Ethereum (ETH) Price Prediction: Ethereum Eyes $4,440 After Gold-Like Rally and $250M Bitm

October 21, 2025

Ethereum (ETH) is showing signs of renewed strength after a recent consolidation phase, attracting both retail and institutional attention.

Analysts are increasingly optimistic, pointing to technical patterns and large-scale purchases that could push ETH toward the $4,440 mark in the near term.

Ethereum Mirrors Gold’s Breakout

Market strategist Merlijn The trader highlighted Ethereum’s striking resemblance to gold’s breakout pattern from 2024. “Gold led the way. Ethereum follows. Same pattern. Same setup,” he noted in a recent post, emphasizing how historical parallels could hint at future price action.

Ethereum follows gold’s breakout, setting the stage for a potential five-digit surge. Source: @MerlijnTrader via X

Ethereum’s correlation with gold reached 0.7 in Q3 2025, fueled by inflows from ETFs and the ongoing growth of DeFi ecosystems. According to analysts, if this pattern holds, Ethereum could potentially enter five-digit territory over the next several months. However, volatility risks remain, particularly amid potential Federal Reserve rate adjustments.

Bitmine’s $250 Million Ethereum Buy Signals Institutional Confidence

Institutional investors continue to show confidence in Ethereum. Bitmine Immersion Technologies recently acquired roughly $251 million worth of ETH, adding 63,539 tokens to its holdings. This positions Bitmine as a major institutional player, drawing comparisons to MicroStrategy’s strategy with Bitcoin.

Bitmine snaps up $250M in ETH, giving Ethereum its own MicroStrategy moment. Source: @TedPillows via X

Bitmine now controls over 3 million ETH, valued at approximately $13 billion—around 2.7% of Ethereum’s circulating supply. Analysts say this accumulation highlights long-term confidence in Ethereum despite short-term market dips. Tom Lee, a well-known market analyst, remarked that ETH remains undervalued and could rebound strongly in the near term.

Technical Outlook: $4,440 in Focus

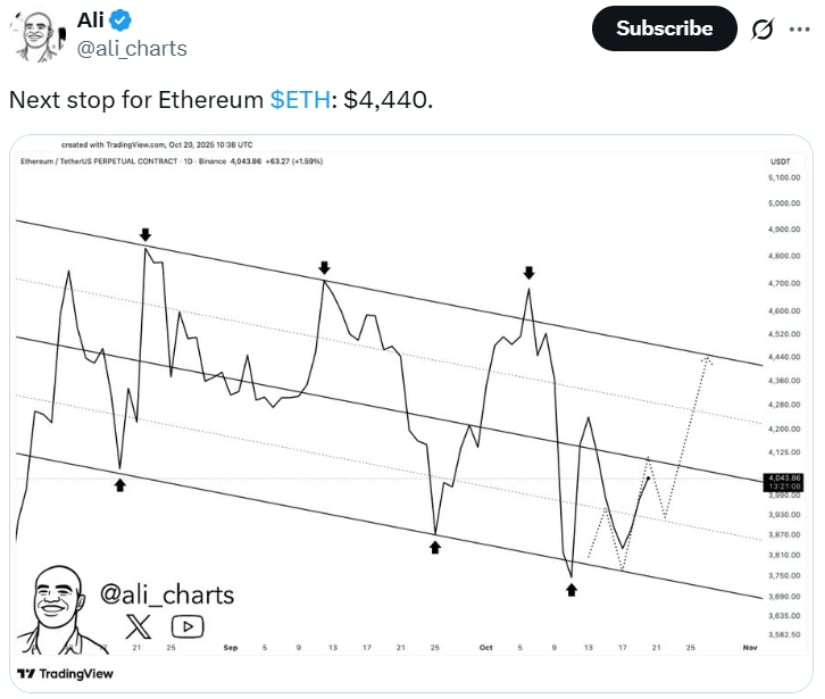

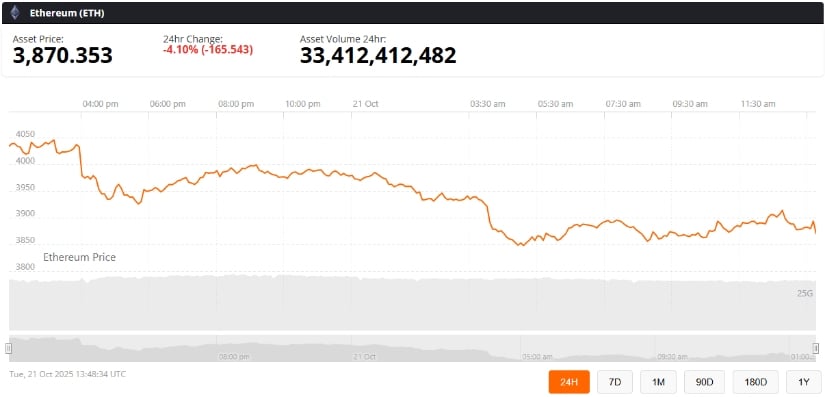

On the technical side, Ethereum appears poised to test resistance at $4,440. Analyst Ali (@ali_charts) recently highlighted that ETH broke a descending trendline, with support near $3,800 providing a foundation for upward momentum. While ETH briefly reached $4,044 intraday, broader market pressure caused a temporary dip to $3,870 on October 21.

Ethereum (ETH) eyes $4,440 as the next major resistance, supported by bullish technical trends and recent institutional accumulation. Source: @ali_charts via X

Maintaining support levels around $3,800 and $3,600 could be key to sustaining a bullish trajectory. If these levels hold, Ethereum could realistically target $4,440 in the coming weeks.

Market Sentiment and Outlook

Ethereum’s overall market outlook remains cautiously optimistic. ETF inflows, DeFi adoption, and growing institutional interest underpin a positive medium- to long-term view, despite short-term market corrections.

ETH pulls back to the broken trendline and is set to gradually climb toward $4,300 while holding key support. Source: bahardiba on TradingView

Some analysts predict that ETH could reach $4,800–$5,000 if current momentum persists and macroeconomic conditions remain favorable. Nevertheless, investors are advised to watch for volatility triggered by market corrections or regulatory developments, particularly in the U.S. and Europe.

Final Thoughts

Ethereum’s recent gold-like breakout pattern, combined with substantial institutional accumulation, suggests a potential upward trajectory. While short-term price swings are expected, technical trends and investor confidence point toward a near-term target of $4,440.

Ethereum (ETH) was trading at around $3,870, down 4.10% in the last 24 hours at press time. Source: Ethereum Price via Brave New Coin

Investors should continue to monitor key support levels and broader macroeconomic developments to gauge ETH’s performance, as institutional strategies like Bitmine’s may influence market sentiment and liquidity.

Search

RECENT PRESS RELEASES

Related Post