Ethereum (ETH) Price Prediction: Ethereum ETF Inflows of $546.9M Propel Bullish Move Towar

September 30, 2025

Ethereum is gaining renewed momentum as institutional investments and technical support indicate the potential for a strong upward move in the coming weeks.

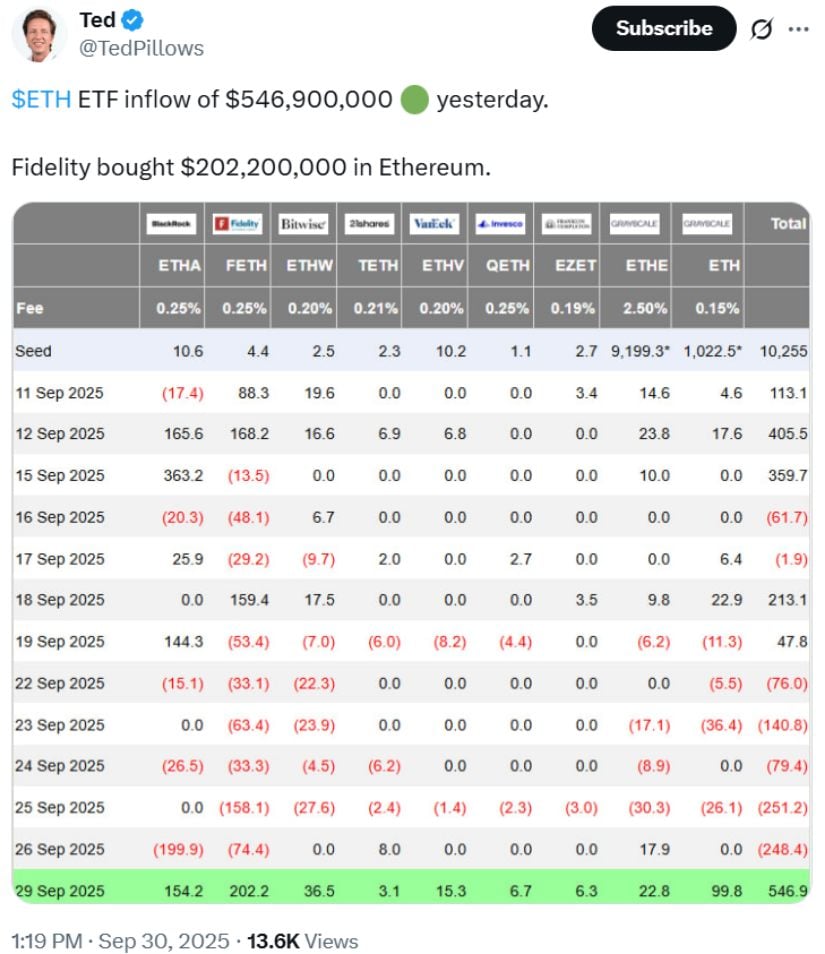

Recent activity shows $546.9 million flowed into spot Ethereum ETFs on September 29, including $202.2 million from Fidelity and $154 million from BlackRock. Combined with Ethereum’s support near $4,191 and the critical $4,300 volume shelf, these factors suggest growing confidence and a possible launch point for the next bullish phase.

Ethereum Price Today and Technical Setup

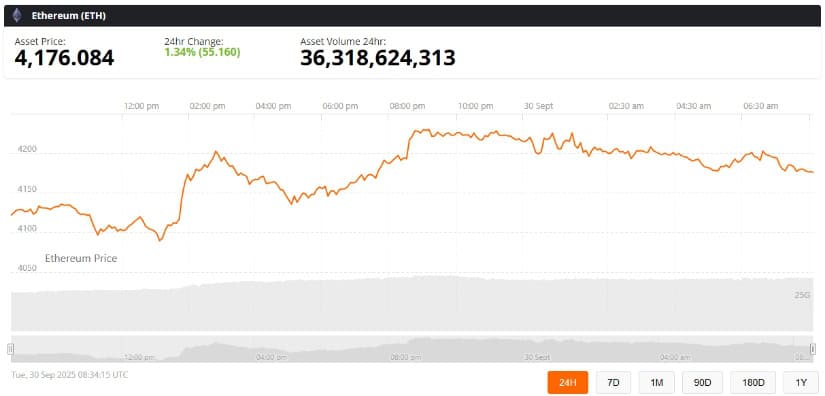

Ethereum is currently trading around $4,191, recovering from last week’s dip near $3,800. Price action has formed a contracting triangle on the 4-hour chart, with immediate resistance stacked between $4,230 and $4,275, where the 100-day and 200-day EMAs converge. Analysts note that a decisive breakout above this zone could mark Ethereum’s first clean reversal since the mid-September correction.

Ethereum (ETH) was trading at around $4,176, up 1.34% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

“ETH is moving toward the volume shelf at $4,300, a potential launch point,” said market analyst Donald Dean. “Momentum is increasing, and the next target aligns with the 50% retracement on the ETH/BTC ratio.”

ETF Inflows Reinforce Bullish Outlook

The surge in Ethereum ETF inflows highlights institutional confidence. Fidelity’s $202.2 million purchase and BlackRock’s $154 million addition are reversing a series of outflows from the previous five days. ETF-driven demand often correlates with short-term price surges, with studies showing a $100 million inflow can lift crypto spot prices by 0.3% to 0.7%.

Ethereum sees massive $546.9M ETF inflow, led by Fidelity’s $202.2M purchase, boosting bullish momentum. Source: @TedPillows via X

These inflows support Ethereum’s recovery and suggest the cryptocurrency could test higher targets in the coming weeks. Institutional participation also stabilizes downside risk, offering investors more confidence amid broader market volatility.

Key Technical Levels to Watch

Long/short ratios across major exchanges remain bullish. Binance reports a ratio of 1.8, while top traders show even stronger conviction at 2.7. Futures open interest holds near $55.9 billion, with daily trading volume climbing 38% to $72.1 billion, and options volume up 50%, indicating that traders are positioning for further volatility.

Ethereum climbs toward $4,300 support, with momentum building toward a $5,766 target. Source: @donaldjdean via X

- Support Zones: $4,100–$4,175

- Immediate Resistance: $4,230–$4,275

- Next Targets: $4,450, $4,800, and medium-term projection $5,766

Risks and Outlook

Despite bullish momentum, Ethereum remains capped under the descending resistance line from September highs. If it fails to clear $4,275, a pullback toward $4,100–$4,000 could occur, where demand clusters are strong. Momentum indicators, including RSI, are improving but require confirmation from sustained price action.

ETF inflows and institutional demand provide a stabilizing cushion, while derivatives market activity suggests traders are betting on further upside. A breakout above $4,300 could signal a structural shift, opening the path to $4,450, $4,800, and potentially the medium-term target of $5,766.

Final Thoughts

Ethereum’s current market structure, supported by ETF inflows and technical patterns, presents a cautiously optimistic outlook. While resistance near $4,275 is a hurdle, sustained momentum could push Ethereum higher in the coming weeks.

Ethereum perfectly bounces off support, mirroring Q2’s setup that triggered a 2x rally—patience pays for holders. Source: @AkaBull via X

Investors should watch Ethereum price today, ETF activity, and key support and resistance levels. If bullish momentum holds, Ethereum could extend its rebound toward its medium-term projection of $5,766, though market volatility remains a factor to consider.

Search

RECENT PRESS RELEASES

Related Post