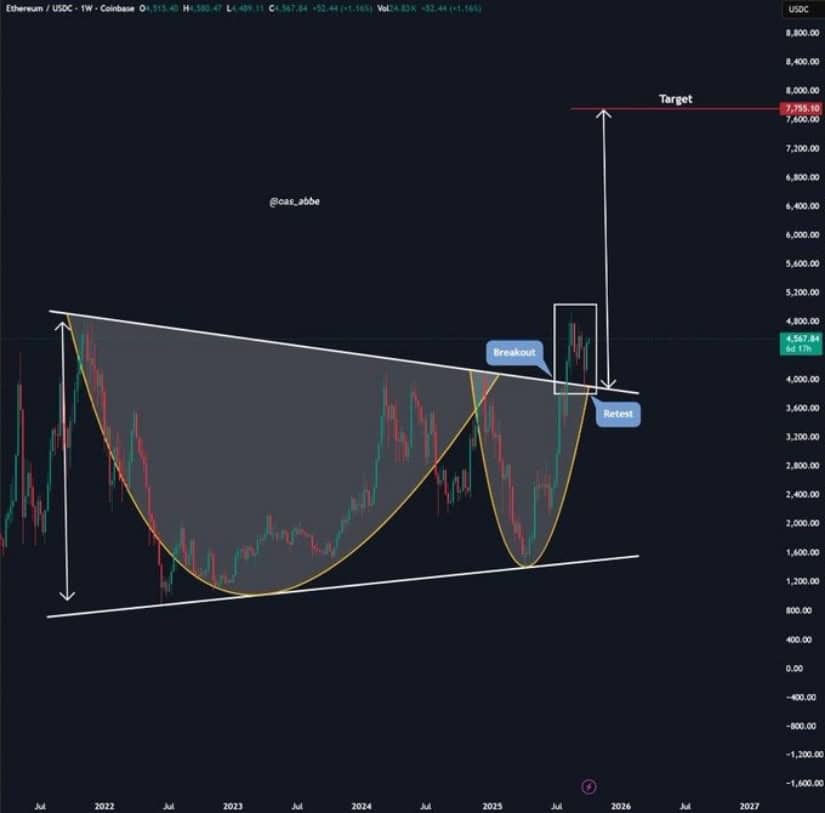

Ethereum (ETH) surges after a perfect cup-and-handle breakout, targeting $7,500 by Q4 2025. Source: @cas_abbe via X

Crypto analyst Cas Abbé described Ethereum’s setup as one of the best in the market. “Perfect breakout, retest to flip resistance into support, and now it’s going up,” he noted. On the weekly chart, ETH has flipped the $3,500 resistance into support, confirming the breakout structure. The pattern historically signals a strong continuation trend, hinting that Ethereum may be entering an extended expansion phase similar to its 2020 bull cycle.

Technical Analysis: Ethereum Retests Support and Confirms Bullish Trend

Ethereum’s cup-and-handle breakout reflects renewed bullish momentum. The handle phase—marked by short-term consolidation—appears complete, with ETH now aiming for resistance between $6,700 and $7,500. This level aligns with the measured move target derived from the cup’s depth.

Ethereum breaks out of a broadening wedge pattern, signaling that the next leg up is inevitable. Source: @misterrcrypto via X

Supporting the structure, on-chain analysis shows rising long-term holder activity and declining profit-taking ratios, suggesting strong hands are accumulating. Analysts also highlight that historical breakouts often experience temporary 20–30% pullbacks before the next leg higher, making healthy consolidation a positive signal rather than a warning sign.

