Ethereum (ETH) Price Prediction: Ethereum Eyes $3,500 as Vitalik Proposes Gas Fee Cap Fuel

July 7, 2025

The recently proposed gas cap by Vitalik Buterin is adding further fuel to the rally, as whales re-enter the scene with renewed conviction.

Ethereum Price Today: Stability Returns Amid Gas Reform Buzz

Ethereum is currently trading around $2,533, holding firmly above the psychological support at $2,500. The bullish stance coincides with a sharp increase in trading volume, which surged over 70% to $15.14 billion, according to market trackers.

Vitalik proposes EIP-7983 to cap Ethereum’s calldata size at 1MB per block, aiming to curb L2 spam and push rollups toward blob usage without harming decentralization. Source: @NewTribeCap via X

This bounce aligns with Ethereum co-founder Vitalik Buterin’s announcement of EIP-7983, a proposal to implement a protocol-level gas cap of 16.77 million units per transaction. The upgrade aims to reduce transaction cost volatility, strengthen network security, and boost compatibility with future technologies like zkVMs.

“Ethereum needs practical, user-centered safeguards as it scales,” said Buterin at the Ethereum Community Conference. “This cap would prevent transaction spikes and encourage more stable block utilization.”

Ethereum Chart Analysis: Accumulation Pattern Signals Next Breakout

From a technical standpoint, Ethereum appears to be gearing up for a breakout, with multiple signals aligning for upside movement. Bollinger Bands on the daily chart are tightening near $2,580, typically a precursor to a price expansion. The Relative Strength Index (RSI) remains in neutral-to-bullish territory, leaving room for further upside before overbought conditions emerge.

ETH/USD is holding above an ascending trendline on the 2-hour chart, signaling continued strength within its bullish structure. Source: FXOnTop on TradingView

Meanwhile, the MACD indicator shows a fresh bullish crossover, and the 100-hourly Simple Moving Average continues to support upward movement. Immediate resistance levels are spotted near $2,650, with breakout targets at $2,900 to $3,000. Should ETH clear these levels, a run toward $3,500 could follow swiftly.

Whale Moves and Layer 2 Buzz Add Fuel to Ethereum’s Climb

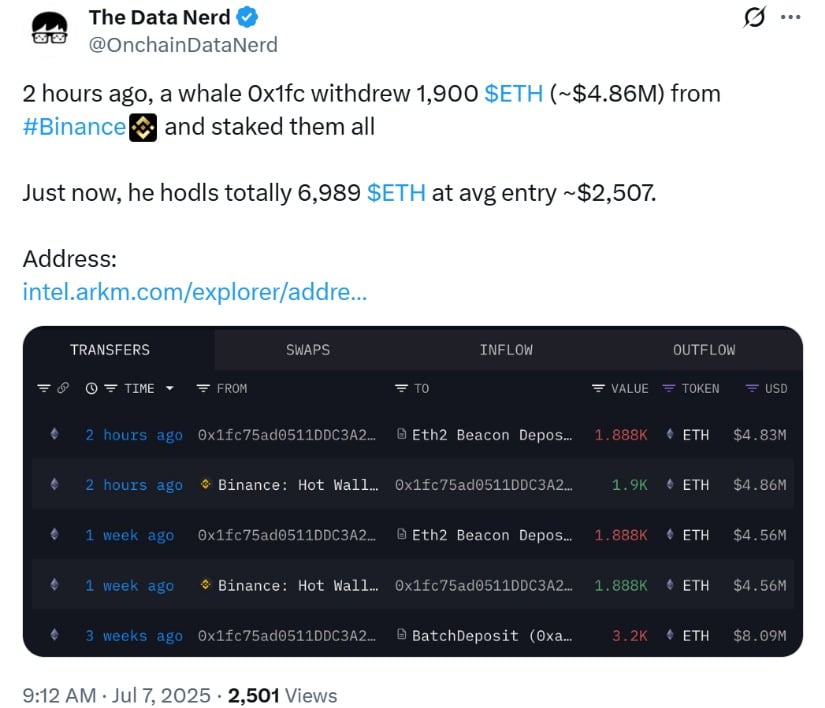

Whale activity is once again shifting in Ethereum’s favor. On-chain data reveals that whale address 0x1fc withdrew 1,900 ETH—roughly $4.86 million—from Binance for staking purposes. This move signals long-term conviction and accumulation rather than short-term speculation.

Whale address 0x1fc has withdrawn 1,900 ETH (worth $4.86M) from Binance for staking, now holding a total of 6,989 ETH at an average entry of $2,507. Source: The Data Nerd via X

Additionally, Ethereum Layer 2 ecosystems, including Arbitrum, Optimism, and zkSync, continue to post record transaction volumes and growing total value locked (TVL), reinforcing Ethereum’s scaling narrative. These L2 networks are critical for reducing congestion and transaction fees, making Ethereum more accessible to users and developers alike.

Fundamental Catalysts: Gas Fee Reform and Market Positioning

Buterin’s EIP-7983 proposal could be a turning point. Currently, a single transaction can potentially consume an entire block’s gas limit, posing security and scalability risks. The proposed cap would ensure more equitable gas distribution, help protect against DoS attacks, and improve conditions for deploying complex decentralized applications.

Ethereum (ETH) is trading at around $2,533.57 at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

Simultaneously, exchange reserves on Binance for ETH have climbed to over 4% of total supply, reaching levels last seen in mid-2023. Rather than indicating impending sell pressure, experts suggest this is strategic positioning.

“ETH holding strong despite rising exchange reserves indicates robust market demand,” noted on-chain analyst BorisVest.

This trend mirrors historical patterns. In 2023, similar reserve spikes led to a temporary price dip, followed by a sharp recovery rally.

Expert Outlook: Ethereum’s Path Toward $3,500—and Beyond

Crypto analyst Master Ananda believes Ethereum is nearing the end of a multi-year wedge pattern, which has been forming since its November 2021 high. Higher lows since 2022 signal growing buying pressure, while the overhead resistance near $3,800–$4,000 is being tested.

Ethereum is gaining momentum with a short-term target of $2,800, and a daily close above this level could pave the way for a swift rally toward $3,500. Source: @cas_abbe via X

Using Fibonacci extensions, the analyst sets an initial target at $5,791, with bullish sentiment potentially carrying the price to $8,500 in this cycle—especially if Ethereum ETFs gain regulatory momentum.

Another analyst, Cas Abbe, supports this thesis, highlighting a Wyckoff accumulation pattern in play. According to Abbe, Ethereum has entered the “markup phase,” which often precedes explosive growth.

Ethereum Prediction: Bullish Setup Could Accelerate

With the gas cap proposal, whale accumulation, and technical breakout patterns all aligning, Ethereum seems poised for a significant upward move. Near-term resistance sits around $2,650, followed by targets at $2,900, $3,000, and eventually $3,500 if momentum persists.

While short-term pullbacks are still possible, the broader structure of Ethereum’s market signals strength. If key breakout levels are breached and ecosystem upgrades continue, ETH could be well on its way toward reclaiming—and exceeding—its all-time highs.

Ethereum price prediction remains bullish for Q3 2025, with $3,500 emerging as the next critical milestone, supported by rising investor confidence, protocol enhancements, and long-term structural strength.

Search

RECENT PRESS RELEASES

Related Post