Institutional Inflows: Ethereum ETFs Add Over $1.3 Billion

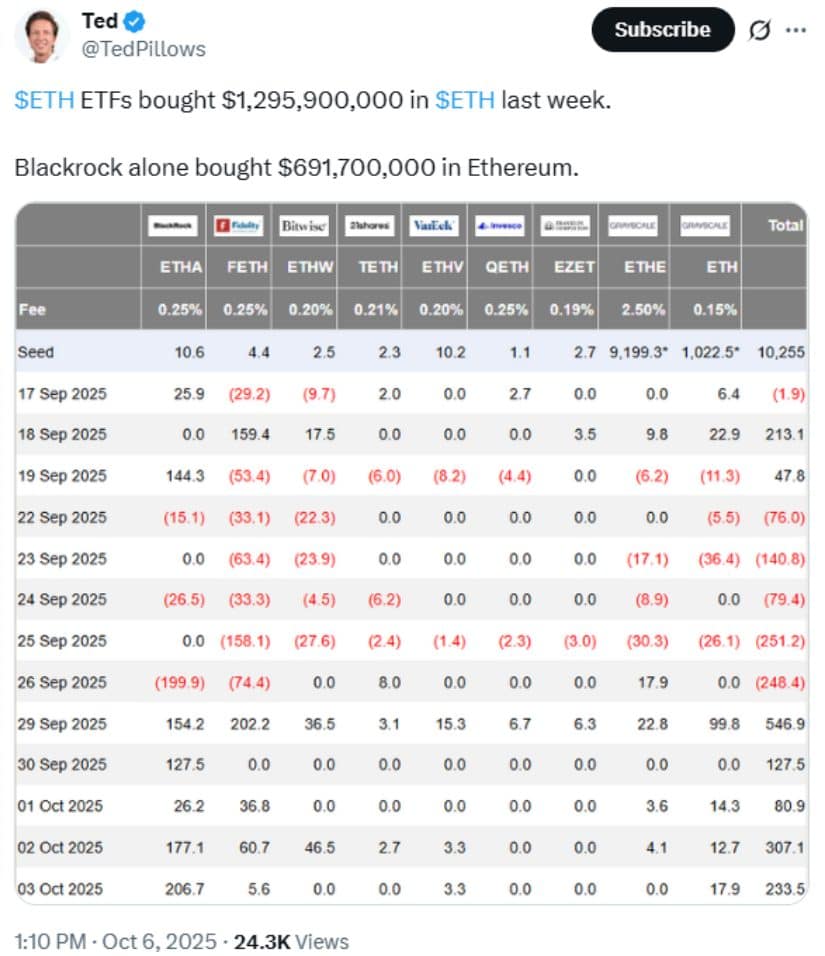

The bullish narrative is further strengthened by substantial Ethereum ETF inflows. In the past week alone, institutional products added nearly $1.3 billion worth of ETH, according to data shared by crypto researcher Ted (@TedPillows). BlackRock led the accumulation, purchasing $691.7 million in Ethereum, followed by consistent inflows into Fidelity and Bitwise funds.

ETH ETFs surged with $1.3B in purchases last week, including $691.7M by BlackRock alone, fueling Ethereum’s bullish momentum. Source: @TedPillows via X

These ETF inflows reflect rising confidence from traditional finance, as institutions look to gain long-term exposure to Ethereum’s ecosystem and staking yield potential. Analysts suggest such capital inflows are reinforcing market support levels, increasing the likelihood that ETH price maintains its bullish trajectory through Q4 2025.

Golden Cross and Whale Accumulation Boost Confidence

Adding to the optimism, Ethereum recently flashed a Golden Cross on the three-day chart—where the 50-day moving average crossed above the 200-day. Historically, this signal has preceded significant rallies, with past crosses triggering gains exceeding 100%.

Ethereum flashes a Golden Cross—historically signaling big rallies, with strong hands already in position. Source: @MerlijnTrader via X

Trader Merlijn The Trader commented, “The Golden Cross just flashed on $ETH. Strong hands are already positioned—are you still bearish?” On-chain data further shows that Ethereum whales accumulated over 800,000 ETH in recent weeks, underscoring institutional confidence amid growing volatility.

Ethereum Price Prediction 2025: Can ETH Reach $7,500?

The latest Ethereum price prediction 2025 models suggest a base-case target of $7,500 if technical patterns and ETF demand continue aligning. More optimistic forecasts see potential extensions toward $10,000–$12,000, supported by the upcoming Fusaka upgrade, which aims to reduce ETH gas fees and enhance scalability.

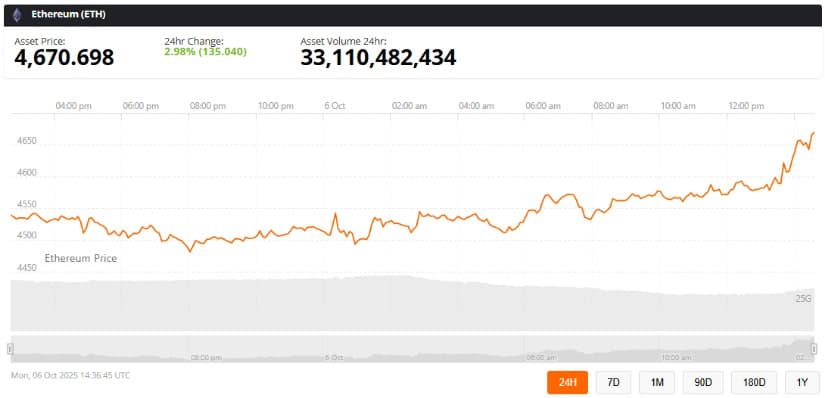

Ethereum (ETH) was trading at around $4,670, up 2.98% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Still, analysts caution that correlation with Bitcoin remains a key risk factor. A sharp BTC correction could temporarily delay Ethereum’s upside. However, with on-chain strength, ETF inflows, and technical confirmation, market sentiment leans bullish.

Search

RECENT PRESS RELEASES

Related Post